New Demand Drives Bitcoin to $120,000: Should We Expect New Records from BTC?

Bitcoin has once again surpassed $120,000, indicating renewed growth and approaching an all-time high.

The sharp price rise reflects improved investor sentiment as fresh capital flows into the market. Average ETF holders and inflows play a key role in this process.

Bitcoin has strong support

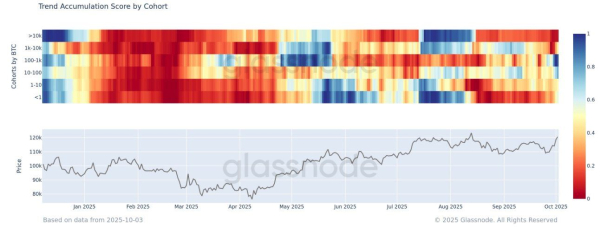

The Trend Accumulation Index shows a significant shift in market conditions. Average holders are actively accumulating Bitcoin, offsetting the selling by large players. This new wave of demand is supporting BTC's current upward trend, creating a more stable foundation for future growth.

Whale distribution has slowed, and small investors remain largely neutral. This balance reduces the risk of sharp sell-offs and strengthens market resilience. This change in investor behavior indicates a healthier environment for Bitcoin growth.

Bitcoin Trend Accumulation Index. Source: Glassnode

Bitcoin Trend Accumulation Index. Source: Glassnode

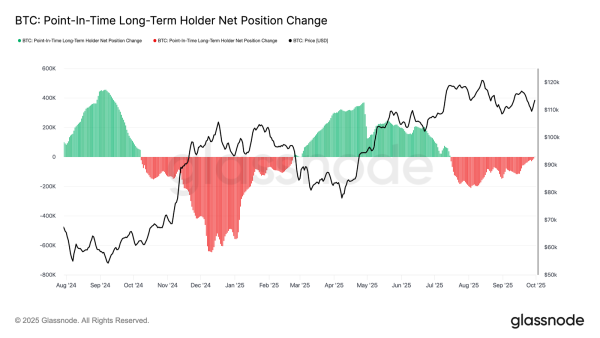

The net long-term holding position (3D) has shifted to neutral after months of active distribution. This indicates a weakening of profit-taking by long-term holders, making the market less vulnerable to sharp selling. The decline in distribution is an encouraging sign for price stability.

With supply pressure easing, external factors such as ETF inflows and institutional demand could now play a key role in supporting momentum. If these inflows remain stable, they will help Bitcoin continue its rally and reach its previous all-time high.

Change in Bitcoin Holders' Net Position. Source: Glassnode

Change in Bitcoin Holders' Net Position. Source: Glassnode

BTC price is heading higher

At the time of writing, Bitcoin is trading at $120,290, attempting to secure $120,000 as support. Holding this level is important to maintain momentum and prevent a short-term reversal.

BTC's next target is to break through $122,000, which serves as the final resistance before its all-time high of $124,474. A successful breakout of this barrier would pave the way for Bitcoin to reach a new all-time high, bolstering confidence in the bullish market sentiment.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

If market conditions worsen and selling intensifies, Bitcoin could lose support at $120,000. The price could then decline to $117,261, which would reverse the bullish scenario and signal a temporary pause in the rally.

Source: cryptonews.net