Bitcoin (BTC) Price Prediction: Will Bitcoin Break $118,000?

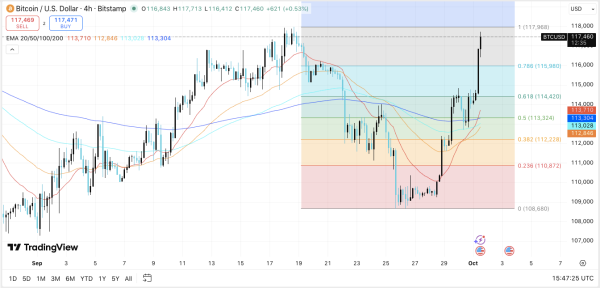

- Bitcoin has retraced key Fibonacci levels, signaling renewed bullish momentum above $116,000.

- Key resistance lies at $117,968 with potential for upside to $118,500–$120,000.

- High interest in futures and Saylor's trillion-dollar strategy are fueling long-term optimism.

Bitcoin recently demonstrated impressive strength, reclaiming key Fibonacci retracement levels on the 4-hour chart. This move signals renewed bullish momentum as the cryptocurrency approaches critical resistance zones.

Traders and investors are closely monitoring the $117,968 level, which serves as a short-term limit. A decisive breakout of this area could push Bitcoin to higher targets, potentially reaching $118,500–$120,000 in the near term.

Key levels and trend forecast

The nearest support for Bitcoin is around $115,980 and $114,420, which correspond to the 0.786 and 0.618 Fibonacci levels. If selling pressure intensifies, the $113,324 zone, combined with several exponential moving averages (EMAs), represents an area of strong demand. Further down, $112,228 will become the next critical support in the event of a deeper market pullback.

SOL Price Dynamics (Source: TradingView)

SOL Price Dynamics (Source: TradingView)

The upward trajectory from the $108,680 low has moved the 50- and 100-day exponential moving averages (EMAs) into support near $113,000. Continued momentum above $116,000 could encourage buyers to seek new highs. However, if the price fails to hold above $115,980, it could trigger a correction to the EMA cluster in the $113,000–$113,500 region.

Futures market activity signals continued engagement

Open interest in Bitcoin futures has increased sharply throughout 2025, rising from less than $20 billion at the start of the year to over $80 billion in October. This growth indicates increased speculative activity and growing institutional participation.

Source: Coin Glass

Source: Coin Glass

While expanding open interest supports the optimistic outlook, it also signals increased volatility during sharp price swings. Currently, the $80 billion level underscores strong market activity, cementing Bitcoin's dominance in derivatives trading.

Source: Coin Glass

Source: Coin Glass

Recent inflows and outflows also reflect cautious accumulation. On October 1, there was a moderate positive outflow of $23.23 million in Bitcoin, suggesting minor short-term selling pressure. Despite this, broader accumulation trends persist, confirming a bullish trend over the medium to long term.

Read also: Buy Bitcoin in 2025? Here's the Safest and Easiest Way

Michael Saylor's Ambitious Trillion-Dollar Strategy

Strategy Executive Chairman Michael Saylor outlined an ambitious vision for corporate adoption of Bitcoin. He compares Bitcoin's transformative potential to breakthroughs like electricity and oil, positioning it as a form of digital energy. Saylor envisions a “trillion-dollar end goal” aimed at massive Bitcoin accumulation and the reimagining of corporate treasuries.

According to Saylor, Bitcoin offers a unique combination of property, capital, and energy in cyberspace. It enables the transfer of value across time and space, creating opportunities for companies and institutions seeking long-term wealth preservation. Importantly, this strategy could impact corporate treasury practices and how institutions interact with digital assets.

Bitcoin Price Technical Forecast

Bitcoin has shown a strong recovery after reclaiming key Fibonacci retracement levels, signaling a resumption of bullish momentum in October.

Key levels and trend forecast

- Upside: Short-term ceiling of $117,968 with potential upside to $118,500-$120,000 if buyers remain strong.

- Downside levels: The nearest support is at $115,980 (0.786 Fibonacci retracement) and $114,420 (0.618 Fibonacci retracement). Further support levels are $113,324 (EMA cluster) and $112,228 if selling intensifies.

- Resistance ceiling: $117,968 remains a key level for a breakout of the medium-term bullish momentum.

The technical picture points to Bitcoin consolidation above major exponential moving average (EMA) clusters, with decisive breakouts likely to increase volatility and extend the trend in either direction. Holding above $115,980 is critical for bulls to maintain the uptrend.

Will Bitcoin's price rise?

Bitcoin's short-term trajectory depends on whether buyers can hold support zones while attempting to break through the $117,968 level. A successful breakout could spark a rally to $118,500–$120,000, while a failure to hold the $115,980 level could lead to a pullback to $113,000–$113,500.

Related: Ethereum Price Prediction: Can ETH Break $4,300 and Reach $4,565?

Futures market activity and inflows/outflows indicate cautious accumulation of funds, with institutional investors actively participating. Positive developments, including Michael Saylor's vision of a “trillion-dollar strategy,” add structural bullish sentiment, strengthening Bitcoin's potential as a long-term store of value.

Source: cryptonews.net