Bitcoin climbs above $116,000 amid US government shutdown

On September 30, the US government suspended operations for the first time since 2018. Bitcoin, the leading cryptocurrency, rose 3.2%, breaking through $116,000.

Binance BTC/USDT hourly chart. Source: TradingView.

Binance BTC/USDT hourly chart. Source: TradingView.

The shutdown was caused by the lack of agreement between Republicans and Democrats on healthcare funding.

The government shutdown has resulted in approximately 750,000 federal employees being furloughed, according to the Associated Press. Some government agencies are closed.

According to USA Today, US President Donald Trump stated that the shutdown would do “a lot of good.” He said it would help “get rid” of Democratic Party policies.

According to The Economist, the current government shutdown could have the following consequences:

- delays in the release of key economic indicators such as employment and inflation;

- complicating the decision-making process on the Fed's key interest rate;

- short-term increase in unemployment.

The previous US government shutdown began on December 22, 2018, and lasted 35 days until January 25, 2019. It was the longest in more than 40 years, CNN noted. The shutdown also occurred during Trump's presidential term.

The Congressional Budget Office estimates that the event cost the United States approximately $3 billion in lost GDP . According to the analytical resource The Kobeissi Letter, the current shutdown will cost the US budget approximately $400 million per day.

The US government shutdown:

For the first time since 2018, the US is about to enter a government shutdown and investors are bracing for it.

This would furlough 750,000 workers PER DAY, costing ~$400M in daily compensation.

What does it all mean? Let us explain.

(a thread) pic.twitter.com/oewTTeOATc

— The Kobeissi Letter (@KobeissiLetter) September 30, 2025

Experts previously assessed the shutdown's impact on the cryptocurrency market, predicting a short-lived correction. However, digital assets continued to rise.

What's happening in the crypto market?

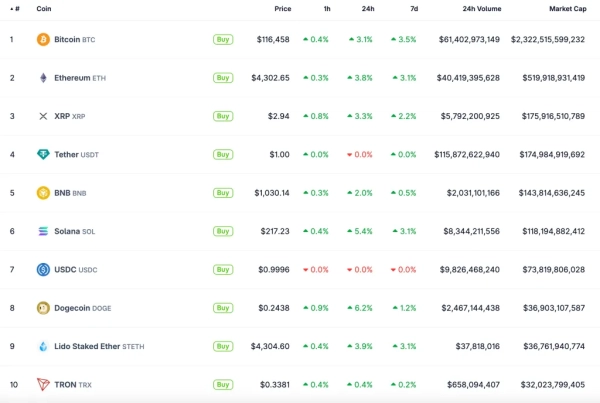

Over the past 24 hours, the digital asset sector's market capitalization increased by 3.2% to $4.09 trillion. All top-10 cryptocurrencies by market capitalization demonstrated upward momentum.

Dogecoin, Solana, and Ethereum were the leaders in daily growth.

Source: CoinGecko.

Source: CoinGecko.

At the time of writing, Bitcoin is trading around $116,400. According to Glassnode, the leading cryptocurrency's dominance has increased from 57% to 59%.

Source: Glassnode.

Source: Glassnode.

“This mean reversal points to a healthier market structure, as Bitcoin-led rallies have historically proven more resilient than altcoin-led moves,” the analysts noted.

Some community members noted that three of the last five US government shutdowns resulted in a pump in the leading cryptocurrency. They believe this time is no exception.

🚨 BREAKING: US GOVERNMENT SHUTDOWN ODDS TOMORROW: 84%

IT SEEMS LIKE A US GOVERNMENT SHUTDOWN IS IMMINENT NOW.

Historically, 3/5 shutdowns or shutdown threats triggered a $BTC pump. pic.twitter.com/DqJjOPeGNu

— AlΞx Wacy 🌐 (@wacy_time1) September 30, 2025

MN Capital founder Michael van de Poppe believes the current growth will continue. According to him, on October 1, the leading cryptocurrency tested a key support level at $112,000, after which it bounced upward. He called this the beginning of another bullish rally.

There has been a quick retest of the $112K region and an immediate upward bounce.

Strong performance of #Bitcoin and I think that we're in for a bullish month and quarter.

Q4 has started, good times are ahead of us. pic.twitter.com/IyXsDR6tdU

— Michaël van de Poppe (@CryptoMichNL) October 1, 2025

“Bitcoin is performing strongly and I think we're headed for a bullish month and quarter,” he wrote.

Investor Ted Pillows noted that the next key resistance level is around $117,500. If it is broken, digital gold “could begin to move toward a new all-time high.”

The expert also pointed out that Bitcoin has now formed two significant liquidity clusters:

- the first is in the $107,000-108,000 zone, where $8 billion of longs are concentrated for liquidation;

- the second – at the levels of $118,000-119,000 with $7 billion in shorts.

$BTC has 2 decent liquidity clusters right now.

One around the $107,000-$108,000 level, which has $8 billion in long liquidations.

The other is around the $118,000-$119,000 level, which has $7 billion in short liquidations.

Which one do you think will happen first? pic.twitter.com/8dBuyQMoUj

— Ted (@TedPillows) October 1, 2025

An analyst using the pseudonym Daan Crypto Trades emphasized that the first cryptocurrency has approached the upper boundary of the bullish “flag” pattern and is attempting to break through it.

$BTC Made its way towards the top of the channel/bull flag and is attempting a break out.

The $112K is a key short term support going forward. Ideally don't want to see price re-visit that.

Up to the bulls to take it from here, a proper breakout & some daily closes above the… https://t.co/WIEDjawZrq pic.twitter.com/z7MmiCJtBD

— Daan Crypto Trades (@DaanCrypto) October 1, 2025

“The $112,000 level now serves as key short-term support. Ideally, the price shouldn't return to this level. The bulls will take the initiative from now on: a strong breakout and several daily closes above the channel boundary will signal to me that the price is ready to move to new highs,” the expert stated.

As a reminder, analysts predicted Uptober despite fear signals.

Source: cryptonews.net