Bitcoin Price Forecast: BTC Holds at $111,000 as ETF Demand and Corporate Buying Absorb Supply

- Bitcoin price is holding around $111,900 today after breaking the $114,000 resistance.

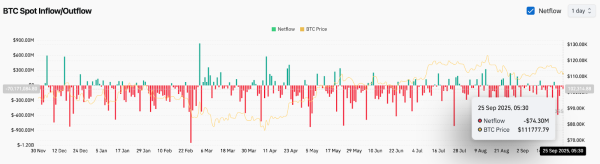

- Net outflows of $74.3 million reflect cautious investor sentiment despite reduced selling pressure.

- Institutional demand from ETFs and corporations continues to absorb more Bitcoin than miners produce.

Bitcoin is hovering around $111,900 today after falling from $114,000 earlier this week. A rebound from the 20- and 50-exponential moving average cluster near $113,200 has curbed any upward moves, while immediate support remains at $111,000. Traders are now focused on whether this consolidation will turn into a rebound or whether a deeper correction is at risk.

Bitcoin price is hovering below EMA resistance

Key Technical Levels for BTC Price (Source: TradingView)

On the 4-hour chart, Bitcoin is rebounding from its mid-September peak near $118,000. Currently, the price is holding just above the 32.8% Fibonacci retracement at $111,800, which coincides with the trend support level formed in early September.

The 20, 50, and 200 EMAs are located in the $113,186–$114,156 region, creating a strong resistance zone. Until BTC reclaims this zone, momentum remains under pressure. The Parabolic SAR has also entered a bearish trend, maintaining a short-term downtrend.

If buyers hold $111,000, a rebound to $114,200 and $117,000 is possible. A break below $111,000 risks opening access to $109,000 and a deeper demand zone of $107,500.

Flows within the chain show net outflow

BTC Netflows (Source: Coinglass)

BTC Netflows (Source: Coinglass)

Spot exchange flow data continues to point to cautious positioning. On September 25, net Bitcoin outflows totaled $74.3 million, reflecting investors' preference to hold assets off-exchange. While this suggests a reduction in selling pressure, it also points to the volatility of spot demand, as accumulation has not yet reached a sustainable level.

Futures positions remain modest, and open interest has declined following last week's $2 billion liquidation. This outflow has forced leveraged long positions to capitulate, and traders are hesitant to commit new capital until technical clarity is restored.

Currently, on-chain signals indicate that Bitcoin's price momentum will remain limited until stronger inflows occur.

Institutional and corporate demand provides a tailwind

🇺🇸 MICHAEL SAYLOR SAYS HAL FINNEY WAS RIGHT, #BITCOIN IS GOING TO $10,000,000 PER COIN

IT'S COMING!!! 🚀 pic.twitter.com/1J6vPlTP19

— Vivek Sen (@Vivek4real_) September 25, 2025

Despite short-term weakness, the overall picture remains favorable for Bitcoin. Michael Saylor, executive chairman of Strategy, confirmed that corporate adoption and ETF purchases are absorbing more Bitcoin than miners produce daily. According to River, miners generate approximately 900 BTC per day, while companies and ETFs collectively acquire over 3,000 BTC.

This ongoing imbalance of buying power is expected to create upward pressure once macroeconomic factors ease. Saylor emphasized that Bitcoin is used both as a Treasury reserve asset and as a form of digital capital to back credit instruments, strengthening balance sheets and expanding institutional use.

The presence of at least 145 companies holding bitcoin on their balance sheets underscores this shift, providing long-term support even as short-term traders remain cautious.

Bitcoin Price Technical Forecast

The Bitcoin price forecast for September 26 points to a tight range with downside risk if $111,000 fails to hold. Upside targets remain capped by EMA resistance until impulsive buyers intervene.

- Growth levels: $113,200, $114,200 and $117,000.

- Reduction levels: $111,000, $109,000 and $107,500.

- Trend support: $106,000 as the last line of defense.

Outlook: Will Bitcoin Rise in Price?

The main question is whether buyers can hold the $111,000 floor long enough to sustain a recovery. The outflow of funds across the chain indicates a reduction in selling pressure, but the inflow of funds remains too weak to support a sustainable rally.

Institutional accumulation and corporate adoption will provide a strong tailwind by the end of the year, consistent with Saylor's view that Bitcoin will “move higher again with vigor” once macroeconomic headwinds subside.

In the short term, Bitcoin's price looks vulnerable below the exponential moving average (EMA) cluster today, but the overall bullish structure will remain as long as $109,000 remains intact. A decisive break above $114,200 would restore momentum to $117,000 and open the way to $120,000.

Source: cryptonews.net