Investors bought $2.6 billion worth of Bitcoin (BTC). Should we expect a new ATH?

Bitcoin (BTC) continues to rise since the start of the month, fueling expectations of a rise to $120,000.

Bitcoin is strengthening thanks to investor activity, which is confidently investing in BTC. Technical and fundamental indicators point to potential for further market growth.

Bitcoin investors have switched to buying mode.

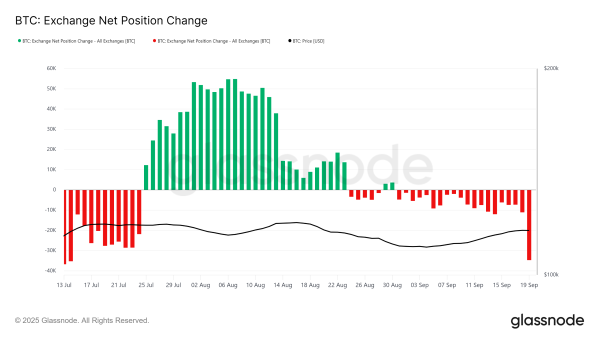

Recent data shows that Bitcoin accumulation has reached its highest level in nearly two months. In the last 24 hours, investors purchased over 23,000 BTC, worth over $2.67 billion, and withdrew them from exchanges.

Historically, such outflows from exchanges indicate that investors are not looking for quick profits. Instead, they plan to hold assets for the long term. This indicates a shift in sentiment compared to the beginning of the quarter, when selling prevailed.

Bitcoin's net position on exchanges. Source: Glassnode

Bitcoin's net position on exchanges. Source: Glassnode

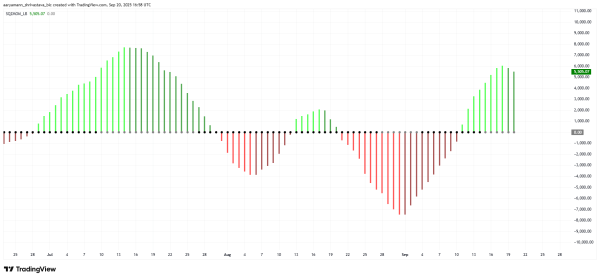

The momentum compression indicator predicts a bullish squeeze for Bitcoin. Upward momentum often indicates that an asset is gaining strength and is preparing a springboard for growth in the near future. This underscores Bitcoin's resilience despite market volatility and allows it to maintain a bullish outlook.

Read also: Fidelity predicts a significant Bitcoin shortage – 28% of BTC will disappear from the market

Bitcoin Squeeze Momentum. Source: TradingView

Bitcoin Squeeze Momentum. Source: TradingView

BTC price may break a key barrier

Bitcoin has been showing steady growth since the start of the month. However, it is currently facing resistance at $117,261. This barrier has limited price growth in recent sessions. A breakout will be key to further momentum.

If Bitcoin can break through and turn $117,261 into support, it could head toward $120,000 in the coming days. Strong buying pressure and favorable momentum indicators make this scenario highly likely. On the other hand, a loss of momentum could reinforce selling pressure. If BTC breaks support at $115,000, the price could fall to $112,500, which would invalidate the bullish outlook.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView

Source: cryptonews.net