Crypto Treasuries Are Losing Momentum, and Blockchains Have Reached a 'Technical Ceiling'

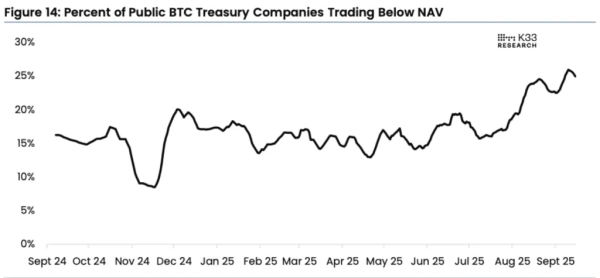

According to K33's September report, there has been a significant decline in the value of public companies with Bitcoin on their balance sheets. One in four companies trades with a market capitalization below the value of their digital assets.

According to K33's head of research, Vetle Lunde, the gap between mNAV and the price of BTC means that companies are effectively giving away more property than they receive in return.

Issuing new shares at a discount results in capital dilution, which limits the ability of some corporate buyers to raise new cash.

Nakamoto, the crypto company formed by the merger of KindlyMD and Nakamoto Holdings, has seen its share price plummet. NAKA has lost over 95% of its market value since its peak, with its mNAV plummeting from 75 to 0.7.

Twenty One, Semler Scientific, and The Smarter Web Company are also leading the pack among discount stock holders, according to Bitcoin Treasuries.

On September 16, GD Culture Group, a streaming and e-commerce company, experienced a drop in its stock price. Following the announcement of the $875 million acquisition of 7,500 bitcoins from Pallas Capital Holding, the stock price fell 28%. At the time of writing, GDC is recovering.

GDC stock price hourly chart. Source: TradingView.

GDC stock price hourly chart. Source: TradingView.

The company shifted its focus to building a diversified crypto asset reserve, but investors reacted cautiously to the news. The share price decline highlighted concerns about significant equity dilution and the risks of a speculative crypto portfolio.

In September, the average mNAV among publicly traded treasury firms was 2.8, down from 3.76 in April, according to a K33 report.

Chart of public companies holding Bitcoin on their balance sheets with an mNAV below one. Source: K33.

Chart of public companies holding Bitcoin on their balance sheets with an mNAV below one. Source: K33.

As Lunde noted, the distribution of values is skewed: smaller firms are increasingly finding themselves in the discount zone, while the leaders in terms of capital volume still have a significant premium.

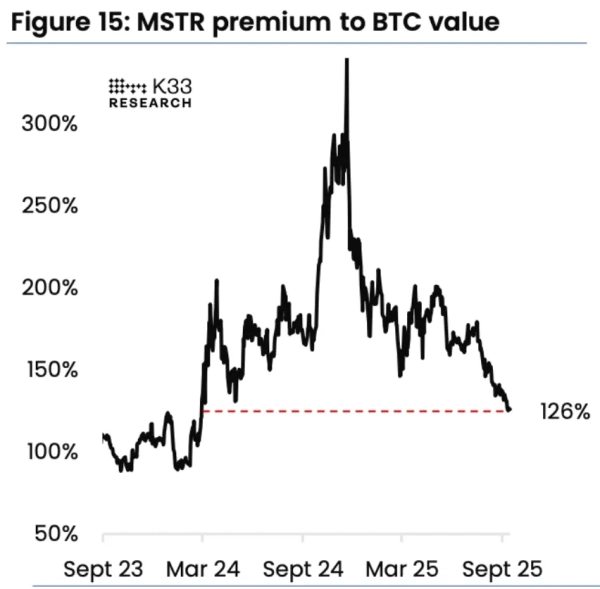

Strategy accounts for approximately 64% of all companies with Bitcoin treasury holdings, with a balance of 638,985 BTC at the time of writing. However, the number one company is also showing some disappointing trends.

MSTR premium to Bitcoin price chart. Source: K33.

MSTR premium to Bitcoin price chart. Source: K33.

According to K33, Michael Saylor's stock premium hit its lowest since March 2024 at 1.26.

“This significantly reduces Strategy's ability to buy Bitcoin and indicates a marked decline in buying demand from one of the most important supply sinks over the past year,” the expert explained.

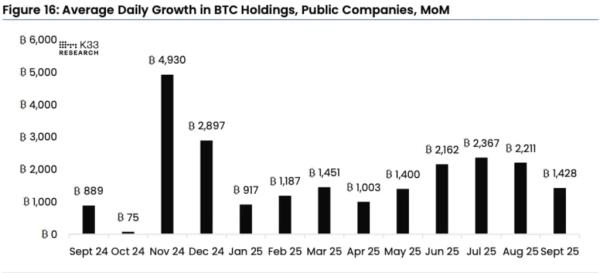

According to the report, the pace of accumulation of the leading cryptocurrency has also slowed. In September, crypto treasury firms added only 1,428 BTC per day, the weakest rate since May.

Monthly chart of average daily Bitcoin holdings by commercial crypto treasuries. Source: K33.

Monthly chart of average daily Bitcoin holdings by commercial crypto treasuries. Source: K33.

K33's head of research called the premium reduction “rational.” He attributed the effect to high consulting fees, insider incentives, and complex capital structures. He also expressed hope that firms could leverage their Bitcoin holdings in other areas of their business.

Analysts suggest that spot ETFs and retail flows are becoming the main drivers of demand.

A New Wave of Cryptocurrency Adoption and a Tech Ceiling

The next wave of institutional adoption of cryptocurrency is happening as established fintech companies begin building their own blockchains, Altius Labs co-founder Annabel Huang told Cointelegraph.

Huang has witnessed the convergence of cryptocurrencies and traditional markets firsthand. She began her career as a trader in New York City, then joined the Amber Group team in Hong Kong as a managing partner. At Altius Labs, she focused on creating a modular execution layer that would directly connect to existing blockchains, increasing throughput without requiring projects to rebuild their entire infrastructure.

Financial services app Robinhood recently announced it was developing its own L2 blockchain to support tokenized stocks and real-world assets, while Stripe followed suit with plans to build Tempo, a payments-focused network developed in partnership with Paradigm.

“What we’re seeing now—and I expect it to continue to happen more in the future—is a trend among institutional investors to embrace stablecoins or even build their own blockchains for specific use cases,” the expert said.

According to Huang, such initiatives are the next stage of institutional adoption of blockchain. Their weakness, like that of many existing crypto platforms, is low throughput.

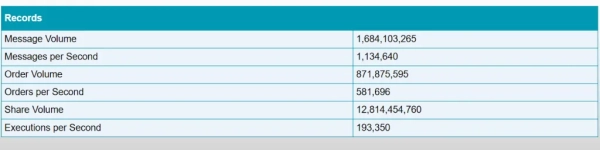

According to Nasdaq statistics, their peak speed is 581,696 orders and 1,134,640 messages per second. Juan believes these figures are incomparable to those of one of the fastest networks, Solana.

Nasdaq network records during peak loads. Source: Nasdaq.

Nasdaq network records during peak loads. Source: Nasdaq.

She called speed an “execution bottleneck” and said it needs to be addressed before blockchains built by fintech companies can support the weight of institutional capital.

“The industry shouldn't expect new 'Ethereum killers' or general-purpose blockchains to emerge. Users prefer to coalesce around a few dominant platforms rather than disperse across dozens of new networks,” Annabel Huang shared her opinion in an interview with Cointelegraph.

The expert commented on the Bitcoin treasury space. She considers the transition to crypto assets on balance sheets risky, especially for retail investors, because not all corporate Bitcoin strategies are structured equally. Comparing stock price surges with token launches, Huang believes that demand for proxy assets like ETFs and treasury strategies will continue.

The expert also added that while exchange-traded fund options exist for Bitcoin and Ethereum, investors looking for exposure to altcoins often turn to debt strategies.

As a reminder, the expert warned that the pursuit of high returns from storing Ethereum carries serious risks for companies.

Source: cryptonews.net