Here's Why Bitcoin (BTC) Price Could Hold Above $110,000

Bitcoin (BTC) is attempting to recover from recent wobbles, holding above key support levels

The coin is benefiting from more stable market conditions, although all signs point to a consolidation phase rather than a sustained rally. History suggests that Bitcoin may be entering a familiar period of calm.

Bitcoin Risks Are Easing

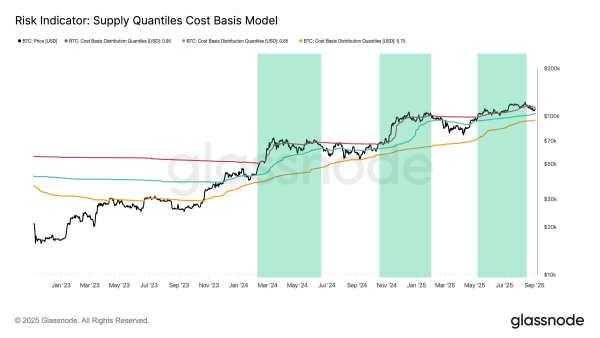

The on-chain supply quantile indicator highlights this development. Bitcoin’s mid-August rally to new highs was the third multi-month euphoric phase of this cycle, with almost all supply in the black. This is reflected in the 0.95 cost quantile, where 95% of supply is in unrealized profit.

The last euphoric phase lasted about 3.5 months before demand began to wane. Bitcoin now trades between the 0.85 and 0.95th quantile of cost, or roughly $104,100 to $114,300. Historically, this range has served as a consolidation corridor after euphoric peaks, creating a sideways movement as buyers and sellers balance out.

Bitcoin CBM Supply Quantiles. Source: Glassnode

Bitcoin CBM Supply Quantiles. Source: Glassnode

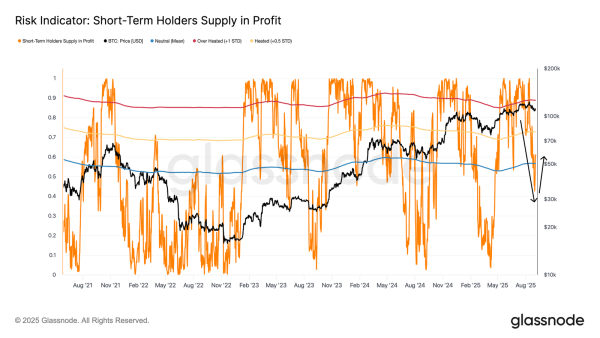

The percentage of short-term supply in profits provides further clarity. When Bitcoin fell to $108,000, the share of short-term supply in profits fell from over 90% to 42%. This sharp change reflected the fear-driven selling that is typical in overheated markets.

After that decline, exhausted sellers helped push the recovery to $112,000. Now, more than 60% of short-term holders are back in the black, a neutral position compared to the recent extremes. However, confidence remains fragile.

For demand to strengthen, a sustained recovery above $114,000–$116,000 is needed, where more than 75% of the short-term supply will be in profit.

Short-term Bitcoin Profit Offer. Source: Glassnode

Short-term Bitcoin Profit Offer. Source: Glassnode

BTC Price May Experience Long-Term Consolidation

Bitcoin's breakout of the $112,500 resistance is encouraging, opening the way to $115,000. This level is important for attracting new investment, which will confirm the recovery and increase the likelihood of sustainable growth.

However, historical data points to the likelihood of consolidation. Bitcoin could settle below $115,000 or fall below $112,500, with price action sideways in the short term as the market digests the recent volatility.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

If profit taking accelerates, Bitcoin could fall sharply. A return to $110,000 or a loss of that support would dampen sentiment and invalidate the bullish scenario, leaving BTC vulnerable to prolonged consolidation or further declines.

Source: cryptonews.net