Galaxy Digital Wallet Outflows Raise Concerns as Bitcoin (BTC) Under Pressure

Bitcoin (BTC) started to rally again in early September after falling more than 13% in August. However, activity from major wallets linked to Galaxy Digital could create selling pressure and hinder the recovery.

On-chain data also shows a change in Bitcoin whale behavior in September.

Galaxy Digital Wallets Signal Bitcoin Sell in Early September

Galaxy Digital is a digital asset management company that provides financial services in the cryptocurrency space, including over-the-counter trading. Recently, wallets associated with Galaxy Digital have been noticed in large transactions. Observers believe that outflows from these wallets may signal possible selling pressure on Bitcoin.

According to analyst Maartunn, an hourly outflow of 691 BTC was recorded on September 4th.

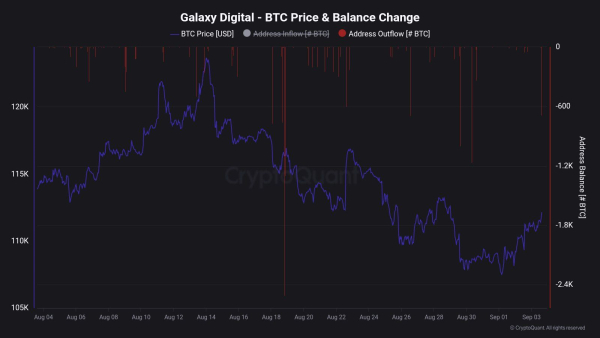

Galaxy Digital Balance Change. Source: CryptoQuant.

Galaxy Digital Balance Change. Source: CryptoQuant.

“Such outflows may precede short-term selling pressure – watch liquidity, spreads and price reaction,” Maartunn said in a statement.

These concerns are justified. Charts show that Galaxy Digital wallets have regularly seen outflows of between 600 and more than 2,400 BTC over the past month, while the price of Bitcoin has been declining in August.

Additionally, Onchain Lens, another on-chain monitoring account on X, noticed a Bitcoin wallet reactivating after 12.8 years of inactivity. The wallet moved 0.25 BTC worth $28,000, but still contains 479.44 BTC.

The reactivation of a dormant whale wallet in early September – albeit less than the last two months – shows that early Satoshi whales continue to awaken while Bitcoin trades at six-figure levels.

Whales Sold Over 100K BTC Last Month

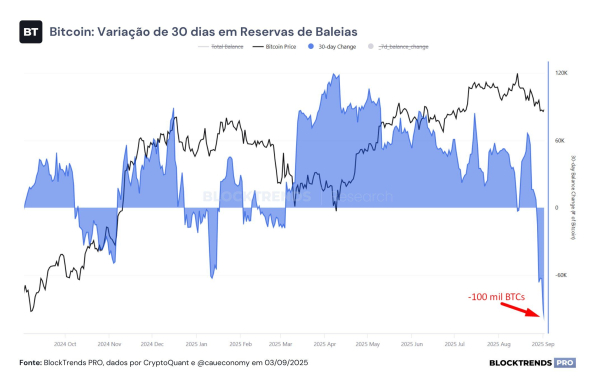

Caué Oliveira noted a trend among Bitcoin whales, indicating that they have sold more than 100,000 BTC in the last 30 days. Blocktrends data shows that this is the largest monthly selling wave since 2022.

Bitcoin Whale Balance Changes. Source: BlockTrends

Bitcoin Whale Balance Changes. Source: BlockTrends

“Yes, whales are dumping the most bitcoin this cycle, but the price has not fallen as much as in other periods,” Oliveira noted.

Bitcoin’s resilience is due to strong demand, which is offsetting whale selling. Blocktrends reported that companies have accumulated $43 billion in Bitcoin in 2025, the largest inflow in history. They have poured in $12.5 billion in the first eight months, surpassing 2024 levels. These companies now own more than 6% of all BTC, up 21-fold from 2020.

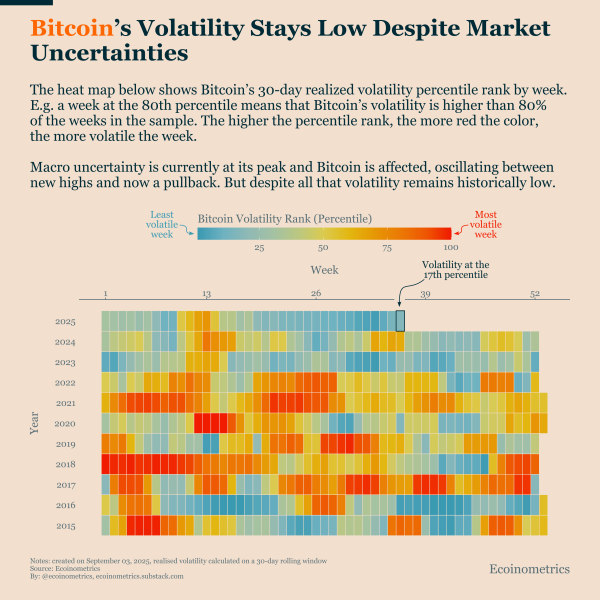

Ecoinometrics report shows that Bitcoin volatility remains extremely low despite macroeconomic uncertainty.

Bitcoin Volatility Map. Source: Ecoinometrics

Bitcoin Volatility Map. Source: Ecoinometrics

“Bitcoin's 30-day realized volatility is lower than it has been in 83% of weeks over the past 10 years. There is uncertainty, but no panic,” Ecoinometrics said.

Strong demand for accumulation has significantly improved Bitcoin’s ability to cope with selling pressure, making it less volatile. Such stability is a key feature of a mature asset, helping Bitcoin to move away from the perception of a high-risk instrument in traditional finance.

Source: cryptonews.net