Bitcoin has hit bottom: should we expect a rebound in BTC prices?

The price of Bitcoin has been falling since August 14, when it hit a new all-time high of $123,731. At the time of writing, BTC is trading at $115,892, down 7% in less than a week.

Let's figure out what's happening in the Bitcoin (BTC) market and what to expect from the cryptocurrency price.

Bitcoin May Enter New Bullish Phase

In a new report, anonymous CryptoQuant analyst SunflowrQuant noted that “a new bullish phase for BTC may be coming soon” as a key on-chain indicator is giving positive signals.

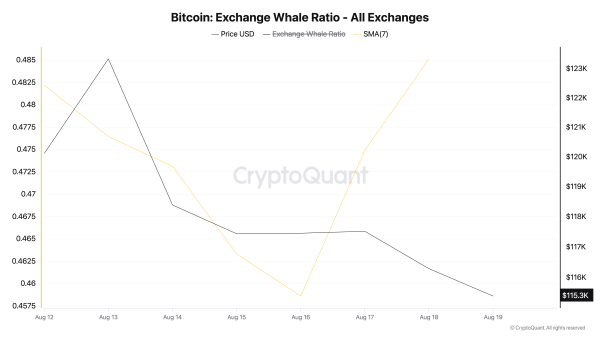

SunflowrQuant analyzed the Exchange Whale Ratio for BTC and found that it has risen into a zone that historically corresponds to local price lows.

Exchange Whale Ratio for BTC. Source: CryptoQuant

Exchange Whale Ratio for BTC. Source: CryptoQuant

The Exchange Whale Ratio for BTC shows how many coins are coming to exchanges from the top 10 transactions. A rise in this ratio indicates activity from large investors, which usually heralds significant market changes.

“When this indicator rises, it means that large investors (whales) are becoming more active on the exchanges. This is often perceived as preparation for significant market changes,” the report says.

The analyst also noted that historically, when the Exchange Whale Ratio for BTC reaches 0.50, it indicates a bottoming phase.

“If you look at recent years, when the Exchange Whale Ratio reached around 0.50, it often meant local price lows, followed by periods of consolidation and then growth,” the analyst noted.

At the time of writing, the indicator is 0.48 and approaching 0.50. Therefore, the recent decline in the price of BTC may be over, setting the stage for a new rally.

Ratio of whales on BTC exchanges. Source: CryptoQuant

Ratio of whales on BTC exchanges. Source: CryptoQuant

BTC's Next Target Is $120,000

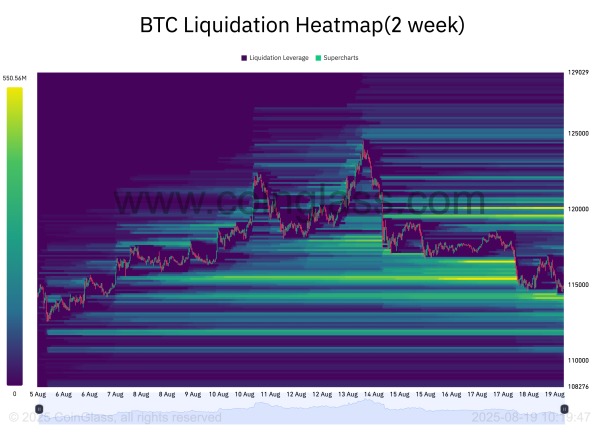

Data from the BTC liquidation heatmap supports this optimistic outlook. According to Coinglass, leveraged positions and liquidity are concentrated above the coin’s current price, around $120,000.

BTC Liquidations Heatmap. Source: Coinglass

BTC Liquidations Heatmap. Source: Coinglass

When accumulations of capital form above the market value of an asset, they can cause short-term gains as traders seek to take advantage of these liquidity zones. For example, they can cause short-term gains for BTC as traders seek to exploit them.

BTC May Fall to $111,000

If SunflowrQuant's prediction comes true and BTC hits a bottom soon, the coin could recover to $120,000 after a period of consolidation.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView

However, if selling pressure intensifies in the near future, BTC risks continuing to fall to $111,961, a level last seen on August 3.

Source: cryptonews.net