Trump-Backed US Bitcoin Company Orders 16,000 ASICs for Bitmain Amid Ongoing Trade War

American Bitcoin, a Bitcoin (BTC) mining company backed by the family of US President Donald Trump, earlier this month exercised an option to purchase up to 17,280 application-specific integrated circuits (ASICs) designed for cryptocurrency mining from Bitmain.

According to TheMinerMag, the mining firm purchased 16,299 Antminer U3S21EXPH units from Bitmain, which provide 14.02 exahashes per second (EH/s) of computing power, for approximately $314 million.

The deal also eliminated the possibility of price increases due to significant trade tariffs and import taxes imposed by the Trump administration that would affect Bitmain's mining equipment made in China.

In response to the pressure caused by the tariffs, Bitmain announced plans to open its first ASIC manufacturing plant in the United States by the end of the year. The company also plans to establish a headquarters in Florida or Texas.

Trade tariffs and other macroeconomic factors have created tension at all levels of the Bitcoin mining supply chain as miners and equipment manufacturers adapt their financial strategies to changing economic conditions.

Related: Jack Dorsey's Block Targets 10-Year Lifecycle for Bitcoin Mining Farms

Mining industry reacts to trade tariffs and economic uncertainty

The tariffs have prompted leading mining equipment manufacturers to consider moving some of their operations to the United States to avoid import taxes on their products.

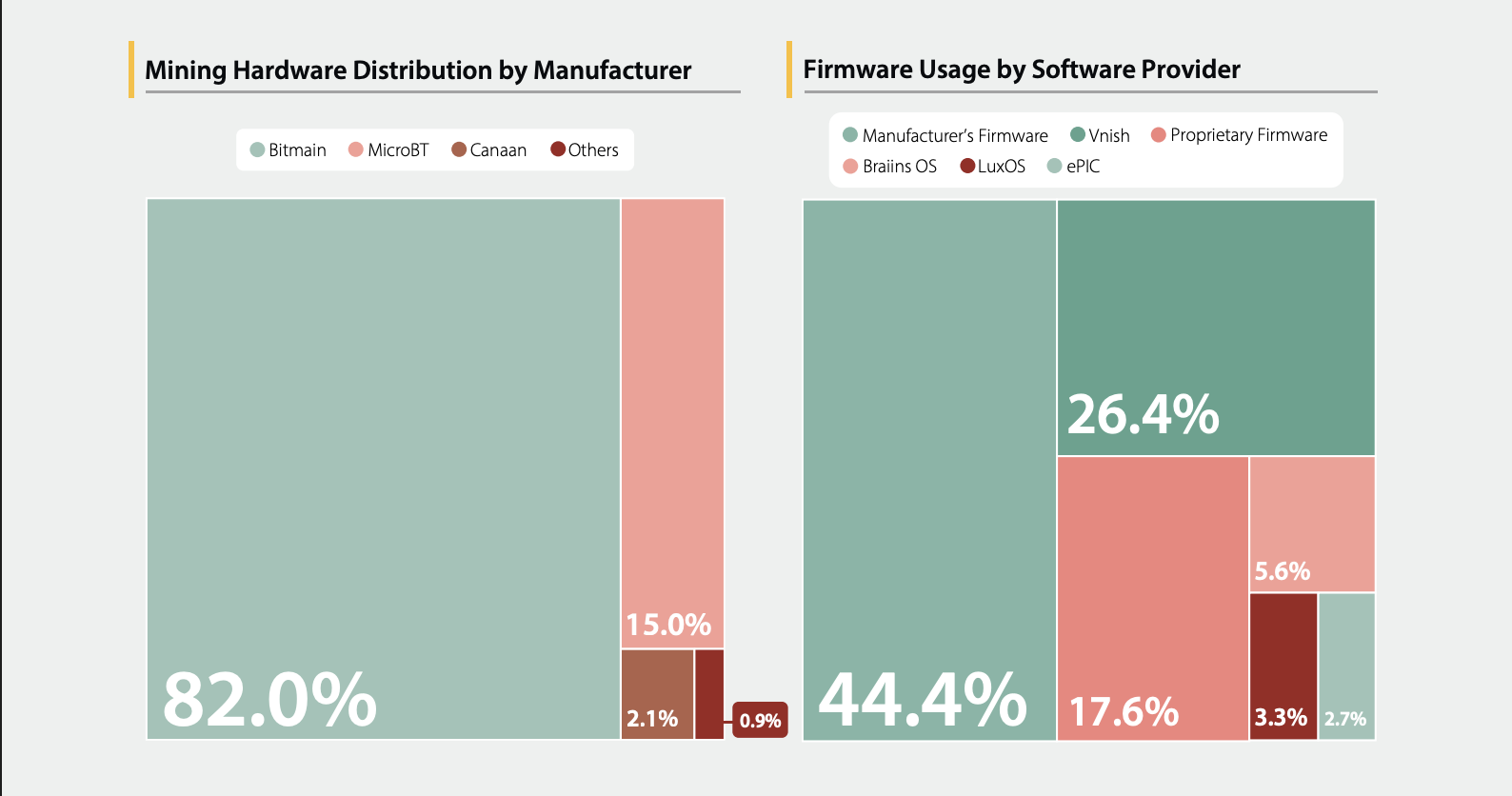

According to a study by the University of Cambridge, more than 99% of all Bitcoin mining equipment is produced by three companies: Bitmain, MicroBT and Canaan.

Bitmain is the largest mining hardware manufacturer in the world, with approximately 82% of the total market share.

The mining hardware market share is divided between three main manufacturers. Source: University of Cambridge.

The mining hardware market share is divided between three main manufacturers. Source: University of Cambridge.

The Trump administration's strategy of using trade tariffs to bring manufacturing back to the U.S. has drawn mixed reviews.

Critics say the policy could cause inflation in the long term and backfire. Jaran Mellerud, CEO of bitcoin mining company Hashlabs, said higher prices due to tariffs could reduce demand from U.S. miners.

ASIC manufacturers could end up with stockpiles that there is no demand for, forcing them to export their products to other countries at lower prices, Mellerud said.

This could lead to mining returning to other countries and put American miners at a disadvantage, which runs counter to the Trump administration's goal of bringing the crypto industry back to the United States.

Magazine: US Risks Becoming 'Leader' in Bitcoin Reserves Among Other Countries: Samson Mow

Source: cryptonews.net