Bitcoin Miners Lose $40M in April as Fourth Straight Revenue Drop Worsens Crisis

Bitcoin miners made $40 million less in April than they did in March, marking the fourth straight month of revenue decline since December as the sector continues its downward trend in profits.

April Brings Losses Again for Bitcoin Miners as Revenues Fall for Fourth Month in a Row

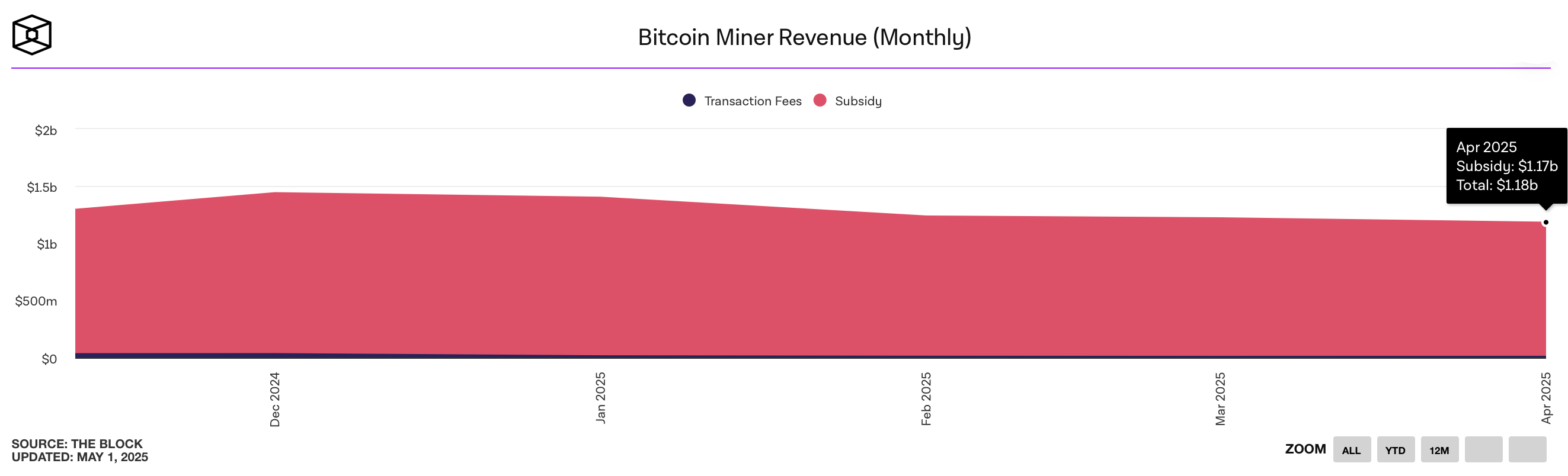

While the drop wasn’t dramatic, it was a contraction nonetheless. In April, Bitcoin miners recorded $1.18 billion in total revenue, including both block subsidies and transaction fees, according to data compiled by theblock.co. Of that total, fees accounted for $15.65 million. By comparison, revenue in March reached $1.22 billion, indicating a $40 million deficit in April.

Source: theblock.co

Source: theblock.co

Interestingly, transaction fees increased slightly in April, compared to $15.11 million in on-chain fees in March. The overall decrease in revenue coincides with a higher BTC price compared to 30 days ago and an increase in the hash rate — the expected daily yield for 1 petahash per second (PH/s) of SHA256 computing power.

On April 1, the hash rate was $46.88, and by May 1, it had increased to $50.26. However, miners face a major obstacle: network difficulty. It currently stands at a record 123.23 trillion. As the average block time slows, the next scheduled difficulty adjustment on May 4, 2025, is expected to reduce the load by about 5.47%.

Currently, rising prices remain one of the few positive factors for miners, and while monthly revenues have declined, the decline has been relatively modest. Miners are facing dwindling margins and increasing operating thresholds, and the market is slowly hinting at a shift in equilibrium. Efficiency is no longer optional – it is becoming existential.

Source: cryptonews.net