Cathie Wood's Ark Invest Raises BTC Price Prediction to $2.4M by 2030

ARK Invest Raises Bitcoin 2030 Price Target to $2.4M in Best-Case Scenario

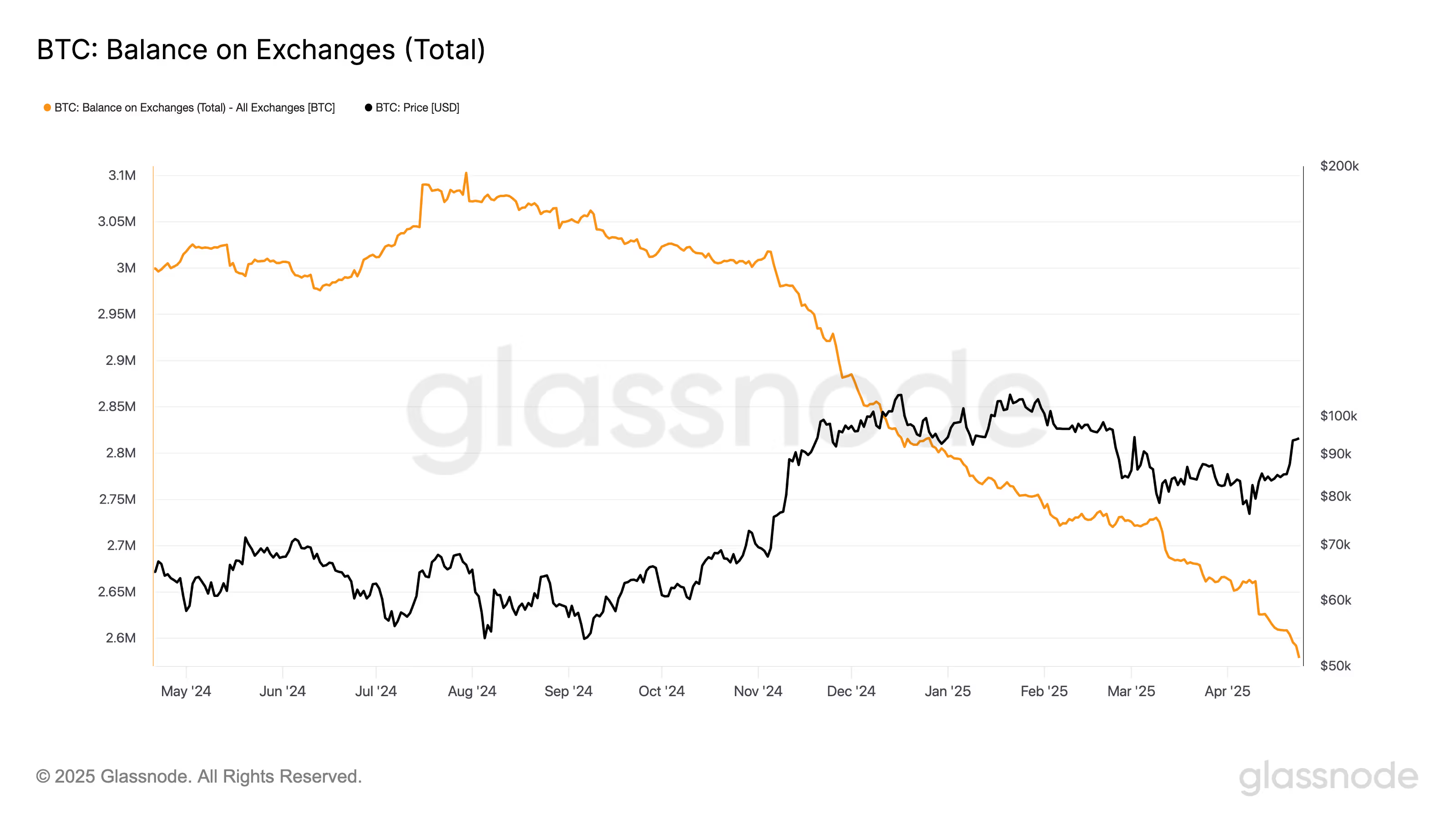

Declining balances on Bitcoin exchanges indicate strong sentiment among holders as Bitcoin price hovers around $94,000.

James Van Straten | Edited by Sheldon Rebeck Updated April 25, 2025, 12:33 PM Published April 25, 2025, 8:50 AM

Key points:

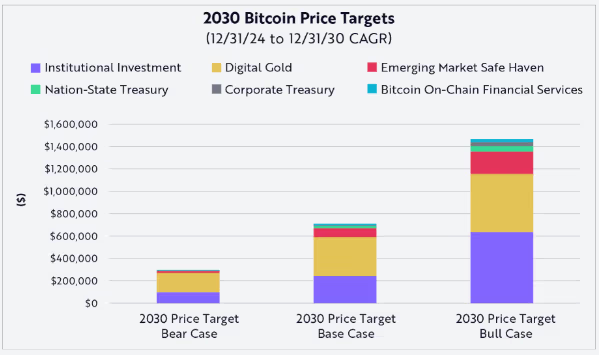

- ARK Invest's updated 2030 Bitcoin price target ranges from $500,000 to $2.4 million, based on asset supply and institutional adoption assumptions.

- BTC's recent rise to $93,000 was made possible by a decline in exchange balances, with Glassnode recording a decrease from 3 million BTC in November to 2.6 million BTC.

ARK Invest has raised its long-term Bitcoin (BTC) price forecast to $2.4 million per unit after revising its asset supply assumptions to exclude lost or long-held coins. The largest cryptocurrency by market cap is currently trading around $94,000.

The expected bullish scenario, which is 60% higher than the January 2024 estimate, implies a compound annual growth rate (CAGR) of 72% from December last year to the end of 2030. The base case assumes a BTC price of $1.2 million, which corresponds to a CAGR of 53%, while the bearish scenario predicts $500,000, which equals a CAGR of 32%.

David Puell, an analyst at investment firm Cathie Wood, applied a model based on the total addressable market and projected market penetration across various sectors. These include institutional investing, bitcoin’s role as “digital gold,” its use as a safe haven in emerging markets, adoption for government and corporate treasuries, and on-chain financial services built on top of the bitcoin network.

Last November, Puell predicted $104,000 to $124,000 by the end of the year. Bitcoin ended December at $93,440, having reached an all-time high of $109,000 in January before falling to lows around $74,500 earlier this month.

Since then, the rise has been partly attributed to a decline in exchange balances, indicating that more BTC is moving into private wallets, which is indicative of long-term holding behavior. According to Glassnode, the number of BTC on exchanges has fallen from about 3 million in November 2024 to 2.6 million, adding to the positive sentiment around the cryptocurrency.