Upexi Shares Soar 700% as GSR Invests $100M in SOL Accumulation

GSR Gives $100M To Upexi To Acquire SOL, Rockets Stock Soars 700%

Upexi intends to use the funds to develop a treasury model focused on Solana staking, with GSR leading the private placement.

Author: Francisco Rodriguez | Edited by: Sheldon Reback Updated: April 21, 2025, 3:56 PM Published: April 21, 2025, 3:09 PM

Key points:

- Upexi plans to implement a Solana-based crypto treasury strategy using $100 million in private placement proceeds.

- The investment led by GSR highlights growing interest in digital assets among public companies.

Cryptocurrency trading firm GSR has led a $100 million private placement of Upexi (UPXI), a consumer goods company that is moving toward a treasury management strategy using digital assets.

The company, whose products include medicinal mushroom gummies and pet care products, said it would use the funds to accumulate and stake Solana (SOL) tokens. The Tampa, Florida-based company had a market cap of $3 million as of Friday.

According to a press release, the investment, structured as a private investment in public equity (PIPE), comes as Upexi transitions from physical production to managing part of its balance sheet using Solana, a fast blockchain known for low fees and fast settlement speeds.

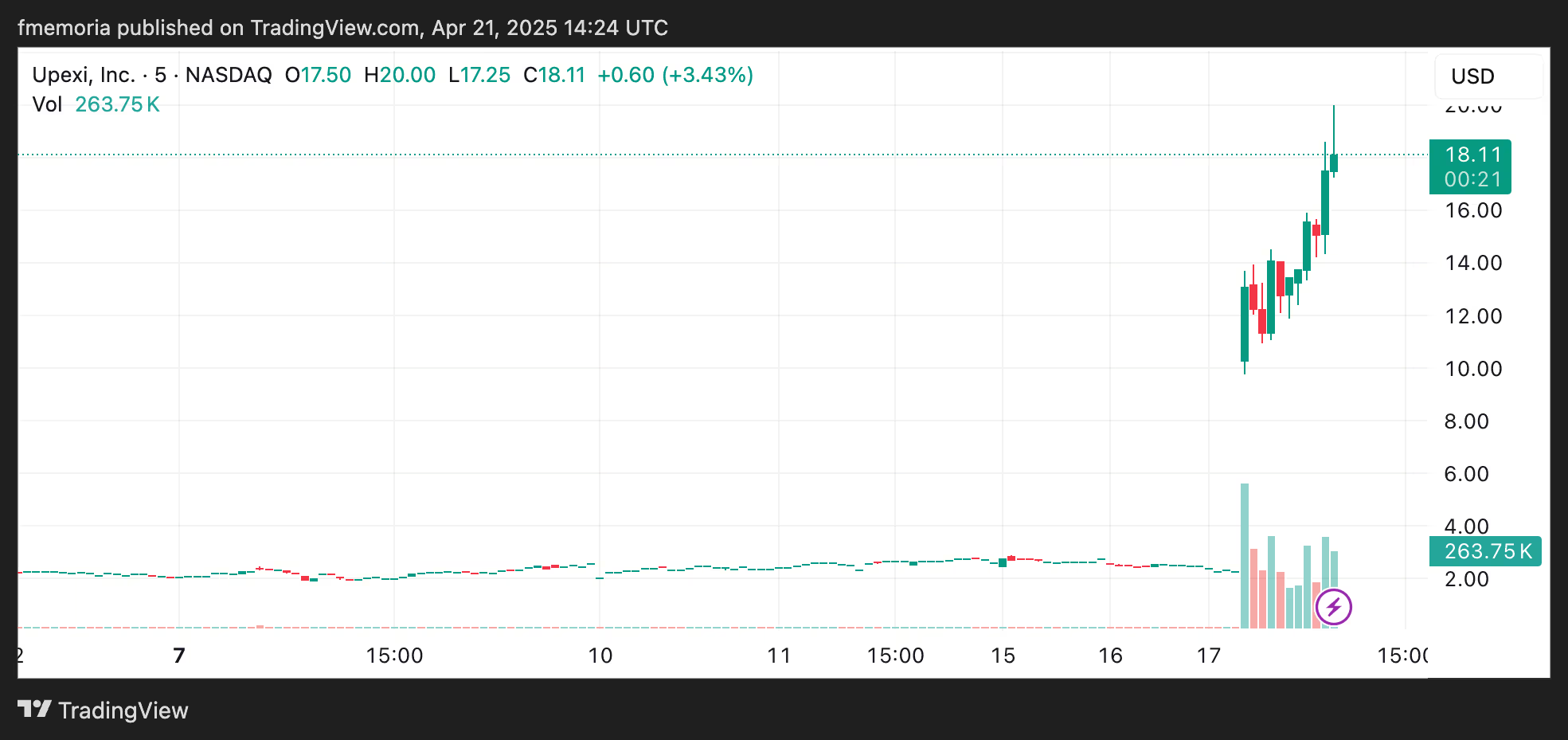

The investment announcement sent Upexi shares up more than 700%, from around $2.30 to $19 at the time of writing.

GSR's participation highlights the growing convergence of public markets and blockchain-based finance.

“This investment highlights the growing interest in efficient and secure access to high-quality crypto assets in public markets,” Brian Rudick, head of research at GSR, said in a statement.

Solana Foundation President Lily Liu noted that this agreement is another step towards integrating traditional financial companies with decentralized infrastructure.

The move “underscores GSR’s confidence in Solana as a leading high-performance blockchain,” the financial company said in a press release.