Circle's EURC Stablecoin Reaches Record Supply as Crypto Investors Seek Dollar Diversification

Circle's EURC Stablecoin Soars 43% to Record Supply Level as Dollar Woes Boost Interest

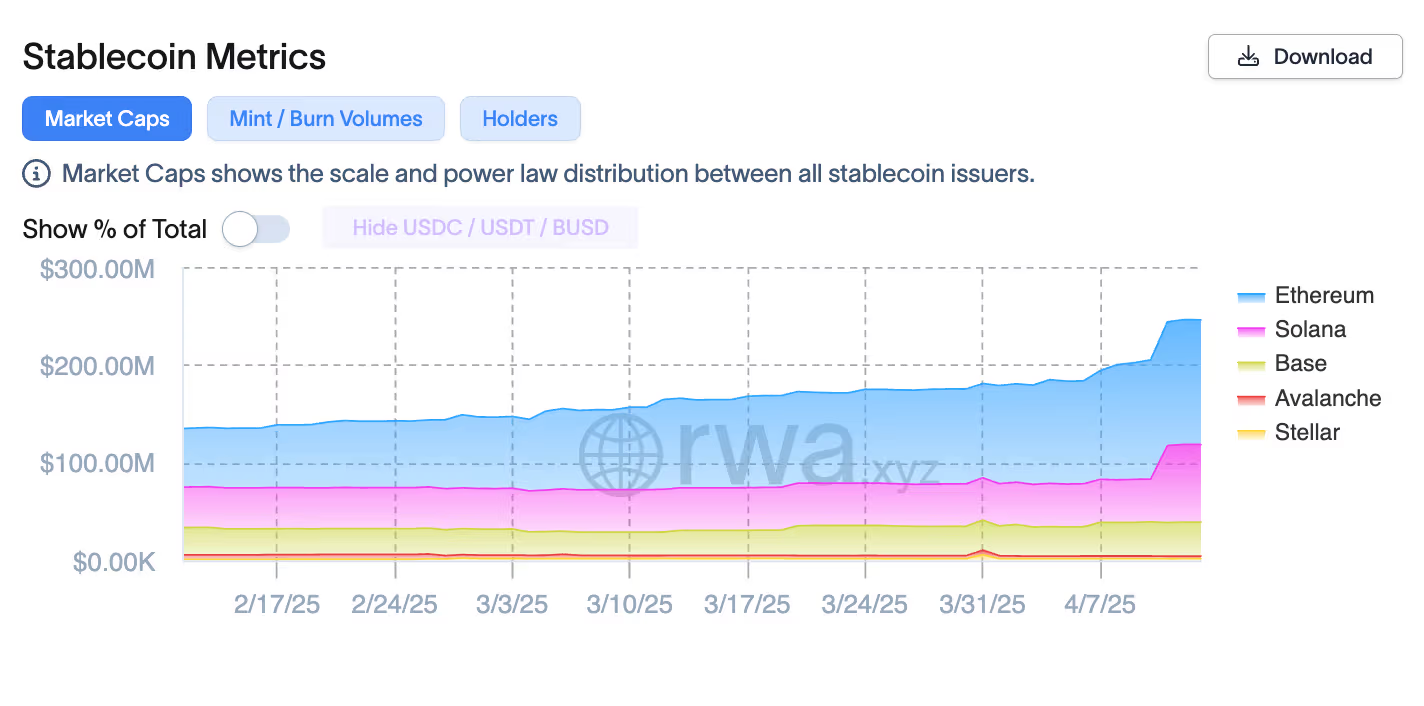

According to the information, the fastest growth is observed in the Ethereum, Solana and Base networks.

Christian Sandor | Edited by Stephen Alpher on April 14, 2025, 7:31 PM

Key facts:

- Circle EURC, a euro-backed stablecoin, has surged 43% in the past month to a record $246 million amid increased interest in euro-denominated digital assets.

- Increased concerns about the stability of the U.S. dollar and worries about Trump-era tariffs have prompted cryptocurrency users to look for alternative solutions, according to Xapo Bank.

- The rise in EURC was also helped by Tether's exit from the Eurostablecoin market and the exclusion of USDT from exchanges including Binance for EU users.

Circle's euro-backed stablecoin EURC has reached a record supply level amid escalating U.S. trade tensions and a weaker dollar, which is likely to drive interest in euro-denominated digital assets.

According to RWA.xyz, the EURC supply has increased 43% in the last month to 217 million tokens worth $246 million, surpassing Paxos Global Dollar (USDG) and behind Ripple’s RLUSD in market cap. The bulk of EURC tokens are on the Ethereum network, up 35% in a month to 112 million, while Solana saw the fastest expansion, up 75% to 70 million tokens. Base, Coinbase’s layer-2 Ethereum, also saw a 30% increase to 30 million in EURC supply.

The token has also seen an increase in network activity, with the number of active addresses up 66% to 22,000 and monthly transfer volume exceeding $2.5 billion, up 47% month-on-month, according to RWA.xyz.

EURC is currently the leading Euro stablecoin on the market, but it is significantly smaller than its dollar-denominated counterparts. Dollar-pegged stablecoins make up 99% of the fast-growing stablecoin segment, including Circle's USDC token with a market cap of $58 billion and Tether's competitor USDT with a market cap of $143 billion.

The accelerating rise in the EURC may indicate growing interest in diversifying into euro-denominated digital assets, especially as global investors try to

Источник