RWA News: Tokenized Real-World Assets Could Reach $18.9 Trillion by 2033, Says Ripple and BCG Report

Ripple and BCG predict the tokenized asset market will reach $18.9 trillion by 2033

The report found that asset tokenization could significantly reduce costs for asset managers and issuers, facilitating wider adoption.

Author: Christian Sandor | Edited by: Stephen Alpher Updated: April 7, 2025, 8:25 PM Published: April 7, 2025, 8:09 PM

What you should know:

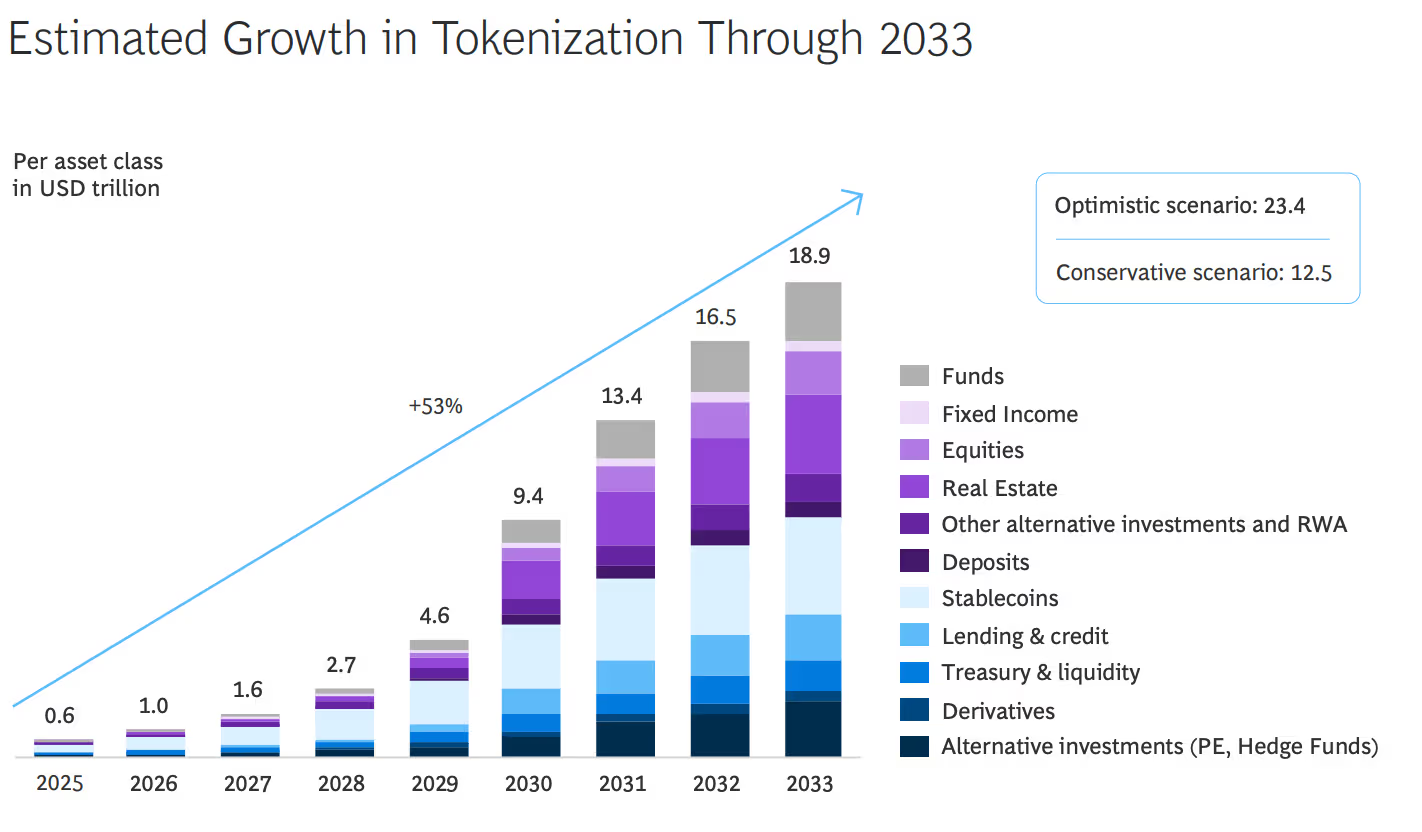

- Ripple and BCG forecasts suggest that the tokenized asset market, including stablecoins, will reach $18.9 trillion by 2033.

- The report highlights that tokenization of money markets, private lending, and carbon emissions are use cases that drive operational efficiency.

- The document notes that unclear rules, lack of standards and market fragmentation are barriers to wider adoption.

The market for tokenized financial instruments, or real assets (RWAs), is expected to reach $18.9 trillion by 2033 as technology advances near a “tipping point,” according to a joint report released Monday from Boston Consulting Group (BCG) and digital asset infrastructure and payments company Ripple.

This would represent a compound annual growth rate (CAGR) of 53%, which is somewhere between the conservative scenario of the report of $12 trillion in tokenized assets over the next eight years and the more optimistic estimate of $23.4 trillion.

Tokenization is the process of using blockchain technology to record ownership and move assets such as securities, commodities, and real estate. It is a rapidly growing area in the cryptocurrency sector, with many large traditional financial firms pursuing tokenization to improve efficiency, make settlements faster and cheaper, and enable 24/7 transactions. JPMorgan’s Kinexys platform has already processed over $1.5 trillion in tokenized trades, with daily volumes exceeding $2 billion. BlackRock’s Tokenized US Dollar Money Market Fund (BUIDL) issued by Securitize is approaching $2 billion in assets under management and is increasingly being used in decentralized finance (DeFi).

“The technology is ready, regulation is evolving, and there are options on the market

Источник