Report: Bitcoin Miners Have $100K in BTC, But Owe $4.6 Billion

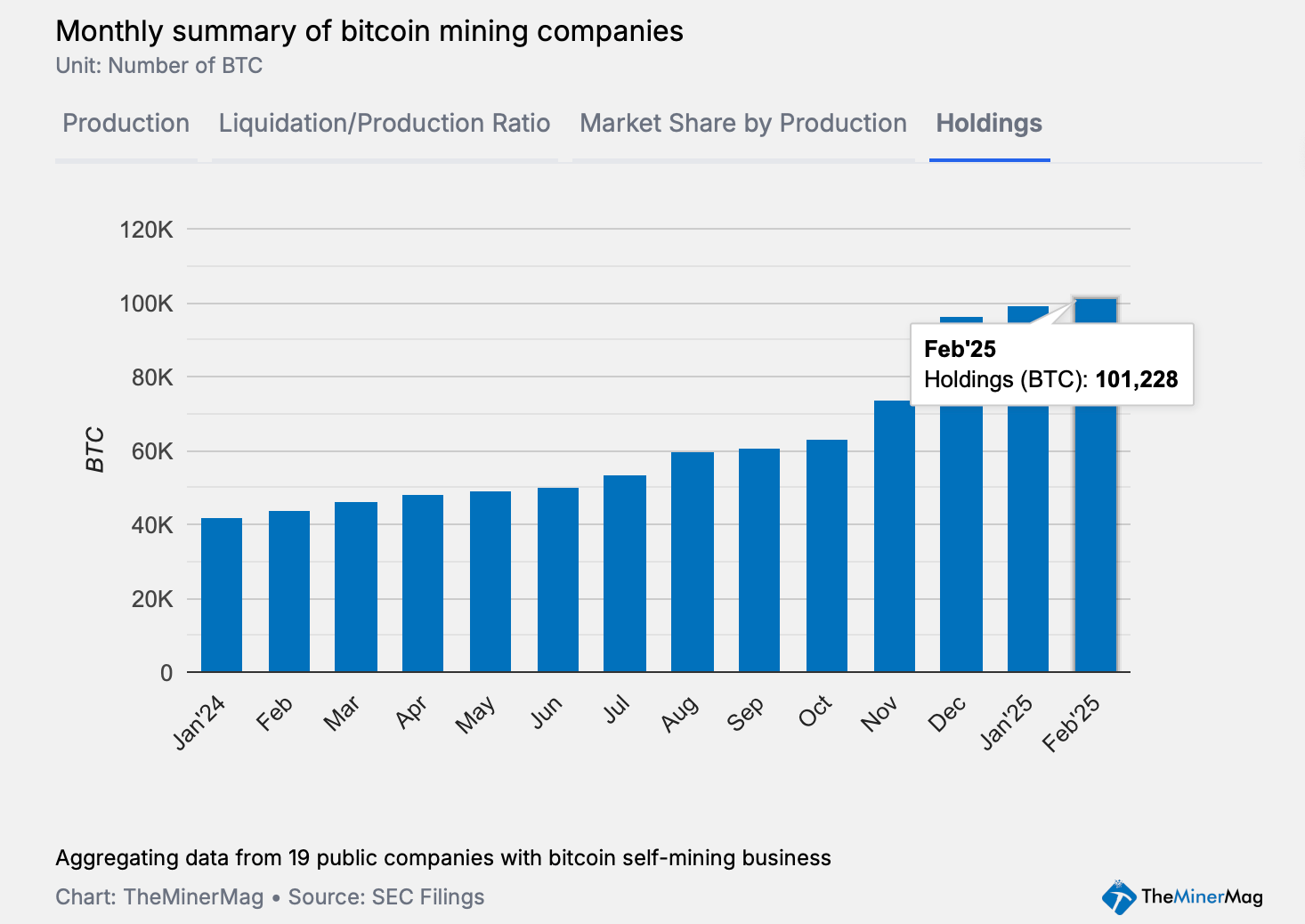

According to a recent study, Bitcoin mining companies that are privately held or traded on the stock market now hold more than 100,000 BTC. However, there is one problem – these firms have also accumulated a significant debt of $4.6 billion.

Bitcoin Miners Are Teetering on the Brink of Debt, Holding 100K BTC

All ten of the largest publicly traded Bitcoin mining companies posted gains on Friday, with Applied Digital standing out with an 11.46% gain. Moreover, news, data, and research platform theminermag.com released a report this week on the current state of Bitcoin miners.

The analysis highlights that among the 14 companies, representing both the private and public sectors, all ended February with a total of 101,000 BTC. As reported in the findings of theminermag.com, companies such as Cango, Core Scientific, Hut 8, Riot, Cleanspark and MARA have seen double-digit declines since January.

Source: theminermag.com

Source: theminermag.com

This total BTC supply is now valued at $8.51 billion at current exchange rates. At the same time, the report also shows that publicly traded Bitcoin miners have accumulated $4.6 billion in debt financing.

“With Bitcoin’s hashrate (daily revenue per unit of computing power) falling below $50 per PH/s again, having reached $45 per PH/s during the recent market crash, it will be interesting to see how this dynamic changes, especially for companies hosting their hardware,” theminermag.com analysis said.

As for the Bitcoin hash rate? Think of it as the estimated daily income a miner can make from one petahash per second (PH/s) of SHA256 hashing power. Fast forward to March 15, 2025, the hash rate was $47.85 per PH/s. Since February 15, the hash rate has fallen 11.84% over the past 30 days.

Source: cryptonews.net