Bitcoin Mining Tightens: Difficulty Hits 110.45 Trillion Amid Revenue Slump

Bitcoin’s mining difficulty has edged up by 0.61%, rising from 109.78 trillion to 110.45 trillion. At the same time, the network’s hashrate remains relatively subdued, following a notable drop from its high of 824 exahash per second (EH/s) to the current 778 EH/s.

Bitcoin’s Difficulty Increases, Hashrate Falters

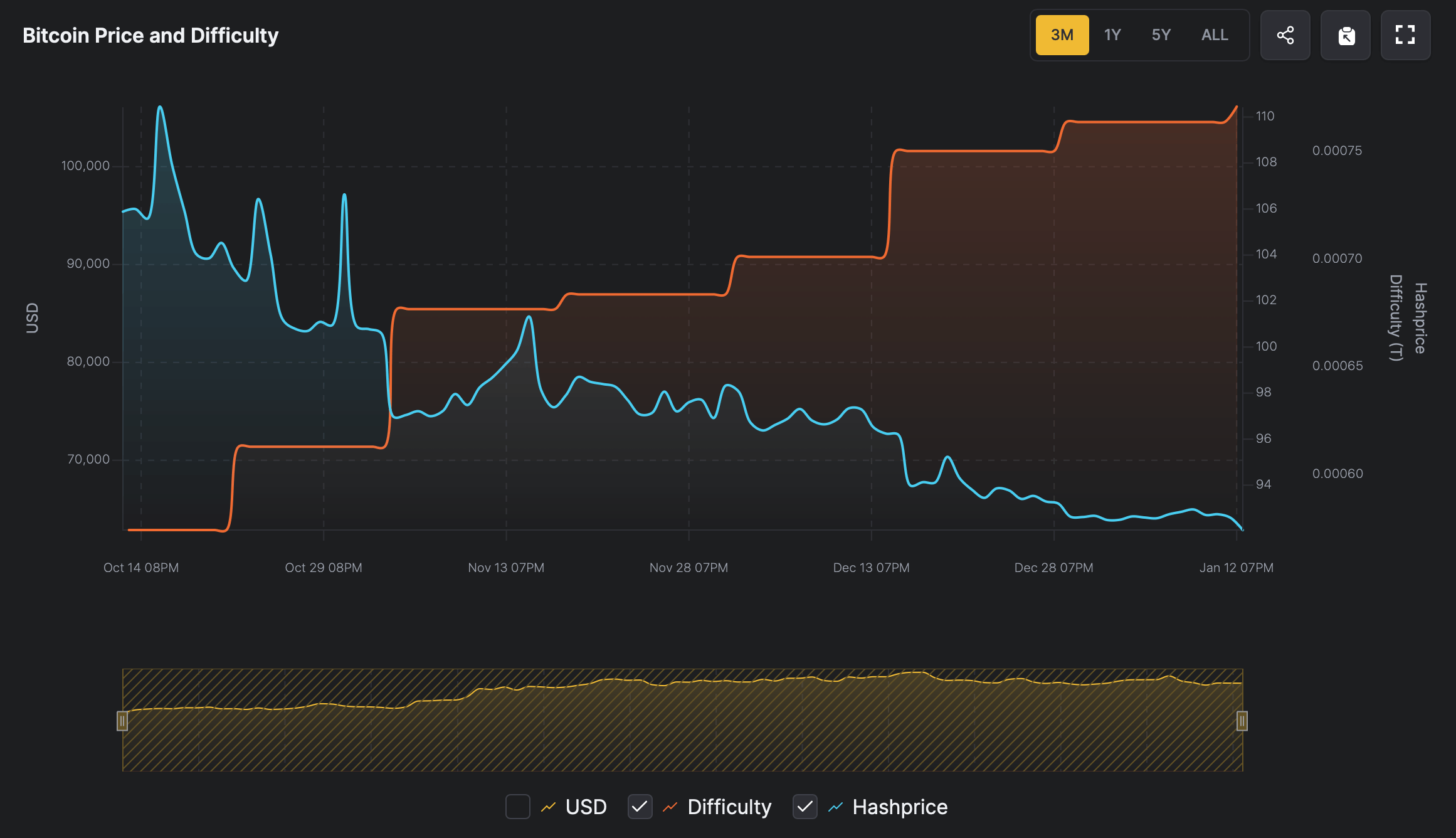

Since block height 878,976 was mined, the process of extracting bitcoin has grown marginally more challenging, as reflected in the 0.61% increase in the difficulty parameter. A difficulty level of 110.45 trillion indicates that the target for hashing computations is now 110.45 trillion times more complex than Bitcoin’s baseline difficulty, which was set at 1 when the network debuted in 2009.

Bitcoin difficulty and hashprice according to hashrateindex.com.

Bitcoin difficulty and hashprice according to hashrateindex.com.

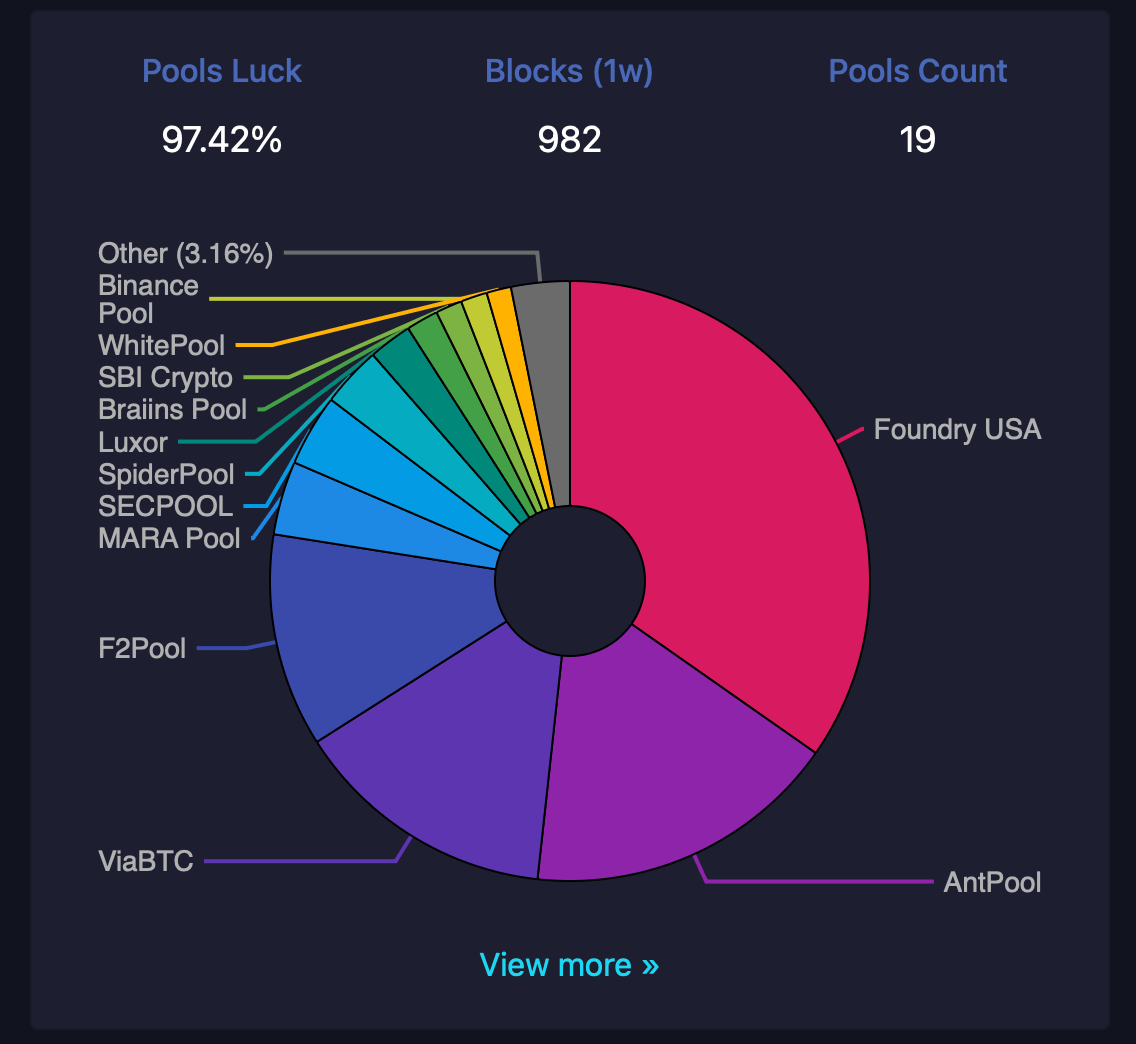

The network’s computational power, or hashrate, currently stands at 778 EH/s, a decline of 46 EH/s from the Jan. 6, 2025, peak of 824 EH/s. Foundry USA leads the mining pools this week, contributing 34.73% of the global hashrate, equivalent to about 265 EH/s. Following closely is Antpool, accounting for 17.01% of the total power with just over 130 EH/s. Viabtc secures the third spot, allocating 109 EH/s to the network, representing 14.26% of the total.

Bitcoin mining hashrate distribution according to mempool.space.

Bitcoin mining hashrate distribution according to mempool.space.

A total of 65 pools or entities are directing hashrate, with contributions ranging from 192.56 kilohash per second (KH/s) to Foundry’s substantial 265 EH/s. Over the last 30 days, miners have experienced diminished revenues compared to mid-Dec. In fact, earnings are now at their lowest point for the month. On Dec. 15, 2024, one petahash per second (PH/s) of hashrate per day was valued at $65.10, but as of today, that figure has fallen to $52.22—a reduction of 19.79% in mining revenue.

The recent adjustments in mining metrics suggest a recalibration period for Bitcoin’s ecosystem, reflecting shifts in computational power and miner profitability. As hashrate dynamics evolve and revenue pressures mount, the network’s resilience and adaptability remain pivotal. How mining participants respond to these economic signals could quite easily shape mining strategies going forward.

Source: cryptonews.net