Tether Amasses Gold: A Top Global Purchaser

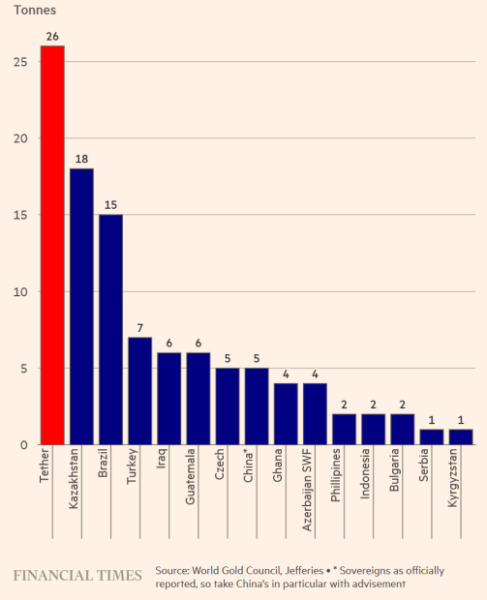

- A notable alteration in the worldwide gold arena is generating attention: Tether is currently procuring more gold than numerous national banks globally. A widely shared graphic reveals the crypto entity has amassed 26 tonnes of gold, exceeding the acquisitions of state purchasers such as Kazakhstan (18 tonnes), Brazil (15 tonnes), or Turkey, which are only obtaining single-digit quantities.

- Even nations such as Bulgaria, Serbia, or the Philippines, which customarily utilize gold as a vital stockpile, seem considerably behind Tether with merely one to two tonnes.

- This signifies the initial occasion a non-governmental stablecoin provider has surpassed a classification that is typically governed by central institutions and state investment organizations.

- The circumstance that a blockchain enterprise is evolving into the foremost catalyst behind prevailing gold procurement is inciting discourse within both the crypto and valuable metals domains. Tether has been predominantly recognized for its substantial distribution to US Treasury securities, yet the noteworthy augmentation of its gold possessions imparts a novel strategic facet to its reserve approach.

- Conventional gold financiers may perceive it as unexpected that a principal propellant of the ongoing price strain is not governmental involvement, but instead the crypto sector. Should Tether sustain its present procurement impetus, the entity could broaden its sway considerably beyond the crypto marketplaces to encompass worldwide commodity streams.

- Possessing a market valuation of $187 billion, Tether reigns as the globe’s foremost stablecoin issuer. During Q3 2025, it documented unprecedented profits of $10 billion. Furthermore, it intends to materialize as the globe’s paramount Bitcoin mining operation by the year’s conclusion.

Recommended video: Bitcoin at an end? How bad is it really?

source

- Financial Times report | Financial Times