On-chain metrics indicate Bitcoin's bottom is forming in November.

Determining a Bitcoin price reversal point is challenging even for experienced analysts. However, an analysis of on-chain indicators and trading data suggests that the asset may have bottomed out this month.

The main task is to determine whether this bottom is temporary or whether it signals a long-term change in trend.

Activity of large investors and market liquidity

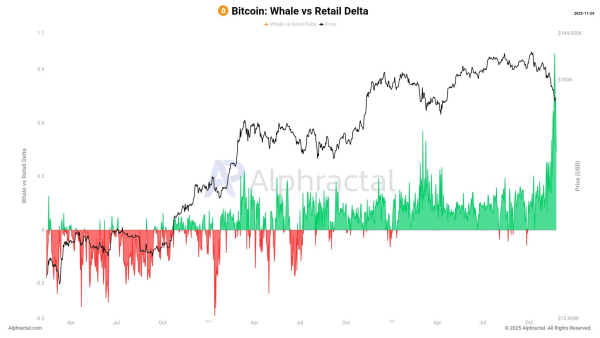

The Whale vs. Retail Delta indicator is delivering an unprecedented positive signal for Bitcoin. This indicator measures the difference between the volume of long positions held by large market participants (“whales”) and retail traders. It reflects the whales' expectations regarding the asset's future volatility in the derivatives market.

According to João Wedson, founder and CEO of Alphractal, for the first time in history, large investors are holding dominant long positions, significantly outpacing retail participants. Earlier, in February and March, a sharp spike in this indicator coincided with the formation of a local bottom near $75,000.

Bitcoin whale vs. retail delta. Source: Alphractal.

Bitcoin whale vs. retail delta. Source: Alphractal.

“When these levels reached such heights in the past, local bottoms were formed – but at the same time, large positions were liquidated,” says João Vedson.

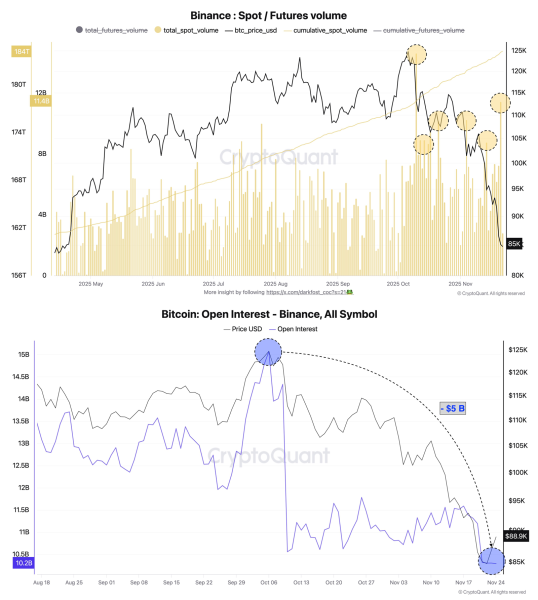

Furthermore, spot Bitcoin trading volumes are growing, while open interest (OI) in the derivatives market is declining. This shift indicates a recovery in the market and a reduction in its reliance on speculative trading.

According to CryptoQuant, daily spot volume on Binance consistently exceeded $10 billion throughout November. This level is significantly higher than the average for previous months. At the same time, daily open interest on Binance decreased by $5 billion compared to October.

Spot/futures volume on Binance. Source: CryptoQuant.

Spot/futures volume on Binance. Source: CryptoQuant.

This trend suggests that speculative positions are being withdrawn from the market. Capital is flowing into the spot market, where investors acquire real Bitcoin without the use of high leverage. This shift provides more sustainable and long-term growth potential for the asset.

“When such capital outflows occur, analysts often say it resets the market and prepares it for a healthier phase. This is true, but only if the spot market is involved. This is exactly what's happening on Binance right now,” comments analyst Darkfast.

These factors suggest that Bitcoin may have successfully bottomed in November. However, not all experts share this optimistic sentiment. Many warn that the current recovery could be a so-called “dead cat bounce.”

This term refers to a temporary price increase following a sharp decline, followed by a resumption of the downward trend. This risk may prompt traders to reduce leverage and reduce positions in case of a sudden negative market reversal.

The post “On-chain metrics indicate Bitcoin bottom in November” appeared first on BeInCrypto.

Source: cryptonews.net