Bear Market? Bitcoin Approaches the Psychologically Important $80,000 Level

The price of the leading cryptocurrency on the Bitstamp exchange briefly dropped to $80,537 on November 21, representing a 36% drop from its all-time high reached on October 6. The correction sparked a heated debate among analysts about whether the current bullish cycle had ended or the market was experiencing a temporary decline.

BTC/USD 1-day chart. Source: Bitstamp

BTC/USD 1-day chart. Source: Bitstamp

Technical levels indicate an extreme correction

Trader Daan Crypto Trades points to the decline to the 0.382 Fibonacci retracement level on the weekly timeframe, which has marked the bottom of every major correction in the current cycle. According to him, the moves are becoming larger in nominal terms as the cycle progresses, but essentially we're seeing roughly equal corrections in terms of percentage size.

BTC/USD 1-Week Chart. Analysis by Daan Crypto Trades

BTC/USD 1-Week Chart. Analysis by Daan Crypto Trades

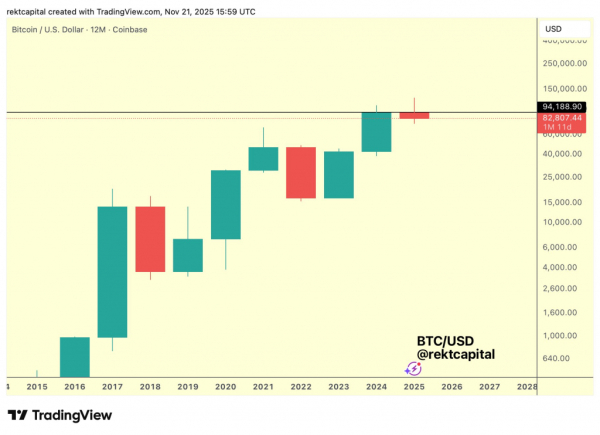

Rekt Capital analyst believes that the fact that Bitcoin is currently below its four-year cycle level of around $93,000 indicates the significance of the current correction. History suggests the price should end 2025 with a green candlestick, closing above $93,000, followed by a bear market phase in 2026.

BTC/USD 12-month chart. Analysis: Rekt Capital

BTC/USD 12-month chart. Analysis: Rekt Capital

Indicators have reached extreme values

Analyst Cas Abbé notes that Bitcoin's daily RSI has been in oversold territory for three days in a row. The daily MACD has already reached its lowest level, indicating a selling peak. The analyst wouldn't be surprised to see a rebound to trap late sellers.

BTC/USD 1-Day Chart. Analysis by Cas Abbe

BTC/USD 1-Day Chart. Analysis by Cas Abbe

Cryptocurrency investor Crypto Rover notes that Bitcoin's RSI is currently at a level that could indicate the beginning of a bearish market phase.

BTC/USD 1-Week Chart. Analysis: Crypto Rover

Opinions Divided on the Fate of the Bull Cycle

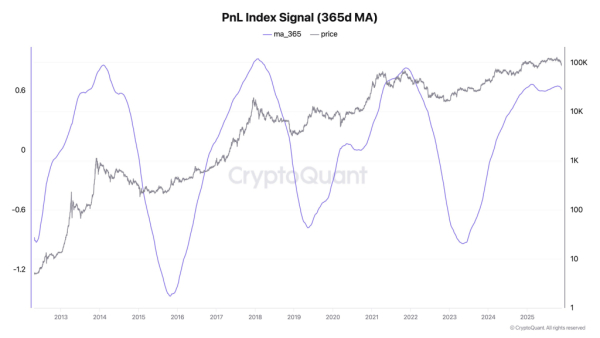

Ki Young Ju, founder and CEO of the analytics platform CryptoQuant, asserts that Bitcoin is in a profit-taking phase. The PnL index measures profits and losses based on the value base of all wallets. Classic cycle theory suggests a bear market is entering. However, the analyst emphasizes that only increased global liquidity can overcome the profit-taking cycle, as occurred in 2020.

Bitcoin PnL indicator. Source: CryptoQuant

Bitcoin PnL indicator. Source: CryptoQuant

Against this backdrop of pessimism, trader, analyst, and entrepreneur Michaël van de Poppe stands out for his optimistic stance. He states, “Everyone will say the Bitcoin cycle is over, but it's not. Buy the dip. Enjoy the bull market in 2026.”

The current situation highlights a key debate in the crypto community: has Bitcoin's bullish cycle ended or is the current correction merely a temporary pause before further growth.

Source: cryptonews.net