Fed minutes show December rate cut on the brink, Bitcoin falls below $89,000

The recently released minutes of the US Federal Reserve's October 28-29 meeting have added uncertainty to the December policy outlook, fueling volatility in stock, bond and Bitcoin markets.

While the minutes reflect economic data available only at the time of the meeting, the change in language within the document has become the final reference point for analysts discussing the Fed's next steps.

Fed meeting minutes show a narrow majority against a rate cut in December.

The Fed described how “many” officials believe a December rate cut is “likely not appropriate,” while “some” said a rate cut “may well be appropriate.”

In the parlance of Fed watchers, hierarchy matters. “Some” > “a few,” and “many” outweigh both. This suggests that at the meeting, a narrow majority opposed a rate cut in December.

💥BREAKING:

FOMC MINUTES:

– MANY SAW DECEMBER RATE CUT AS LIKELY NOT APPROPRIATE

– SEVERAL SAID DECEMBER CUT 'COULD WELL BE' APPROPRIATE pic.twitter.com/nAVD0RFUEc

— Crypto Rover (@cryptorover) November 19, 2025

The minutes also point to new tensions emerging in money markets:

- Repo volatility,

- reducing the use of ON RRP, and

- drift of reserves towards deficit.

This combination historically precedes the end of quantitative easing (QT). Therefore, sentiment is that the Fed may be closer than expected to completing balance sheet reduction.

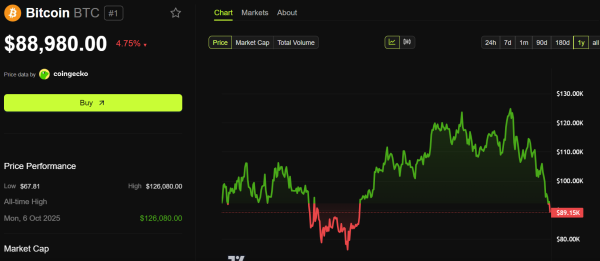

Ahead of this publication's release, markets had already begun to reduce risk, and the price of Bitcoin fell below $89,000, reaching a seven-month low. This sentiment spread to crypto stocks and TradFi indices.

Bitcoin (BTC) Price Dynamics. Source: BeInCrypto

Bitcoin (BTC) Price Dynamics. Source: BeInCrypto

Macro traders say the real story is a razor-thin split within the Fed. Meeting minutes show a lack of firm consensus, suggesting December will be one of the toughest policy months since the Fed began its fight against inflation.

Some officials emphasized still-elevated inflation risks, while others pointed to cooling labor conditions and waning demand. Armed with data released after the meeting, including a lower consumer price index, stable jobless claims, and cooling retail activity, December could be reshaped by the next two data points.

The market is currently reorienting itself to a scenario where liquidity tightens, political uncertainty increases, and Bitcoin is in a structurally vulnerable zone until buyers regain control.

If the Fed decides to hold rates in December, markets can expect a longer-than-expected plateau and more volatility.

The post Fed minutes show December rate cut on the brink, Bitcoin falls below $89,000 appeared first on BeInCrypto.

Source: cryptonews.net