Bitcoin hits seven-month low amid record outflows from exchanges

The price of the leading cryptocurrency fell to $90,000 after several days of correction. This is the lowest level in the last seven months. However, many market participants view the current price drop as an opportune entry point.

Price dynamics indicate the emergence of an investment opportunity, not the beginning of a protracted crisis. Long-term investors remain constructive.

The transition of holders to the accumulation phase

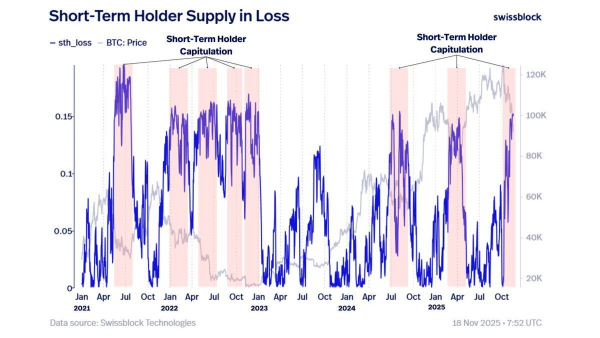

Analytical data from the Swissblock platform reveals a significant trend. The supply of short-term holders (STHs) at a loss has reached historical highs. Such spikes often correlate with the formation of local market bottoms.

These indicators indicate extreme pressure in the current cycle. Typically, such metrics appear immediately before the recovery phase.

Short-term asset holders are showing no signs of panic selling. This strengthens the case for a quick stabilization of the exchange rate. Current metrics point to a “window of opportunity” for finding a bottom. The absence of forced capitulation confirms the hypothesis that a solid foundation for growth is forming.

Bitcoin STH supply is at a loss. Source: Swissblock

Bitcoin STH supply is at a loss. Source: Swissblock

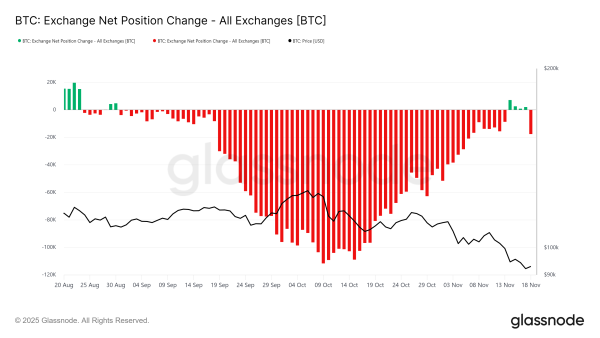

The situation with exchange balances is also changing for the better. The net position of exchanges has once again entered the outflow zone after a brief period of inflow. Over the past 24 hours, more than 20,167 BTC were withdrawn from trading platforms. In monetary terms, this amount exceeds $1.82 billion.

This shift signals growing investor confidence. Market participants perceive the price pullback as an opportunity to accumulate positions.

Steady outflows traditionally reflect traders' long-term beliefs. Coins are moving into cold storage rather than remaining available for quick sale. Strong buying interest during price declines supports the narrative of impending growth. As inflows slow and accumulation intensifies, the macroeconomic environment for Bitcoin continues to strengthen.

Bitcoin Exchange Net Position Change. Source: Glassnode

Bitcoin Exchange Net Position Change. Source: Glassnode

Technical analysis and recovery prospects

At the time of writing, Bitcoin is trading at $90,331. The price is holding above key support at $89,800. This level has become an important buffer during the decline.

The fall to a multi-month low has heightened market caution. However, technical and behavioral signals suggest selling pressure is easing.

Historical patterns and investor support make a deeper decline unlikely. A rebound from $89,800 could return the price to $95,000. This will be supported by improved sentiment and stronger demand.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

There's also a negative scenario. If the bullish momentum fades and overall market weakness intensifies, the asset could fall below current support. In that case, the price risks falling to $86,822. Such a decline would invalidate the current positive outlook and signal a deeper correction.

The post Bitcoin hits seven-month low amid record exchange outflows appeared first on BeInCrypto.

Source: cryptonews.net