A “dangerous” situation is developing in the Bitcoin market – K33

Over the past week, the price of Bitcoin (BTC) briefly fell to $89,183—its lowest level since April. According to analysts at K33 Research, the situation in the leading cryptocurrency market is complicated by a combination of two risk factors.

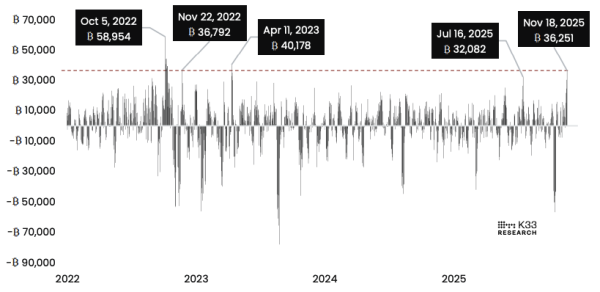

First, perp futures traders increased open interest (OI) by 36,000 coins, the largest weekly increase since April 2023.

Bitcoin perp futures OI for 7 days. Source: K33 Research.

Bitcoin perp futures OI for 7 days. Source: K33 Research.

Secondly, funding rates have risen. Traders are overly aggressively opening limit orders in the hopes that the cryptocurrency will rebound.

“Hopes for a rebound forced traders to leverage at the lows. Since the price hasn't risen, leverage now threatens the market with increased volatility due to forced liquidations,” commented Vetle Lunde, head of research at K33.

On the topic: Bitcoin below $92,000 – what's happening to the world's leading cryptocurrency miners

The expert noted that a sharp price movement could result in a wave of liquidations affecting both buyers and sellers. However, rising financing rates indicate that the market is overflowing with long positions.

If prices continue to fall, the mass exodus of buyers will cause an even stronger collapse.

Experts note a worrying gap: while some traders are actively speculating, institutional investors on the CME are cautious, not expecting growth. According to K33, in 86% of cases over the past five years, this situation has led to a price drop of an average of 16% in the following month.

“This is a dangerous signal that forces us to recommend reducing risks despite previous optimism,” Lunde said.

The ETF market is also suffering

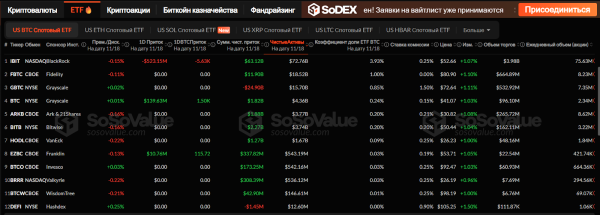

The Bitcoin spot ETF market also saw significant capital outflows. The largest BTC ETF, IBIT, experienced its highest withdrawal ever ($523.15 million in a single day).

On the topic: The US won't launch a Bitcoin reserve until other countries do so.

Capital outflows/inflows in the spot Bitcoin ETF market. Source: SoSoValue.

Capital outflows/inflows in the spot Bitcoin ETF market. Source: SoSoValue.

Lunde noted that Bitcoin ETFs have lost 20,150 BTC in the past week and nearly 40,000 BTC in the past 30 days. Meanwhile, altcoin-based funds are faring much better: they generally haven't experienced such steep losses, and some have even attracted new investment.

What to expect next?

K33 Research concluded that they do not expect a repeat of the prolonged bearish cycles of 2018 and 2022. However, analysts also anticipate a more worrisome scenario: if Bitcoin continues to decline, a new bottom could be expected between $84,000 and $86,000.

Lunde explained that these levels are important from a psychological perspective. It's widely believed that Michael Saylor's company, Strategy, will sell en masse if the price of its assets falls below its own, but this isn't true. However, the mere fact that traders are paying attention to these levels could trigger active selling at them.

Related: Wall Street Isn't Harming Bitcoin – Michael Saylor

This article does not contain investment advice or recommendations. Every investment and trading decision involves risk, and readers should conduct their own research before making decisions.

Source: cryptonews.net