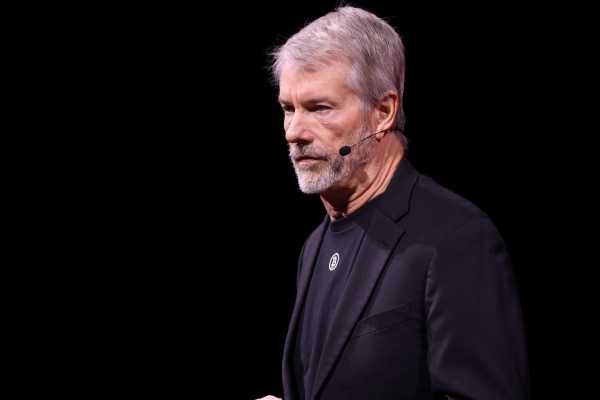

Speculation surrounding Strategy: Is Saylor currently selling off its Bitcoin holdings?

- Shares of Bitcoin treasury giant Strategy are under massive pressure. From their all-time high of $543 on November 21, 2024, the price has fallen to around $220 – a drop of almost 60 percent. The market capitalization of approximately $63.5 billion has recently even fallen below the value of Bitcoin's balance sheet, which is worth around $65 billion.

- Against this backdrop, large Bitcoin transfers at Strategy are currently causing wild speculation on social media: Is the company selling off its Bitcoin holdings?

- A closer look reveals that this is very likely not the case. Current transfers are not going to known exchanges. Furthermore, forced sales are extremely unlikely. Strategy could, if necessary, defer the payment obligations arising from dividends on the preferred shares or finance them through new share issues without having to directly sell Bitcoin.

- Things would only get really tricky when the more than eight billion US dollars in convertible bonds mature from 2028 onwards and the share price remains so low that refinancing or conversion into shares is hardly possible – then BTC sales could become an option.

- The Multiple Net Asset Value (mNAV) is currently around 1.2 due to the inclusion of convertible bonds and preferred shares, and is therefore significantly lower than in the past.

- This reduced premium is precisely what puts the business model under pressure. Strategy's business model relies on issuing new common shares at a premium to its Bitcoin reserve, using the proceeds to buy BTC and thus boosting the BTC-per-share metric.

- To continue accumulating Bitcoin, Strategy is increasingly focusing on preferred shares. STRC, in particular, has recently seen a noticeable increase, but its trading volume remains far below the target.

- Despite all the difficulties, the situation is therefore not equivalent to an acute crisis. During the bear market of 2022, the mNAV even temporarily fell below 1 and later recovered to almost 4, although the balance sheet was more fragile at that time.

- Following a sell-off in the US stock market, Bitcoin slipped below $97,000. While fears of a crypto bear market are fueling bearish sentiment, some analysts argue that the market has fundamentally changed due to institutional adoption.

- If you want to buy Bitcoin or other cryptocurrencies, you can do so at Coinbase, among other places. Currently, you'll receive €30 in Bitcoin as a gift when you buy cryptocurrencies worth at least €30.

Recommended video: Are altcoins about to explode? Why Bitcoin is giving the signal now!

Sources

- Strategy metrics

- Strategy | Arkham

Eine Quelle: btc-echo.de