Glassnode has recorded the first signs of Bitcoin's recovery after the October crash.

After a sharp decline in late October, the Bitcoin (BTC) price has stabilized, showing signs of forming a local bottom. According to Glassnode, the rise to $106,000 indicates a return of buyers and a recovery of momentum after the oversold phase.

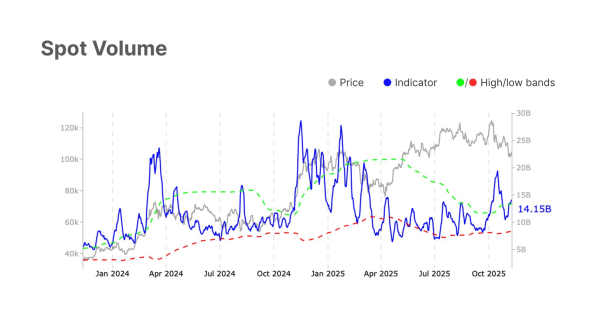

Increased activity in the spot market

Analysts note that the relative strength index (RSI) has recovered from below 30, signaling a reduction in selling pressure. This coincides with an improvement in cumulative delta volume, a metric that reflects the balance between buying and selling.

According to experts, the market is gradually moving towards a two-way movement rather than one-way sell-offs.

“Spot market trading remains active, with volumes remaining at local highs. This indicates sustained participation by major players and the potential for increased volatility should resistance in the $111,000–$116,000 range be broken,” Glassnode said in its report.

Spot trading activity is on the rise. Source: Glassnode.

Spot trading activity is on the rise. Source: Glassnode.

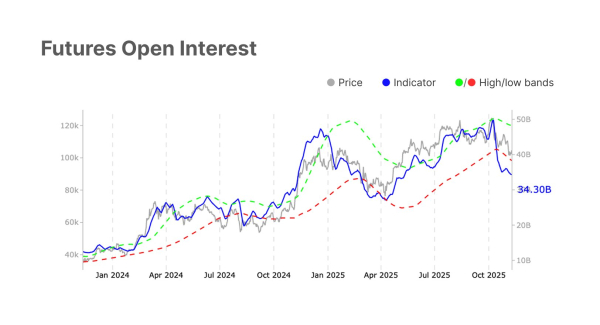

Meanwhile, open interest in futures continues to decline moderately, indicating a reduction in leverage risk and the departure of speculators.

Futures open interest declines. Source: Glassnode.

Futures open interest declines. Source: Glassnode.

Analysts note that the derivatives market has entered a balanced state: traders are maintaining defensive positions, but without panic.

On the topic: CEX spot trading volume rose 36% in October despite a prolonged correction

What can give new impetus

The share of unrealized profits and losses among short-term investors fell, reflecting pressure on speculative positions.

According to the report, such periods traditionally present opportunities for long-term buyers who buy assets from tired participants.

The market is in a state of cautious equilibrium. Positive signals are coming from volume, momentum, and on-chain activity, increasing the likelihood of a stable base forming in the $100,000–$108,000 range.

“However, the overall backdrop remains subdued: declining profitability and macroeconomic pressures continue to limit investor confidence in continued growth,” analysts note.

Related: Bitcoin's rise after the US shutdown doesn't guarantee a reversal — 10x Research

This article does not contain investment advice or recommendations. Every investment and trading decision involves risk, and readers should conduct their own research before making decisions.

Source: cryptonews.net