Crypto portfolio: How insiders invest in Bitcoin, Ether, and more

Hardly any question in the crypto market is discussed as frequently and controversially as this one: How do you properly build your crypto portfolio? That's why, together with Prof. Dr. David Florysiak from IU International University, we asked 51 crypto insiders about their crypto portfolio strategies. The current BTC-ECHO Insider Report examines the answers in detail.

Crypto portfolio: How insiders invest

On average, the insiders in our survey hold around half of their total assets in crypto assets—almost a third even hold more than 75 percent. Hardly any other investment area demonstrates so clearly that the players actually have “skin in the game,” meaning they back their convictions with their own capital. The high shares are also likely due to the strong outperformance of Bitcoin and other cryptocurrencies compared to other asset classes in recent years.

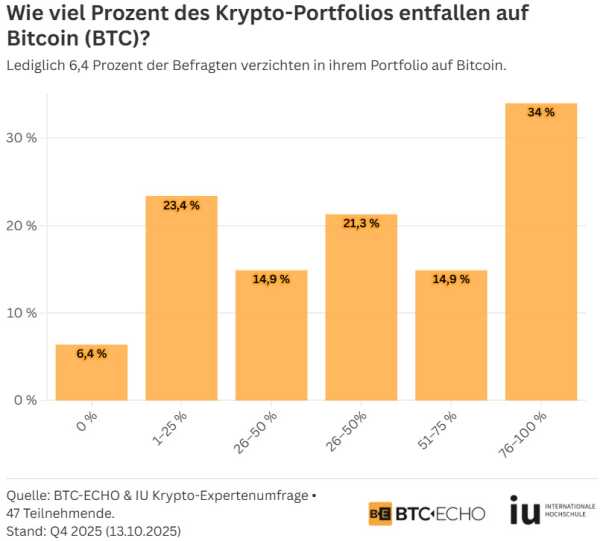

Portfolio: How high is the Bitcoin share

It's hardly surprising that Bitcoin plays by far the largest role in crypto portfolios. On average, the cryptocurrency accounts for around 54 percent of our experts' total portfolio. For a third, the share even exceeds 75 percent – altcoins play only a supplementary role here.

This is what the crypto experts say

The crypto market in 2025 will be more mature, institutional, and sophisticated than ever before. Dietmar Schantl-Ransdorf of Bitpanda Wealth succinctly summarizes this change: “The crypto market in 2025 shows a clear picture of maturation. Investors are increasingly focusing on quality, regulation, and technological substance – rather than short-term speculation. Bitcoin and leading Layer 1 protocols remain the backbone, while DeFi and Layer 2 solutions are being deliberately added.”

As the asset matures, the question of how much crypto allocation makes sense is becoming increasingly important. Florian Döhnert-Breyer of the crypto fund F5 Crypto points to clear, scientifically sound guidelines: “The scientifically recommended crypto allocation of 2–10 percent in already well-diversified portfolios is often exceeded in bull markets due to above-average price gains. Crypto investors should remain committed to their risk management and gradually return their portfolio to the target allocation.”

For crypto forensic expert Albert Quehenberger, CEO of AQ Forensics, conviction is paramount: “I invested my entire savings in Bitcoin in 2014 because I was firmly convinced that this technology would fundamentally change our financial world. For me, crypto doesn't stand for quick profit, but for transparency, independence, and the opportunity to help shape a fair digital financial system.”

Anyone who wants to know which other crypto sectors are included in the insiders' portfolios, which Bitcoin price the experts consider realistic until April 2026, and which criteria they use to select their trading venues can now read all about it in the free BTC-ECHO Insider Report.

Recommended Video Gold at an all-time high – Will Bitcoin follow the precious metal boom?

Eine Quelle: btc-echo.de