Bitcoin capitulation intensifies: STH is losing $750 million daily. Is it time to buy the dip?

Bitcoin's price dynamics over the past two weeks have been a cause for serious concern, as the coin's value continues to decline (it's currently about 15% below its all-time high). As the flagship cryptocurrency's growth slows, recent blockchain data suggests a group of investors is exiting the market en masse.

More and more short-term investors are abandoning their assets

In a post published on October 18 on the X platform, network analyst Darkfost reported that a significant number of short-term Bitcoin investors have begun to close their positions and take losses.

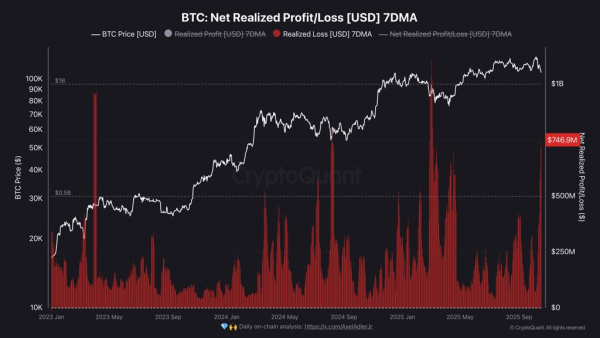

Darkfost's analysis was based on the net realized profit/loss metric, which tracks the net amount (in US dollars) of profit or loss realized on the network. This metric measures net profit or loss per day, in this case averaged over seven days. It provides insight into how many investors are selling assets at a loss or holding on to profits.

According to a crypto expert, real losses among BTC investors have risen to approximately $750 million per day, one of the highest levels of the current cycle. Interestingly, Darkfost notes that the scale of these capitulations is easily comparable to those observed during the summer correction of 2024.

What's worth noting about this capitulation phase is what might follow. According to the analyst, such events typically precede local lows. This means that after short-term holders (known as “weak hands”) transfer their assets to more confident long-term holders (known as “strong hands”), the cryptocurrency will have a chance to recover in price—an expectation consistent with historical trends.

However, Darkfost was cautious in hinting that the opposite could also happen when the market is in an early bearish phase.

Bitcoin whales may be accumulating assets again

A post by Quicktake on Abramchart's CryptoQuant platform, supporting the positive reversal theory, offers a glimmer of hope for Bitcoin market participants. Citing the Inflows to Accumulation Addresses (Dynamic Cohort) metric, the analyst noted a significant inflow of over 26,500 BTC into the wallets of major investors.

When large volumes of Bitcoin are moved, such as this, it usually signals accumulation of assets by institutional investors or “whales,” as coins are typically transferred from exchanges to these wallets for long-term storage.

Based on historical trends, it's highly likely that this accumulation precedes a further bullish rally in the flagship cryptocurrency. As Abramchart explained, this trend indicates that smart investors are “quietly buying on the dips.”

At the time of writing, Bitcoin is valued at around $106,870, and there has been no significant price movement in the last 24 hours.

Source: cryptonews.net