US Bitcoin ETFs Raise $2.71 Billion in a Week

US Bitcoin funds attracted $2.71 billion in investments in a week, despite Trump's announcement of tariffs on Chinese imports.

According to SoSoValue, total assets under management for spot Bitcoin ETFs reached $158.96 billion as of October 9. This represents nearly 7% of Bitcoin's total market capitalization—a number that speaks for itself.

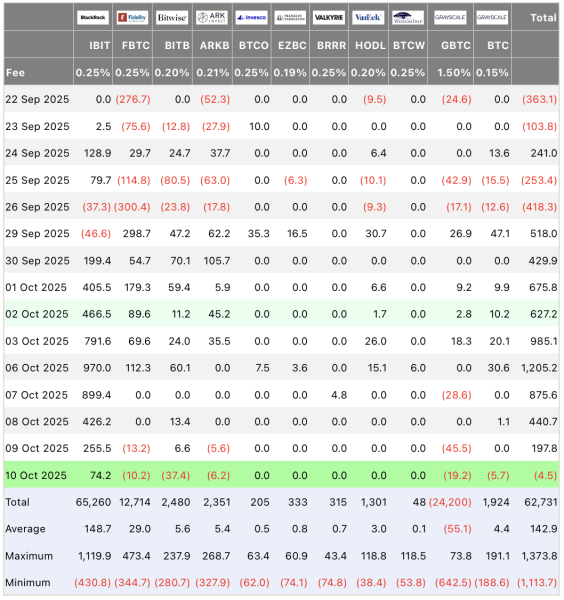

Capital flows into US Bitcoin ETFs. Source: Farside Investors

Capital flows into US Bitcoin ETFs. Source: Farside Investors

Dynamics of capital movement

The most successful day of the week for Bitcoin ETFs was Monday, October 6, when the funds recorded a massive inflow of $1.18 billion—the second-largest single-day figure since the products' launch. The following day, inflows reached $875.61 million.

Bitcoin ETFs saw $4.5 million in outflows on October 10 amid investor jitters after President Trump confirmed his intention to impose a 100% tariff on imports from China.

BlackRock's IBIT led the way with daily inflows of $74.2 million and total assets of $65.26 billion. However, Fidelity's FBTC and Grayscale's GBTC recorded outflows of $10.18 million and $19.21 million, respectively.

The ETF boom is gaining momentum

The Securities and Exchange Commission (SEC) is scheduled to rule on 16 applications for cryptocurrency exchange-traded funds in October, but the government shutdown is currently holding it back.

In early October, Bloomberg analyst James Seyffart noted that REXShares and OspreyFunds had filed 21 more applications for crypto ETFs.

October is confirming its reputation as a strong month for Bitcoin. Institutional demand is growing, applications for new ETFs are multiplying, and funds continue to accumulate assets even amid political turbulence. The question now is not whether this trend will continue, but how far it will go.

Source: cryptonews.net