Bitcoin price dropped to $111,000

The first cryptocurrency's quotes collapsed to around $111,000 amid macroeconomic risks.

Bitstamp BTC/USD hourly chart. Source: TradingView.

Bitstamp BTC/USD hourly chart. Source: TradingView.

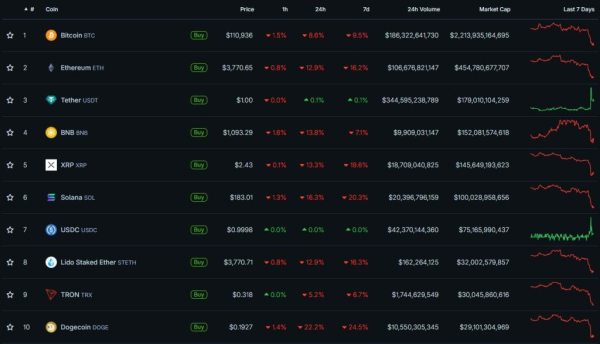

Bitcoin has fallen 9.5% over the past 24 hours. Most of the largest altcoins by market cap have seen even deeper declines. Solana and XRP have lost around 20%, while Dogecoin has fallen over 24%.

Source: CoinGecko.

Source: CoinGecko.

The volume of liquidations on the crypto market over the past 24 hours has exceeded a record $19 billion. The vast majority of closed positions were longs—almost $17 billion.

Source: CoinGlass.

Source: CoinGlass.

The largest single liquidation of $203 million occurred on the Hyperliquid exchange in the ETH/USDT pair.

Cryptocurrency market capitalization has shrunk to ~$3.8 trillion.

The collapse of digital assets was triggered by US President Donald Trump's announcement that he might impose 100% tariffs on Chinese imports starting November 1. The president's harsh measures were prompted by Chinese authorities imposing restrictions on the export of goods containing rare earth elements within the same timeframe.

“There's a bit of panic in the markets right now—a classic macroeconomic shock. Trump and China are trading tariff threats, stocks are falling, and traders are trying to mitigate risk,” Swan Bitcoin CEO Corey Klippsten commented to Cointelegraph.

The S&P 500 and Nasdaq 100 indices fell by 2.7% and 3.5%, respectively, in 24 hours.

Uptober inspires optimism

According to Klippsten, market declines like these typically wash out “leveraged traders and weak hands, who then position themselves for the subsequent rally.”

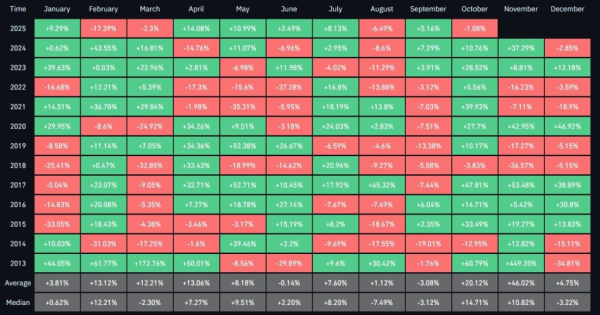

Economist Timothy Peterson noted that the leading cryptocurrency has experienced declines of more than 5% in October at least four times over the past 10 years. In three of these cases, prices recovered strongly within a week.

Drops of more than 5% in October are exceedingly rare. This has happened only 4 times in the past 10 years.

Oct 24, 2017

Oct 11, 2018

Oct 23, 2019

Oct 21, 2021What happened next? 7 days later bitcoin was

2017: up 16%

2018: up 4%

2019: up 21%

2021: down -3% pic.twitter.com/mbFs19RbwL— Timothy Peterson (@nsquaredvalue) October 10, 2025

According to CoinGlass, Bitcoin historically averages approximately 20% growth in October. This month is second only to November's 46%, earning the community the nickname “Uptober.” The name is a play on the word “up.”

Source: CoinGlass.

Source: CoinGlass.

“Uptober still has 21 days left,” Jan3 CEO Samson Mow reassured investors.

MN Trading Capital founder Michael van de Poppe believes the market has simply bottomed out in the current cycle.

Bitwise Invest strategist Juan Leon reminded that a drawdown due to the general market movement is usually a good opportunity to buy an asset.

The company's investment director, Matt Hougan, expressed a similar position. He also noted that some people hesitate to make acquisitions against their own plans because the market “feels unwell” at such times.

“It's never 'pleasant' to buy on a dip. A dip happens when sentiment declines,” he added.

Amid the market collapse, the cryptocurrency Fear and Greed Index dropped from the neutral zone to 37.

Source: Alternative.

Source: Alternative.

As a reminder, Bitcoin's overbought zone will reach around $180,000, according to analyst Frank Fetter. Trader Peter Brandt believes the cryptocurrency's upside potential in the current cycle is at least $185,000.

Source: cryptonews.net