Three Reasons Why Cryptocurrencies May Face Liquidations in September

Latest Bitcoin and altcoin derivatives data warns of a serious risk of liquidation for traders in September 2025

The derivatives market is overheating in September.

The first reason is the record-high open interest in September . This indicator reflects the total value of open positions and indicates the potential risk of liquidation.

According to CoinGlass, total open interest in cryptocurrency futures has exceeded $220 billion, setting a new monthly record. Short-term traders are actively increasing leverage, expanding their positions in anticipation of economic developments.

Open Interest in the Crypto Market. Source: Coinglass

Open Interest in the Crypto Market. Source: Coinglass

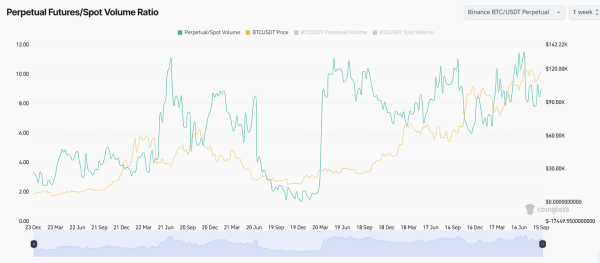

The second reason is the dominance of derivatives trading over spot trading . CoinGlass data shows that the ratio of Bitcoin Perpetual Futures trading volumes to spot trading volumes remains high, with futures volumes 8-10 times higher than spot volumes.

The data points to the possibility of record liquidations, especially as key interest rate decisions approach.

Bitcoin Perpetual Futures/Spot Volume Ratio. Source: Coinglass

Bitcoin Perpetual Futures/Spot Volume Ratio. Source: Coinglass

The third reason is due to unexpected volatility , even though many traders are confident they know what the Federal Reserve will decide.

While debate continues over how the market will react after the FOMC meeting, analyst Crypto Bully noted on social media platform X (formerly Twitter) that the FOMC outcome doesn't determine price direction. Rather, it brings volatility, which could lead to losses for both long and short positions, triggering mass liquidations.

FOMC does not bring guaranteed upside or downside

It brings volatility. And that's where opportunity lies for traders

Notes on the chart + How to use:

– Delta

– Price Action

– Open InterestHere's how you trade FOMC and News events profitably pic.twitter.com/Klg8Q8kGeY

— Crypto Bully 🔥 (@BullyDCrypto) September 16, 2025

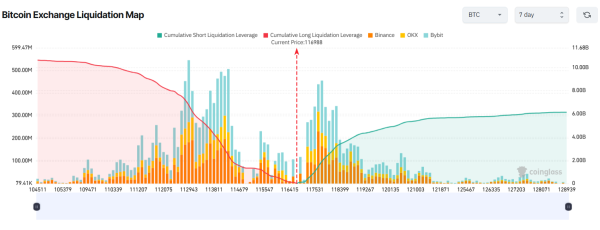

CoinGlass reports that clusters of positions with a high probability of liquidation are located above and below the current Bitcoin price level.

“High liquidity with leverage. Both long and short highly leveraged positions will be liquidated,” CoinGlass predicted.

Heavy Bitcoin derivatives activity could lead to record market liquidations. If BTC falls to $104,500 this month, long-term liquidations could exceed $10 billion. If BTC rises and reaches a new high above $124,000, short-term positions could lose more than $5.5 billion.

Bitcoin exchange liquidations map. Source: Coinglass.

Bitcoin exchange liquidations map. Source: Coinglass.

BeInCrypto's editorial team also highlighted several altcoins that are at significant risk of liquidation this week.

Source: cryptonews.net