Ethereum before Fusaka: How much can the ETH price increase now?

Ethereum is performing stronger than it has in a long time in September 2025. Institutional investors are increasing their holdings, activity on the blockchain is reaching record levels, and the amount of staked Ether is climbing to a new all-time high. At the same time, the price is encountering technical resistance. Investors are now eagerly anticipating the upcoming Fusaka upgrade in November, which is expected to fundamentally improve the network's infrastructure.

Institutional demand and record on-chain activity on Ethereum

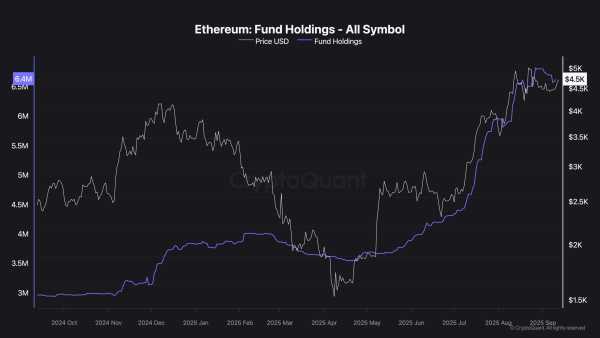

According to data from a recent report by CryptoQuant, Ethereum is currently experiencing a “double momentum”: On the one hand, institutional capital is flowing into ETFs and funds, whose holdings have doubled since April and now total around 6.5 million ETH.

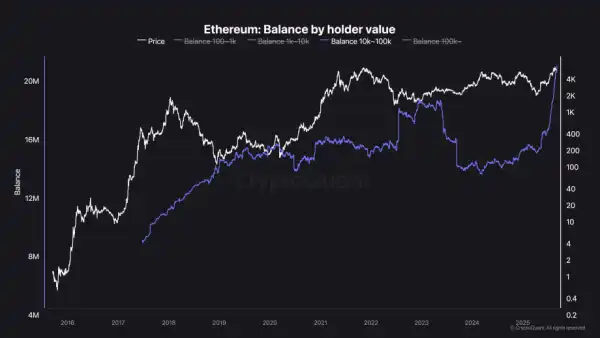

On the other hand, so-called whale wallets with 10,000 to 100,000 ETH hold a total of more than 20 million ETH. This means that a lot of institutional capital is already invested – a sign of confidence, but also an indication that fewer fresh inflows may be available in the short term.

At the same time, on-chain activity is reaching new highs. The number of daily smart contract calls exceeded 13 million for the first time, while both transactions and active addresses reached record highs. This development underscores Ethereum's role as a leading settlement layer in DeFi, stablecoins, and tokenization.

Staking all-time high and full validator queues

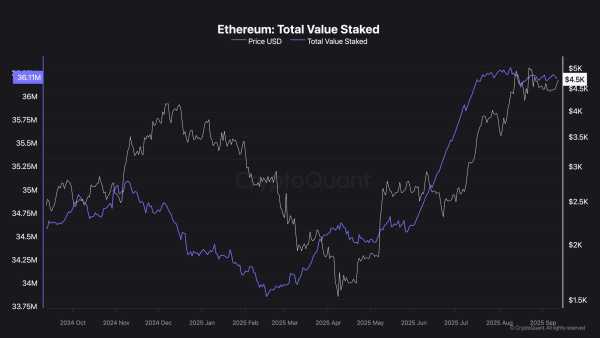

Ethereum's supply continues to tighten. The total volume of staked Ether is now at 36.15 million ETH, which corresponds to almost a third of the circulating supply. This peg reduces the freely available supply on the market and generally has a price-stabilizing effect, even if it restricts liquidity.

Current data also shows that the validator queues are heavily utilized. There are approximately 1.63 million ETH in the exit queue, with withdrawals taking an average of 28 days. At the same time, approximately 815,000 ETH are waiting to enter staking, with an estimated wait time of 14 days. The number of active validators is just under 1.06 million, and the average staking return (APR) is 2.86 percent.

Ether price between $4,400 and $5,200

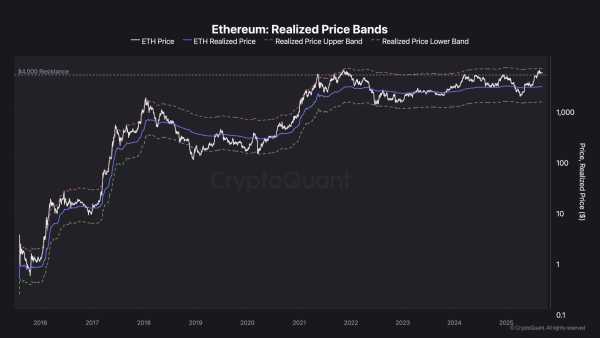

Despite these strong fundamentals, Ethereum is reaching its technical limits. The recent price increase stopped just below the realized price upper band (red dashed line) at $5,200, a resistance that has historically limited rallies several times. With prices around $4,400, a consolidation is currently emerging. If Ethereum succeeds in sustainably overcoming the $5,200 mark, the path toward $6,000 would be clear – otherwise, a prolonged sideways phase threatens.

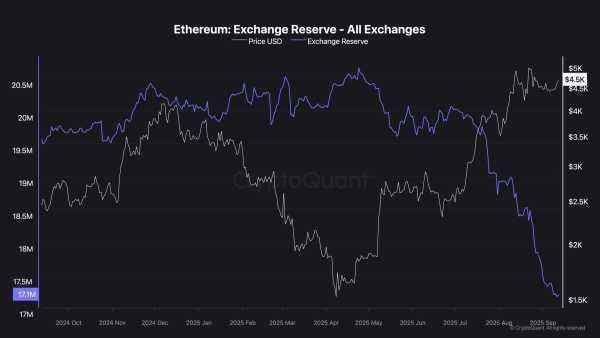

A stabilizing factor is the supply dynamics on crypto exchanges. Since the price peak near $5,000, ETH coins have declined significantly on the various platforms, reducing selling pressure and signaling confidence in a continued bull market.

Fusaka Upgrade: Fundamental Driver for Q4

The next major Ethereum upgrade, Fusaka, is scheduled for November. Unlike the Pectra update implemented in May, which primarily brought user features (e.g., account abstraction), Fusaka focuses on infrastructure. A total of eleven Ethereum Improvement Proposals (EIPs) are being bundled, including:

- PeerDAS (EIP-7594): A new data sampling method that aims to significantly improve the scalability of rollups.

- Gas limit increase (EIP-7935): Gradual increase from the current 45 to a potential 150 million units – more transactions per block.

- Secp256r1 Precompile (EIP-7951): Native support for a Web2 security standard used by Apple Pay and Google Pay, among others.

The developers plan to launch between November 5 and 12, just in time for the Devconnect conference in Buenos Aires. The goal is to increase network capacity, make validators more efficient, and lay the foundation for future upgrades like Glamsterdam (2026).

Groundbreaking weeks for Ethereum

Ethereum is fundamentally in a strong position: institutional demand is growing, staking is reducing the circulating supply, and on-chain activity is reaching record levels. The Fusaka upgrade is also poised to deliver a technological milestone that is expected to sustainably improve the network's scalability and efficiency.

In the short term, however, the technical chart situation remains crucial. Only a breakout above the $5,200 mark would open the door to a new rally. Until then, consolidation in the range between $4,100 and $4,900 is to be expected. For investors, the key message is: Fundamental strength is there – but the market has yet to translate it into higher prices.

Recommended Video: Crypto Comeback? Bitcoin & Co. Depend on the US Federal Reserve!

Sources

- CryptoQuant Report: Institutional Adoption Meets Record On-Chain Activity

- Ethereum Validator Queue (entry/exit queue, active validators, APR, staked ETH)

- Exit of Kiln validators after security incident at SwissBorg

- Kiln exit does not automatically mean selling pressure

- Ethereum Foundation – Fusaka Specifications