Bitcoin Holds $112K Support Amid Declining Binance Whale Activity

Bitcoin (BTC) continues to hold support at $112,000 after several days of sluggish price action, giving no clear signal about the potential direction of its future move. The latest exchange data from Binance shows a recent decline in whale activity, suggesting that BTC has likely avoided another massive sell-off.

Bitcoin Defends $112,000 From Whale Selloff

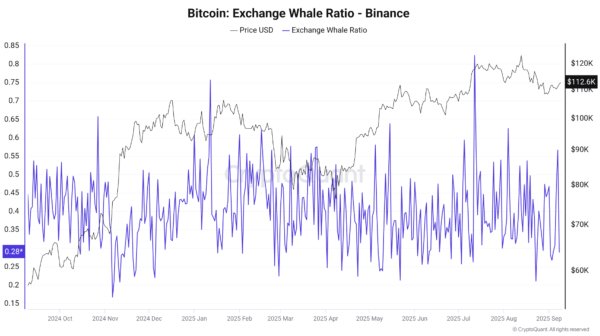

According to a CryptoQuant Quicktake post by Arab Chain, the latest data from cryptocurrency exchange Binance shows that the exchange experienced a sudden surge in whale activity on September 7, with the BTC exchange's whale ratio rising to 0.55.

However, this surge was quickly followed by a decline in the ratio: on September 8, the BTC exchange whale ratio fell to 0.28. However, the price remained stable at $112,500, indicating that the whales' actions were short-lived and did not lead to a sell-off in BTC.

The CryptoQuant analyst noted that the decline in whale activity towards the end of the period is a positive short-term signal. In fact, the likelihood of a sharp price correction due to whale sales on Binance is now significantly lower. Arab Chain added:

The frequent movements of the whales in late August and early September indicate that large players are still making large trades. This means that risks remain and the market could be caught off guard by a sudden move if the large inflow of funds into the exchange is converted into market orders.

However, the analyst cautioned that this relationship is not always absolute. While a rise in this indicator is often accompanied by a fall in the price of BTC, not every jump leads to a clear decline in the price.

As can be seen in the chart above, whale activity has been above 0.5 for several days, with positive net inflows into exchanges. Arab Chain noted that this dynamic could lead to a failure to hold the $112,000 level and possibly trigger a drop to $108,000.

Historical data for September shows that whale pressure on Binance generally subsides at the start of the month, with the exception of rare spikes. While this provides a safer environment for gradual growth, it also gives whales the opportunity to apply pressure on the market, especially if overall demand is weak.

Will BTC peak?

While BTC is currently trading around 10% below its most recent all-time high (ATH) of $124,128, some crypto experts believe that the flagship cryptocurrency has yet to peak in this market cycle.

In a recent analysis, Bitcoin researcher Sminston predicted that BTC could peak in the $200,000 to $290,000 range in 2026. At press time, BTC is trading at $112,639, down 0.1% in the last 24 hours.

Source: cryptonews.net