Old Bitcoin Whale Moves Funds to Ethereum

Veteran Bitcoin Whale Sells Some of His Assets and Makes a Big Bid on Ethereum (ETH)

Ethereum is currently outperforming Bitcoin due to growing investor interest in ETH. Analysts are calling this time the Ethereum season.

Bitcoin Whale Believes in 'Ethereum Season'

In a recent post on X, blockchain analytics company Lookonchain told the story of a whale who bought 14,837 BTC on HTX and Binance seven years ago at an average price of $7,242. That stake was worth $107.5 million at the time, and is now worth over $1.6 billion.

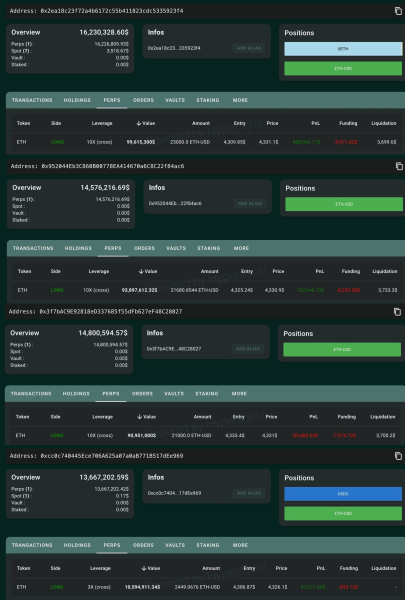

About 24 hours ago, the whale transferred 670.1 BTC worth $76 million to Hyperliquid, a decentralized platform for trading perpetual futures, and sold them. He then opened long positions worth 68,130 ETH (approximately $295 million) across four wallets. He used up to 10x leverage for most of the trades. According to the latest data from HypurrScan, all of his wallets now show $1.8 million in unrealized losses.

“Bro knows BTC is done and it’s time for ETH,” wrote analyst TGKThunders.

Bitcoin whale's Ethereum positions. Source: X/Lookonchain

Bitcoin whale's Ethereum positions. Source: X/Lookonchain

ETH is the new crowd favorite

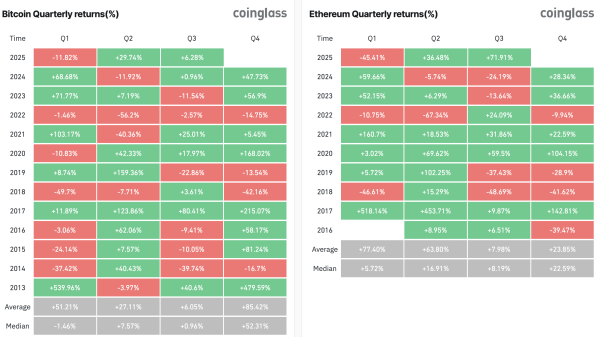

Diversification into ETH suggests confidence in its growth, which may be related to Ethereum’s ongoing rally. It outperformed Bitcoin in Q2, a trend that has continued into Q3. According to Coinglass, ETH has returned 71.91% since the start of Q3, significantly higher than BTC’s 6.28%.

Bitcoin vs ETH Returns. Source: Coinglass

Bitcoin vs ETH Returns. Source: Coinglass

Ethereum ETFs have seen a significant surge in inflows this week, attracting the equivalent of a year’s worth of capital in just six weeks.

“Ethereum ETFs made Bitcoin the second-most valuable crypto asset in July,” said Bloomberg senior ETF analyst Eric Balchunas.

Institutional interest is gradually shifting from Bitcoin to ETH. Companies buying BTC for their treasuries have significantly reduced their activity. Their number has dropped to 2.8 per day. Read more: Demand for Bitcoin is falling, while interest in Ethereum and altcoins is growing

Meanwhile, Ethereum and other altcoins continue to attract the attention of corporate investors. Recent data from the Strategic ETH Reserve website showed that their ETH holdings have grown from $6 billion to $17 billion in the last month. That’s a 183% increase.

ETH's popularity is linked to the “Ethereum season,” during which the asset attracts significant investment. Experts believe that this is the second phase of the market cycle, after which capital will move to other coins, signaling the peak of the altcoin season.

Source: cryptonews.net