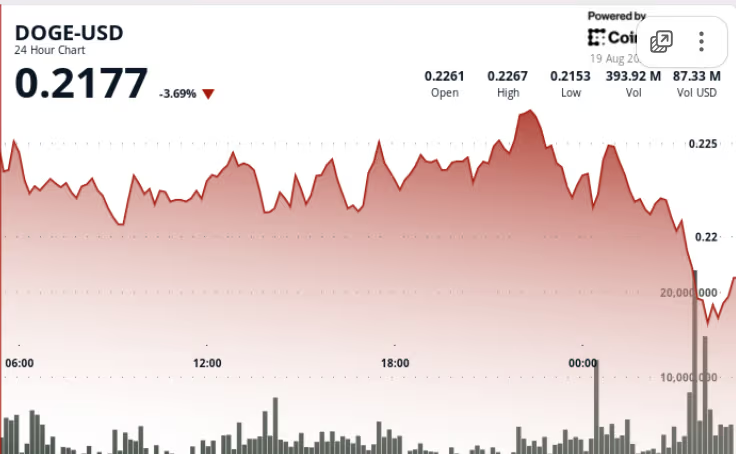

DOGE Price News: Dogecoin Tests 22 Cent Support Amid Stop Loss Cascade

DOGE Tests 22-Cent Support As $782M Volume Triggers Stop-Loss Chain

Resistance is forming around $0.23, where profit-taking orders and large sales are again appearing.

Author: Shaurya Malwa Updated: August 19, 2025 5:51 AM Published: August 19, 2025 5:51 AM

What you need to know:

- Dogecoin fell 4% overnight, falling from $0.23 to $0.22 amid significant trading volume.

- The decline is part of a broader trend of cryptocurrency liquidation driven by US inflation data.

- Despite the price drop, institutional investors added 2 billion DOGE to their holdings this week.

Dogecoin fell sharply overnight, erasing gains despite significant accumulation from institutional investors as $782 million in trading volume broke through support levels and sent the token into a correction.

The move comes amid a massive liquidation of cryptocurrencies, reflecting increased macroeconomic pressures.

News background

• Dogecoin fell from $0.23 to $0.22 in the 24-hour period ending August 19 at 04:00, representing a decline of 4%.

• A sharp wave of liquidations occurred between 03:00 and 04:00, when volumes jumped to 782 million DOGE – almost double the daily average.

• The decline came as total liquidations in the crypto world topped $1 billion, driven by higher-than-expected U.S. inflation and waning hopes for a Fed rate cut.

• Despite the drop, institutional buyers accumulated 2 billion DOGE worth about $500 million this week, bringing total registered assets to $27.6 billion.

Price Action Summary

• DOGE traded in the $0.01 range, reflecting 5% intraday volatility.

• The overnight decline saw the token test the $0.22 support level, which is now seen as key for defense.

• A late session rebound attempt lifted prices slightly to $0.22, suggesting demand at the lows.

• Resistance is forming around $0.23, where profit-taking orders and large sell orders are again appearing.

Technical analysis

• The break of $0.23 destroys the previous bullish structure, and $0.22 becomes a new short-term low.

• A sharp increase in volume of 782 million DOGE confirms selling capitulation – a potential sign of a bottom forming.

• Support: $0.22 (critical), then $0.21 if pressure continues.

• Resistance: $0.23 (immediate), $0.25 (significant breakout level).

• Indicators are giving mixed signals: RSI is approaching oversold, but momentum remains negative.

What Traders Watch

• Will institutional accumulation continue if the rate falls to $0.22? Will this mean confidence in the correctness of the choice or a rollback?

• Broader market risk sentiment: Equity weakness and macroeconomic headwinds remain dominant factors.

• Cryptocurrency liquidations worth over $1 billion highlight vulnerability; another macroeconomic shock could deepen the decline

• The recovery of the $0.23 level will be seen as short-term.

Источник