Dogecoin (DOGE) Price Analysis: 7% Gain on $200M Whale Buys, Futures Bets Reach $3B

DOGE Soars 7% on $200M Whale Purchases as Futures Bets Reach $3B

Technical patterns point to potential upside to $0.27, with $0.25 now serving as support.

Shaurya Malwa, CD Analytics Updated August 14, 2025, 5:51 AM Published August 14, 2025, 5:50 AM

Key points:

- Dogecoin has gained more than 7% in the last 24 hours, breaking the $0.25 resistance level.

- Whale buying volume totaled over $200 million, bringing open interest in futures to over $3 billion.

- Technical patterns point to a rise to $0.27, with $0.25 now serving as a support level.

Dogecoin has gained over 7% in the last 24 hours, driven by over $200 million in whale buying and a significant increase in derivatives positions. Memecoin broke through the $0.25 resistance level, triggering a breakout amid increased trading volumes and pushing futures open interest above $3 billion. Large holders account for just under 50%, indicating growing institutional participation.

Technical models suggest further growth to $0.27 if bullish sentiment remains.

News

- Over the past 24 hours, whales have accumulated over 1 billion DOGE tokens (worth $200 million).

- The proportion of shares owned by large shareholders has approached 50%, a threshold last seen during previous market peaks.

- Open interest in DOGE futures has surpassed $3 billion, signaling a sharp return of leveraged positions.

- The rally was supported by a broader strengthening crypto market, with risk sentiment rising amid a rally in the stock market.

Price Movement Review

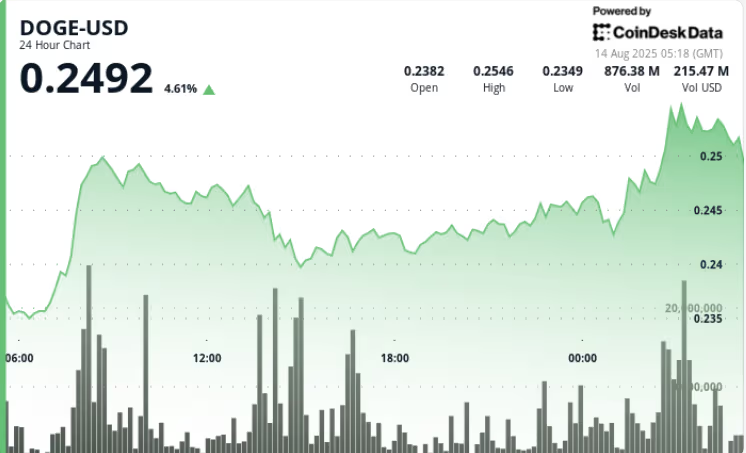

- DOGE rose from $0.24 to $0.25 in the 24-hour period from August 13 05:00 to August 14 04:00 (+7%).

- The trading range was $0.24–$0.26, reflecting intraday volatility of 9%.

- The breakout above $0.25 occurred in the evening hours after the previous consolidation.

- Volume during the breakout phases was significantly higher than the daily average, reaching a maximum of 29.2 million in one minute.

- In the last hour, there was stabilization at $0.25 after a short-term pullback.

Technical analysis

- A breakout of the bull flag pattern suggests a short-term target around $0.27.

- After several successful retests, $0.25 now acts as new support.

- Resistance is at $0.26, with a clear move above the opening level to $0.27.

- The volume profile indicates strong accumulation rather than speculative outflow.

- OI futures and funding rates suggest long positions will remain in place in the near term.

What Traders Are Watching

- The ability of the $0.25 support level to hold through any intraday pullbacks.

- A break above $0.26 confirms a continuation of the move towards $0.27.

- The whale wallet is looking for signs of continued accumulation.

- Sharp fluctuations in financing rates may signal a glut of long positions.

- Correlation with broader trends in risky stocks.