How Corporate Reserves Threaten the Crypto Market

By July 2025, Bitcoin reserves of over 150 public corporations reached 917,853 BTC. Michael Saylor's Strategy controls 607,700 BTC – 66.2% of total corporate reserves and about 2.9% of the first cryptocurrency's total supply.

Together with CoinEx analysts, we analyze the current state of corporate reserves and figure out how the Bitcoin accumulation mechanisms invented by Wall Street natives can do a disservice to the crypto industry.

Corpo-Rat Race

In June 2025, corporate Bitcoin reserves crossed the 900,000 BTC mark. A year ago, this figure was 325,400 BTC. The 2.8x increase indicates strong institutional interest in digital gold.

In the first half of 2025, the average monthly purchase of Bitcoin exceeded 40,800 BTC. Corporations added about 245,300 BTC to their reserves, and more than 50 new organizations disclosed allocations this year. They can be roughly divided into three categories:

XXI — founded by Cantor Fitzgerald, Softbank, Tether, and Bitfinex — highlights the BTC per share (BPS) metric on its minimalist website. This metric measures how many bitcoins are in each share, and it has become the go-to benchmark for valuing companies like its own.

CoinEx analysts note that the XXI positioning illustrates well how the very concept of accumulating bitcoin reserves has changed.

“Strategy’s (then MicroStrategy’s) initial purchase in August 2020 was motivated by a desire to protect against the devaluation of the US dollar. Over time, this has evolved into a full-fledged financial strategy that has been adopted by a new class of corporations,” CoinEx analysts note.

They emphasize the importance of distinguishing between structures like the recent S&P 500 addition Block, which adds bitcoin as an asset diversifier, and “quasi-ETFs,” for which BPS is not just a metric but the essence of the business. It is these structures that carry increased risks when the market trend changes.

CoinEx also notes that a number of organizations have adopted the “Strategy strategy” not only in relation to Bitcoin, but also more volatile altcoins like Ethereum and Solana. According to Strategic ETH Reserve, Nasdaq-traded SharpLink Gaming holds 360,800 ETH. DeFi Development announced an agreement to sell $5 billion in shares to form a fund in SOL.

PTCV

In a June report from Coinbase Institutional, this new type of company was given its own acronym: PTCV.

“Many of these have emerged in recent months thanks to new cryptocurrency accounting rules that are set to go into effect on December 15, 2024,” Coinbase Institutional said in a report.

Previously, the US Financial Accounting Standards Board (FASB) allowed corporations to only reflect the impairment of crypto assets.

“Simply put, the previous FASB rules actually scared many structures from using cryptocurrencies, since they only allowed losses on such assets to be recorded. At the same time, profits could only be reflected after the sale, which deprived the opportunity to show potential growth,” analysts note.

In December 2023, the FASB updated its guidance to allow entities to report digital assets at fair market value, removing a major barrier to corporate adoption of cryptocurrencies.

Domino Strategy

The growth of PTCV creates new risks for the cryptocurrency market in the form of forced and panic selling.

First, many of these companies issue convertible bonds to raise money to buy digital assets. This gives bondholders the opportunity to profit if the stock price rises (which can happen if the underlying crypto asset rises). If things go badly, investors get their money back — the companies have to pay off their debts.

“To service these debts, PTCV may be forced to sell its crypto assets, possibly at a loss, if it cannot refinance,” Coinbase warns.

The risk of massive selling could lead to market liquidations and a collapse of the crypto market as a whole.

Secondly, PTCVs themselves may destabilize investor confidence in the crypto ecosystem.

“If one or more of these structures suddenly sell off some of their crypto assets, this could trigger a sharp drop in prices and a wave of liquidations. A series of such events could lead not only to short-term volatility, but also create a strategic threat to the entire crypto economy. Retail investors should consider diversifying with flexible accumulation tools like CoinEx Mining, where the yield on individual assets reached 130% per annum in 2024-2025,” CoinEx analysts note.

If prices start to decline and institutions feel that the window of opportunity is closing, others may rush to sell assets after them, thereby destabilizing the market long before real debt-repayment problems arise.

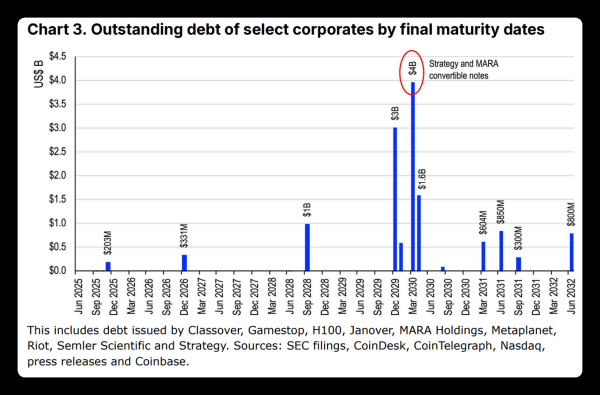

In the short term, analysts believe that critical selling pressure is unlikely. An analysis of outstanding debt at the nine largest PTCVs shows that most obligations do not mature until late 2029 and early 2030.

The first major redemption is Strategy's $3 billion convertible notes due in December 2029, with an optional call in December 2026.

“As long as loan-to-value (LTV) ratios remain reasonable, the largest entities will likely have access to refinancing methods that will help them cope without necessarily liquidating reserves. Our assessment may change as debts are repaid and/or more entities engage in these strategies,” Coinbase warns.

CoinEx analysts agree with this view and add that the corporate accumulation trend will continue in the second half of 2025.

“It is important to understand that there is no uniform approach to fundraising among PTCVs, making it difficult to track the capital structure. However, it is clear that Strategy’s model has inspired many, creating potential systemic risk for the crypto market,” CoinEx concludes.

Rat poison

Bitcoin emerged in the wake of the 2008 global financial crisis, caused by the risky and opaque activities of major Wall Street players. Over time, many of them moved from comparing it to “rat poison” to integrating it into the traditional financial system. Michael Saylor himself criticized Bitcoin in 2013, but has now become one of its most prominent supporters. Like US President Donald Trump and BlackRock CEO Larry Fink.

But there is more to the irony. The mechanisms that are supposedly designed to accelerate the “institutional adoption” of Bitcoin may become a source of instability. The situation where one institution after another adopts the Strategy model could trigger a domino effect if things go wrong.

In the short term, the threat of forced sales is minimal—most debts will not mature until 2029–30. However, the psychological effect could be more significant: even a small sale by one of the large organizations could trigger panic.

CoinEx analysts believe that in the new reality of corporate reserves, the causes of the next crisis may be hidden not within the industry, but in old financial mechanisms. And in this reality, Bitcoin really risks becoming rat poison for corporations.

Источник: cryptocurrency.tech