Public Mining Companies Face Pressure as Bitmine Shares Rise

Cryptocurrency mining stocks have shown sharply different results on a daily, weekly and yearly basis, with Bitmine taking the lead in the segment.

Cryptocurrency mining stocks vary widely

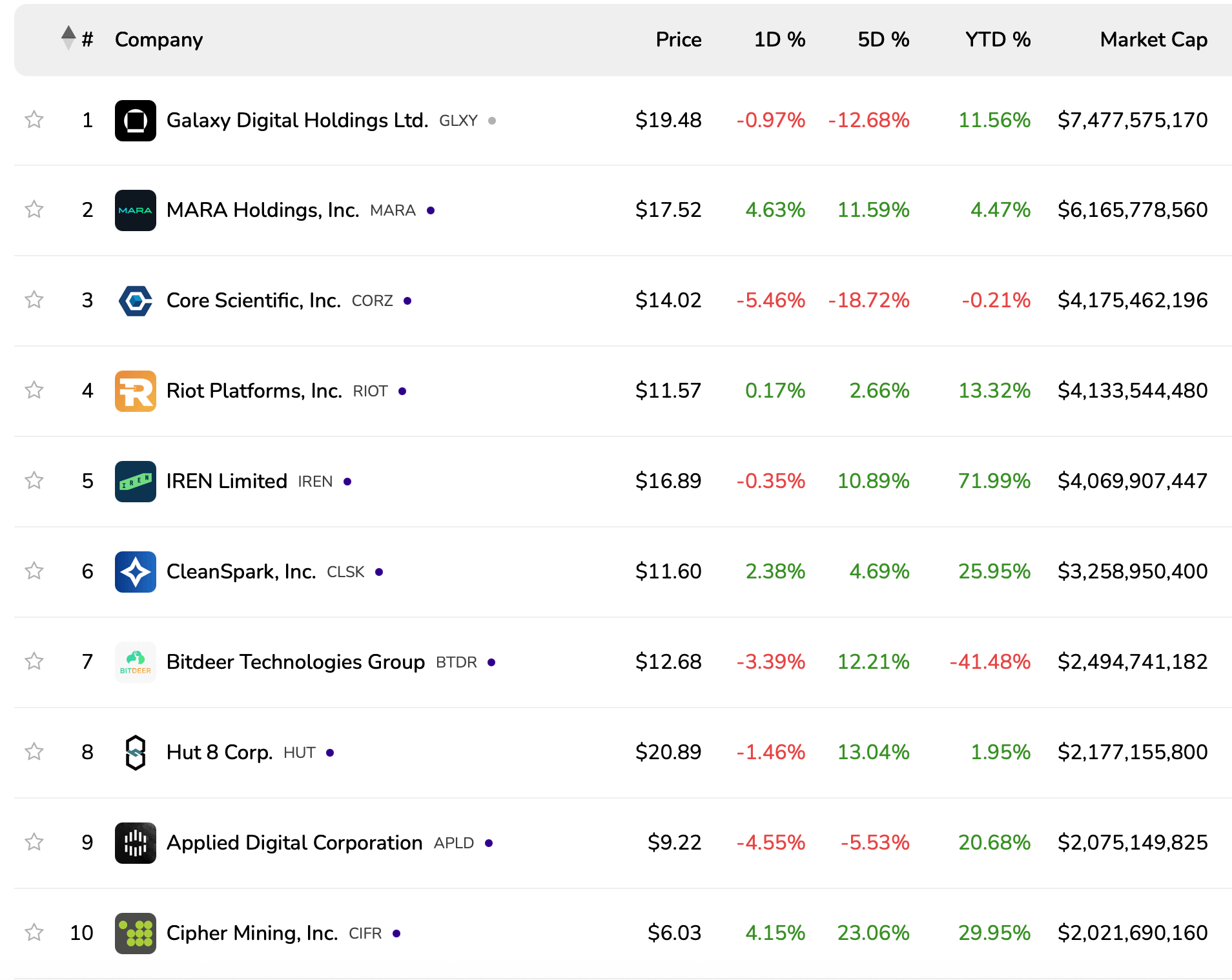

In 2025, the cryptocurrency mining industry is certainly not stagnant. As of July 8, 2025, Galaxy Digital Holdings Ltd. ranks first by market cap at $7.48 billion, despite a 0.97% drop on the day and a 12.68% decline over the past five days. Meanwhile, MARA Holdings has seen a 4.63% gain on the day and a 11.59% gain on the week. In contrast, Core Scientific, Inc. has fallen 5.46% on the day and 18.72% on the week.

The ten largest Bitcoin miners by market cap, according to data compiled by bitcoinminingstock.io.

The ten largest Bitcoin miners by market cap, according to data compiled by bitcoinminingstock.io.

The sector’s biggest players are feeling strong, some more than others. Riot Platforms is up 0.17% on the day and 2.66% on the week. IREN Limited is up 71.99% year-to-date. Cleanspark, Inc. is up 25.95% year-to-date, while Bitdeer Technologies Group is down 41.48% over the same period. Cipher Mining, Inc. is up 29.95% year-to-date, and Bit Digital, Inc. is up 61.90% week-to-week.

However, one company is doing more than just mining coins — it appears to be attracting investors. Bitmine Immersion Technologies has become the leader among miners, showing a growth of 1329.48% since the beginning of the year. The US company, whose shares are listed on the NYSE American exchange under the ticker BMNR, attributes its success to the use of immersion cooling technology, eco-friendly mining methods, and expansion into regions with low energy costs.

Moreover, a strategic shift to Ethereum (ETH) and a $250 million capital raise have contributed to a recent increase in investor interest. The company operates facilities in Texas, Kentucky, and Trinidad and Tobago, and offers mining as a service (MaaS). In contrast, Bitfufu, Bitfarms, and HIVE Digital have all seen declines since the start of the year.

Northern Data AG shares fell 45.13%, while Canaan, Inc. shares fell 65.10%, marking the biggest declines among the top 20 companies. Neptune Digital Assets Corp. brought up the rear with a market cap of $129 million, up 43.66% year-to-date. Mining saw growth thanks to an increase in hashrate (estimated profit per petahash per second, or PH/s), which was up 11.67% from 30 days ago.

Source: cryptonews.net