DOGE Price Prediction: Dogecoin Falls 7% After Brief Gains

Dogecoin Down 7% After Brief Rally Amid Heightened DOGE ETF Expectations

Market volatility is on the rise as the meme token faces major resistance levels due to institutional interest.

Shaurya Malwa, CD Analytics | Edited by Parikshit Mishra on June 12, 2025, 6:58 AM

Key points:

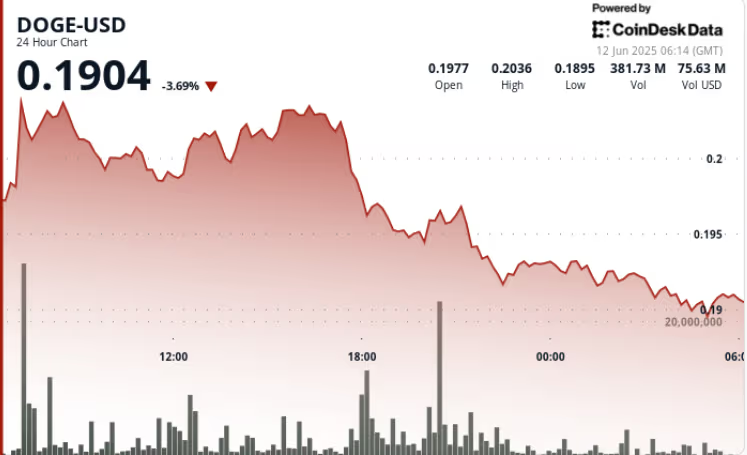

- Dogecoin's price has seen significant fluctuations, initially jumping to 20 cents and then dropping to 19.1 cents in a 6.63% range.

- There has been increasing talk of a potential DOGE ETF, with a 51% chance of SEC approval by 2025, which could attract institutional investment.

- Dogecoin's integration with Coinbase's Base network increases its functionality by bringing secure DOGE into DeFi ecosystems.

Dogecoin The exchange rate has seen sharp movements over the past 24 hours, rising to 20 cents and then falling to 19.1 cents, a range of 6.63%.

The meme coin formed a V-shaped recovery pattern late in the trading session, rising to $0.192 on rising volume, although resistance remains stable just above 20 cents.

News context

- Dogecoin's recent price moves come amid renewed interest in meme tokens following a series of turmoil in the cryptocurrency market.

- Speculation about a possible DOGE ETF is growing more urgent, with Polymarket data indicating a 51% chance of SEC approval in 2025, an event that could attract institutional capital to the market.

- At the same time, Dogecoin's integration with Coinbase's Base network adds functional value, introducing DOGE into DeFi ecosystems on a broader level for the first time.

- The meme coin's ability to attract significant volume support near key levels suggests that institutional investors may be gradually adding to their positions even as retail traders remain cautious.

Technical data analysis

• DOGE increased from $0.196 to $0.204 (4.08%) and then fell sharply to $0.191 (in a range of 6.63%).

• Resistance confirmed at $0.203-$0.204 after three rejections on heavy volume (>1bn units at 07:00).

• Support was established at $0.192, with short-term bounces off this level despite the weakness.

• Final hourly drop from $0.192 to $0.190 followed by a quick V-shaped recovery to $0.192.

• Signs of accumulation have emerged: trading volume has exceeded 2.3 million in the last minutes.