XRP, DOGE News: Ripple and Dogecoin Bets Become Most Popular on South Korean Exchanges Amid Lower U.S.-China Tariffs

South Koreans Invest in XRP, Dogecoin as Trade War Easing Increases Risk Appetite

Korean crypto markets see gains driven by $1 billion shortfall and improving geopolitical sentiment.

Shaurya Malwa | Edited by Parikshit Mishra May 12, 2025 7:57 AM

Key points:

- Retail traders in South Korea are increasingly investing in XRP and Dogecoin, overtaking Bitcoin and Ethereum in trading volumes on local platforms.

- The increase in altcoin trading is linked to easing trade tensions between the US and China, as well as expectations of a possible rate cut.

- Korean crypto markets see gains boosted by $1 billion shortfall and improving geopolitical sentiment.

Retail investors in South Korea are pouring funds into XRP and Dogecoin (DOGE), signaling renewed interest in risk assets among speculative traders.

Over the past 24 hours, trading volumes of these tokens on local exchanges have exceeded the volumes of Bitcoin (BTC) and Ethereum (ETH).

The surge comes amid renewed risk sentiment in cryptocurrency and stock markets as trade tensions between the U.S. and China ease and macroeconomic data points to the possibility of rate cuts later in the year, some traders said.

Over the past week, XRP and DOGE have both increased by more than 15%, outpacing Bitcoin's 10% gain, while ETH has soared nearly 40% for its biggest weekly gain since 2021.

“Risk assets are rapidly recovering to levels that now challenge even the most ardent bears,” said Augustin Fan, head of research at crypto options platform SignalPlus. “We believe risk asset prices will continue to rise until more macro bears give in.”

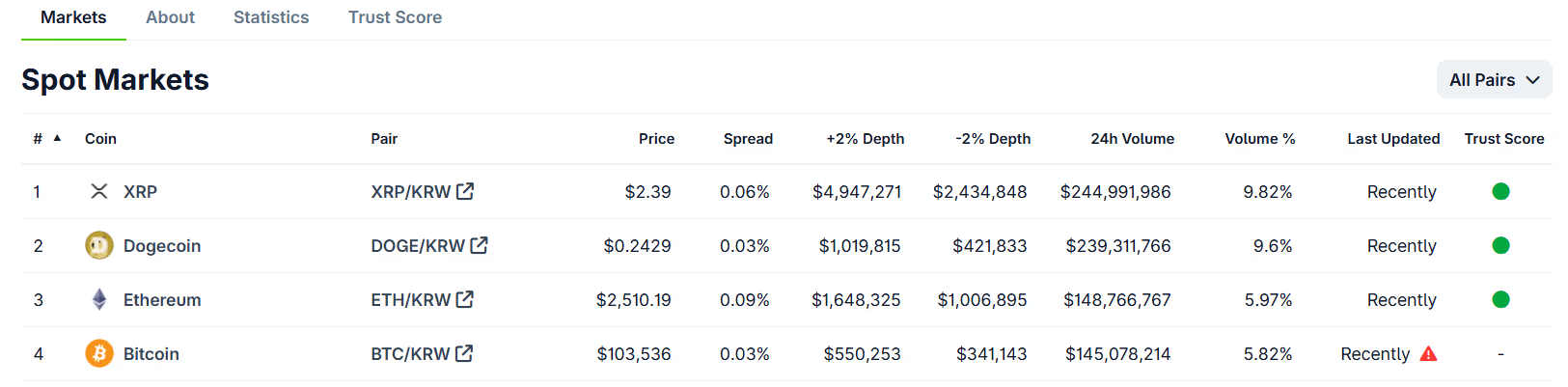

UpBit, the largest exchange in Korea, reports that 24-hour volumes for XRP/KRW and DOGE/KRW have exceeded $250 million, while Bitcoin and Ethereum volumes remain below $150 million.

The trend is reminiscent of previous euphoric phases of retail trading in the Korean cryptocurrency market, often referred to as the “kimchi premium” era, when local investors actively hunted for highly volatile assets.

Korean cryptocurrency markets have long served as an indicator of retail sentiment.

This growth

Источник