Bitcoin Miners Get a Break: Network Difficulty Drops by 3.34%

After four consecutive difficulty increases starting on March 9, the Bitcoin network has finally settled down, recording a 3.34% decline, which has come as a welcome relief to miners.

Bitcoin network sees first difficulty reduction after four consecutive increases

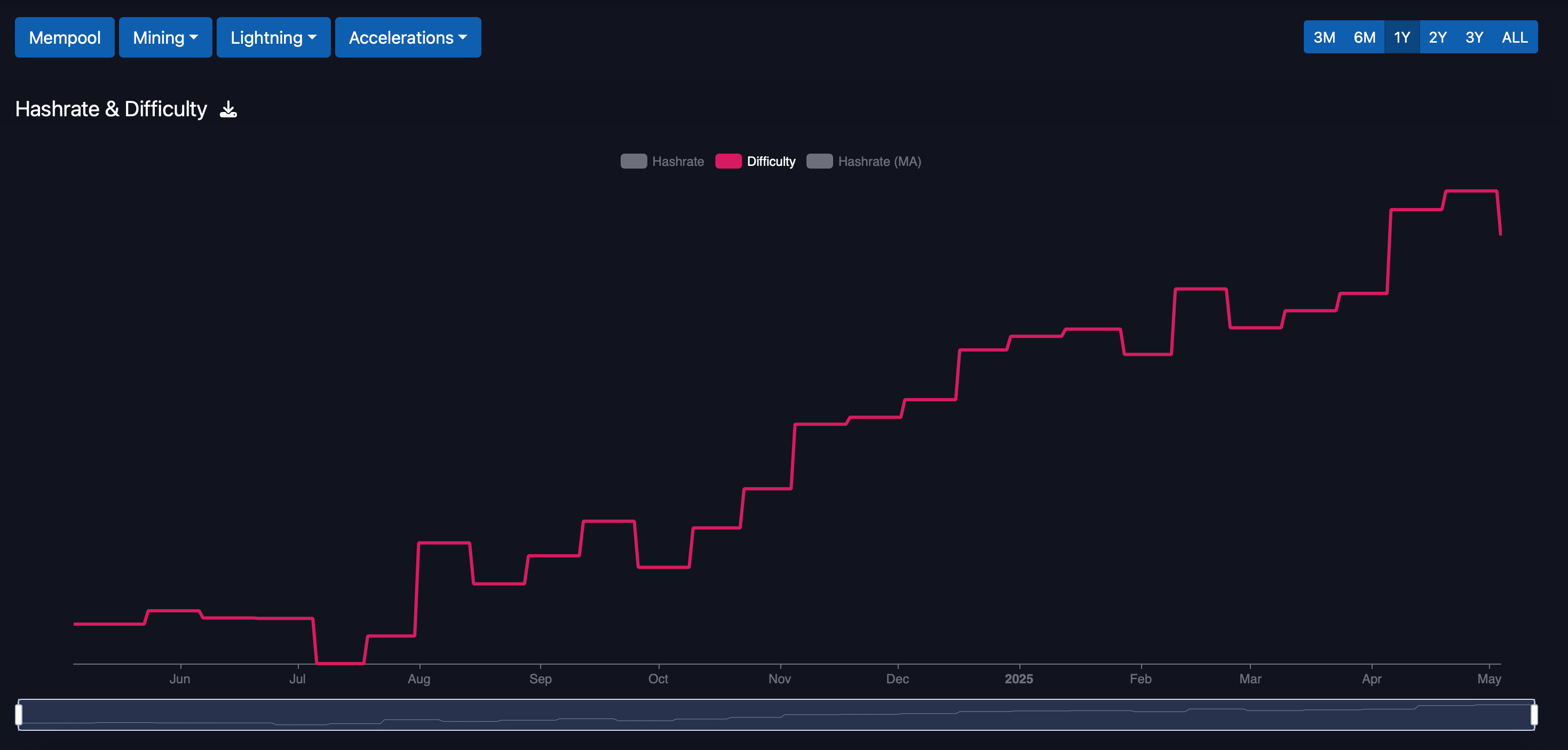

Bitcoin difficulty has decreased for the first time since its March 9, 2025, spike, breaking a string of four consecutive increases over the past eight weeks. At block height 895,104, the metric has fallen 3.34%, dropping from 123.23 trillion to 119.12 trillion. The 119.12 trillion figure represents the current mining difficulty on the Bitcoin network, a dynamic benchmark that determines how difficult it is to mine the next valid block.

Bitcoin difficulty according to data collected by mempool.space.

Bitcoin difficulty according to data collected by mempool.space.

In practical terms, this number represents the number of hashes a miner must perform on average to produce a block hash that meets the protocol's goal. In other words, it requires a whopping 119.12 trillion possible attempts to mine a block, keeping the network at roughly one block every 10 minutes, regardless of the overall hashrate.

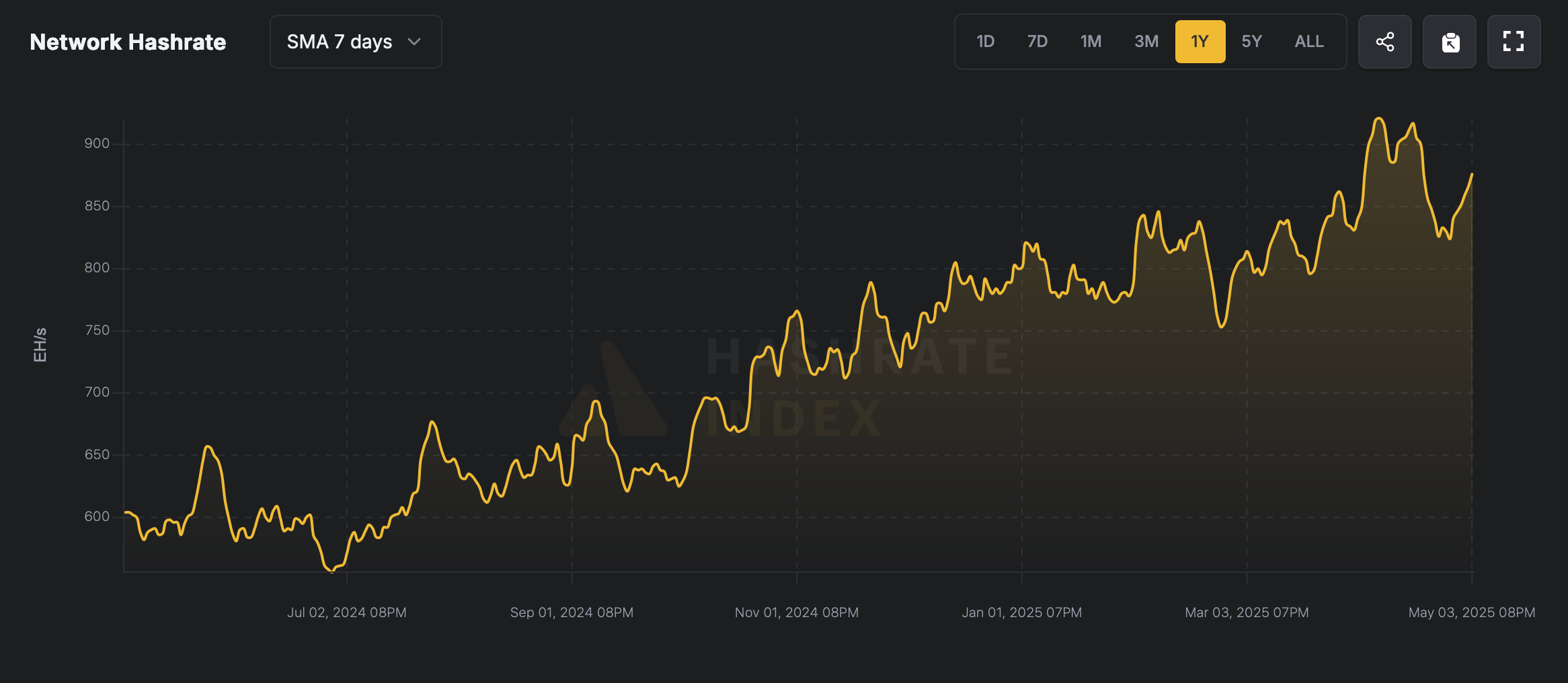

Network hashrate according to hashrateindex.com as of May 4, 2025.

Network hashrate according to hashrateindex.com as of May 4, 2025.

As of Sunday, May 4, the network is running at full capacity, with a hashrate of 885.51 exahashes per second (EH/s) buzzing around the world. However, even with the difficulty reduced at block height 895,104, block times remain stubbornly above target, averaging 10 minutes and 22 seconds. If this pace continues, another downward difficulty adjustment is expected on May 18.

However, the hash rate can change at any time, shortening the intervals between blocks and changing expectations. At the same time, miners’ profitability has increased: the hash rate, or the estimated daily income per petahash per second (PH/s) of SHA256 calculations, has increased from $45.87 on April 4 to $50.80 today. This increase in income has helped the hash rate increase from 824 EH/s on April 27 to the current 885.51 EH/s.

Source: cryptonews.net