Crypto Price Review: Bitcoin (BTC) Dominance Soars Ahead of FOMC Meeting as Volatility 'Burst' Looms

Analyst: Bitcoin Dominance Increases Significantly Ahead of FOMC as Volatility Spike Set to Arrive

Cryptocurrency markets are in a state of suspense as an outflow of funds from altcoins has seen Bitcoin's market share rise to a new four-year high.

Author: Christian Sandor | Edited by: Stephen Alpher Updated: May 6, 2025, 9:12 PM Published: May 6, 2025, 9:04 PM

What you need to know:

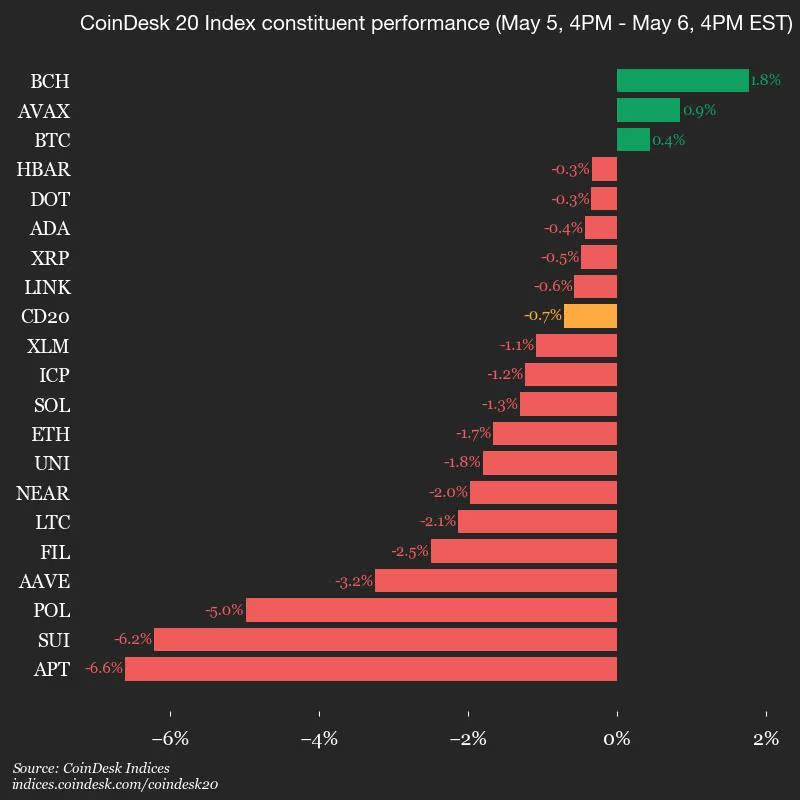

- BTC maintained a stable price range around $95,000, while large-cap altcoins such as ETH, SUI, and APT showed slight declines, similar to traditional stock indices.

- Analysts expect potential volatility after the Federal Reserve's meeting on Wednesday.

- K33's Vetle Lunde calls for “aggressive spot exposure” as past periods of negative perpetual swap funding rates have provided buying opportunities.

Bitcoin (BTC) strengthened its hold on the cryptocurrency market on Tuesday, hitting a new four-year high as crypto traders switched to the leading asset ahead of tomorrow's key Federal Reserve policy meeting.

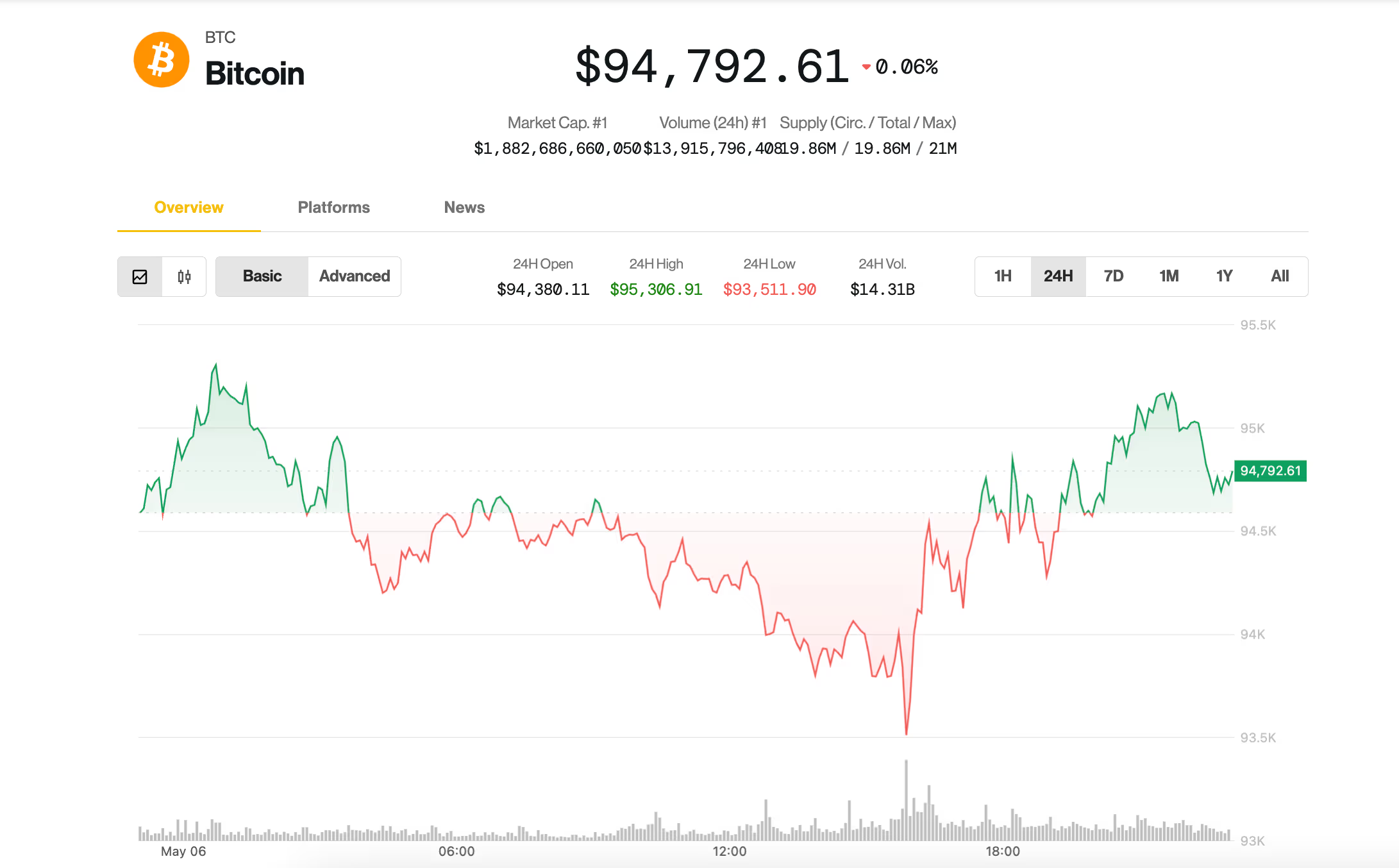

BTC remained in the $94,000-$95,000 range, showing a slight increase of 0.4% over the past 24 hours and continuing the tight trading range that has persisted since the weekend.

Meanwhile, the CoinDesk 20 Broad Market Index fell 0.7% as Ethereum (ETH) and tokens Sui (SUI), Aptos (APT) and Polygon (POL) dragged the benchmark down.

A look at traditional markets showed stocks suffered double losses, with the S&P 500 and tech-heavy Nasdaq closing down 0.7-0.8%, once again lagging behind BTC.

Despite the lack of significant price action, Bitcoin's growing share of the overall cryptocurrency market is drawing increasing attention: Bitcoin's so-called dominance metric has surpassed 65%, its highest level since January 2021, according to TradingView data, signaling a consolidation of capital in an asset seen as the most reliable amid macroeconomic uncertainty.

Источник