Bitcoin News: BTC Price Set for Biggest Weekly Gain Since Trump Victory Amid $2.7B ETF Inflow

Bitcoin is set for its biggest weekly gain since Trump's victory as ETFs attract $2.7 billion.

Hedera's SUI, BCH and HBAR led the gainers on Friday on the CoinDesk 20 Index, with one analyst noting that the recent crypto rally could be the start of BTC's climb to new records.

Author: Christian Sandor | Edited by: Aoyon Ashraf Updated: April 25, 2025, 10:18 PM Published: April 25, 2025, 10:09 PM

Important facts:

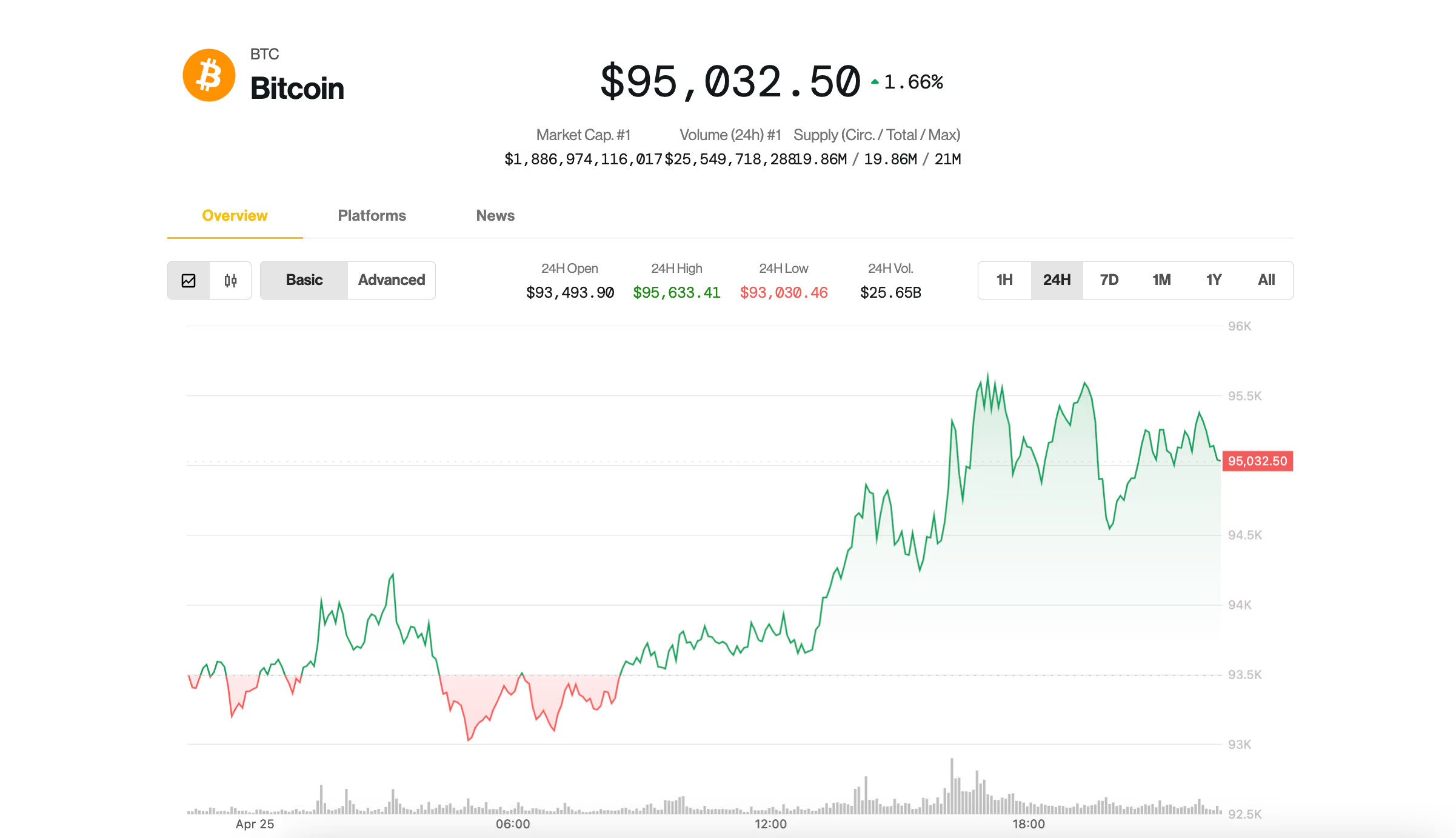

- Bitcoin's 11% gain to $95,000 this week could be the asset's biggest weekly performance since November 2024.

- Net inflows into U.S.-listed Bitcoin ETFs this week through Thursday totaled $2.68 billion, the highest since December.

- According to the forecasts of Ledn's CIO, by the end of 2025 – beginning of 2026, the cost of Bitcoin may exceed $130,000.

Bitcoin (BTC) continued its spring rally on Friday and is on track for its strongest weekly performance since Trump's election victory.

The largest and oldest cryptocurrency remained near $95,000 in U.S. daytime trading, up 1.8% over the past 24 hours. Ether (ETH) followed closely behind, up 2% to settle just above $1,800. Sui (SUI), Bitcoin Cash (BCH), and Hedera’s HBAR topped the CoinDesk 20 Index crypto benchmark.

The day's gains cap a remarkable momentum for crypto markets, which have been rebounding from early April lows amid market volatility. BTC has risen more than 11% since Monday, posting its biggest weekly gain since November 2024, when Donald Trump became U.S. president, kicking off a massive crypto rally.

Read More: Bitcoin Traders Target $95K Near-Term; SUI Extends Multi-Day Rally

Investor interest in ETFs has also increased significantly: Net inflows into U.S.-listed spot Bitcoin ETFs totaled $2.68 billion this week, the most since December, according to SoSoValue. (Friday's inflow figures will be released later.)

BTC Resolution

David Duong, head of global research at Coinbase Institutional, noted that Bitcoin's recent rise relative to U.S. stocks and gold highlights its separation from traditional macro assets.

“It’s rare that you see turning points in the market in a real way.

Источник