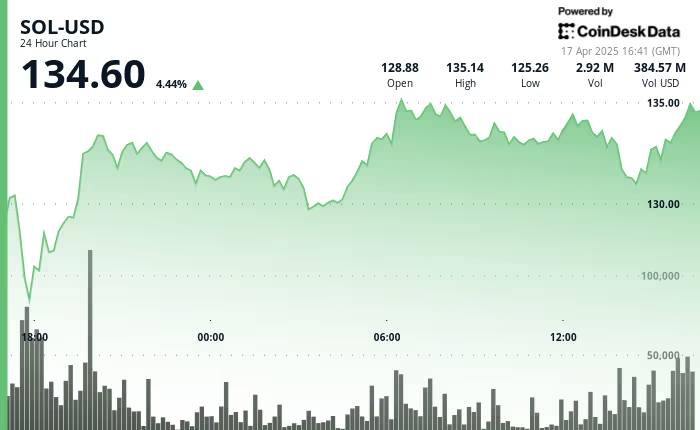

Solana Stock Price Analysis: SOL Up 4.5% After Canada Launches First Spot ETF

Solana surges 4.5% after Canada launches first spot ETF

Institutional interest in North America is on the rise as SOL reclaims its DEX lead over Ethereum with a 16% weekly gain.

Author AI Boost | Edited by Aoyon Ashraf Updated April 17, 2025, 6:00 PM Published April 17, 2025, 5:11 PM

Key points:

- Solana's price has risen more than 4% amid global economic instability, outperforming the broader cryptocurrency market.

- The $125–$127 range has become an important support zone for SOL, successfully fending off multiple downward attempts.

- Canada launched the first Solana spot ETF in North America, increasing institutional interest in the token.

Global economic tensions and trade policy uncertainty continue to cause volatility in the cryptocurrency market, with SOL managing to weather these challenges better than many alternatives.

Solana's token price rose more than 4% on Thursday, while the broader CoinDesk 20 market indicator rose about 3%.

The $125-$127 range for SOL has emerged as a key support zone that has successfully fended off multiple downside attempts, while the $133.50-$133.60 area represents significant resistance, according to technical analysis from CoinDesk Research.

Blockchain data suggests that there are over 32 million SOL (over 5% of the total supply) at the $129.79 level, making it an important pivot point for future price movements.

Key aspects of technical analysis

- SOL has formed a clearly defined support zone in the $125–$127 range, which has successfully repelled multiple downward attempts.

- The price has shown considerable resilience, rising 4.5% from its April 16 low of $123.64 to $135.57, indicating a clear uptrend.

- On April 16, Canada launched North America's first Solana spot ETFs, issued by asset managers including 3iQ, Purpose, Evolve and CI, attracting the attention of institutional investors.

- Solana has reclaimed the top spot for DEX activity, overtaking Ethereum after rising 16% in a week, with total value locked (TVL) increasing 12% to $7.08 billion.

- Volume analysis shows particularly strong accumulation during the April 16 surge, when over 3 million units were sold and the price broke the $130 resistance level.

- The Fibonacci retracement from the April 14 high ($136.01) to the April 16 low shows that the recent rally has reclaimed the critical 61.8% level.

- Over the last 100 minutes of trading, SOL experienced a significant downward correction, falling from $134.11 to $130.81, a decline of 2.5%.

- The sell-off intensified between 14:03 and 14:07, when volume increased sharply to over 92,000 units in a one-minute candle.

- A strong resistance zone at $133.50-$133.60 has rejected multiple recovery attempts.

- A break of the $132.00 support level was observed, which triggered a cascading liquidation.

- Prices have now broken above the 78.6% Fibonacci level, indicating a possible continuation of the move towards the $125-$127 support zone if the bearish momentum continues.

Disclaimer: This article was created using tools from I

Источник