BTC Price Forecast: Bitcoin, the digital gold some consider to be, is behaving more like a risk indicator for the AUD-JPY forex market

Bitcoin, the supposed safe haven crypto investors had pinned their hopes on, is more of a risk indicator, says Godbole

Bitcoin, rather than functioning as digital gold, has established itself as a risk indicator, confirming the view of currency market participants who watch it as a gauge of speculative sentiment.

Author: Omkar Godbole | Edited by: Sheldon Reback Updated: Apr 17, 2025 12:46 PM Published: Apr 17, 2025 8:36 AM

What you should know:

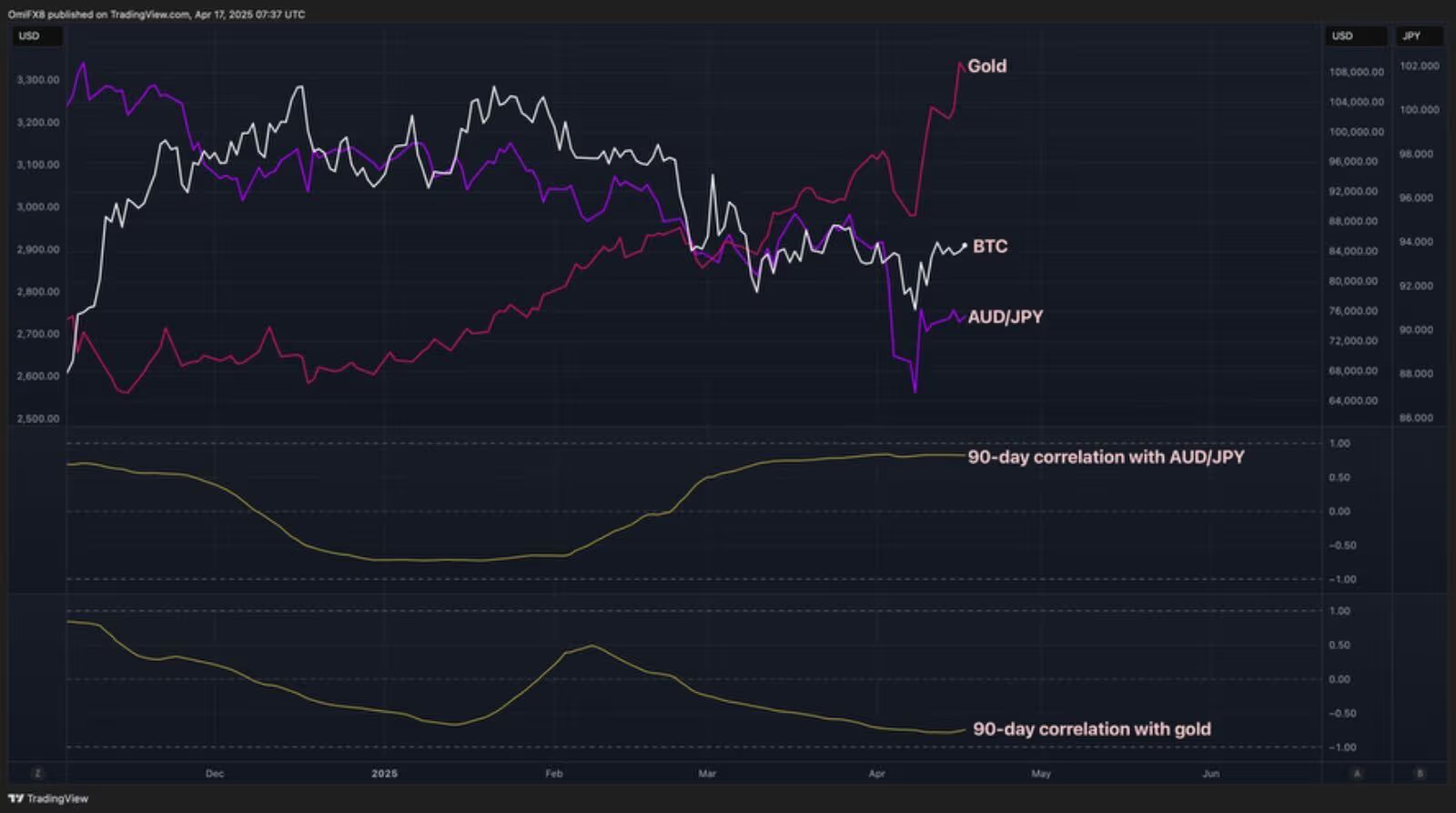

- Bitcoin, with a significant positive correlation with the Australian dollar to the yen exchange rate, is becoming an even more significant risk indicator in light of the trade war between the US and China.

- The correlation with gold is currently -0.80, indicating that the two assets tend to move in opposite directions.

The trade war initiated by President Donald Trump has caused significant volatility in financial markets since March, sending investors scrambling for assets they believe will provide protection from the volatility.

One thing is clear: Bitcoin (BTC) is not one of those assets, which has come as a major disappointment to bullish investors who have long categorized the world’s largest cryptocurrency as digital gold or a store of value and safe haven. In fact, since the start of the trade war, Bitcoin has become more closely correlated with the Australian dollar-yen (AUD/JPY) pair, which serves as a barometer of forex risk.

Data from TradingView shows that the 90-day correlation coefficient between Bitcoin and the AUD/JPY pair turned positive in late February and has since reached its highest since November 2021. The mutual tariff war between the two countries has resulted in a staggering 245% total tax on Chinese imports into the US, prompting Federal Reserve Chairman Jerome Powell to again mention the risks of stagflation on Wednesday.

A correlation of 0.80 (the highest possible value is 1) is considered high, indicating that the two variables, BTC and AUD/JPY, are closely related in their movements in the same direction.

In contrast, Bitcoin's 90-day correlation with gold turned negative in late February and has since fallen to -0.80, slightly above its low of -1. This suggests that the two

Источник