BTC, XRP, ADA News: Bitcoin Falls Along With XRP, ADA As Nvidia's Huge $5.5B Spend Sours Investor Mood

Bitcoin Slips Along With XRP, ADA As Nvidia's Whopping $5.5 Billion Creates Negative Investor Sentiment

Nvidia shares fell 8% after the US banned shipments of its H20 chips to China, weighing on stock and cryptocurrency markets.

Author: Omkar Godbole | Edited by: Aoyon Ashraf Updated: April 16, 2025, 5:21 AM Published: April 16, 2025, 12:48 AM

Key points:

- Nvidia shares fell 8% after the US banned shipments of H20 chips to China, weighing on stock and cryptocurrency markets.

- Bitcoin and other cryptocurrencies such as XRP and ADA fell after Nvidia shares fell at the end of trading.

- The market is awaiting a U.S. retail sales report and a speech from Federal Reserve Chairman Jerome Powell for more economic data.

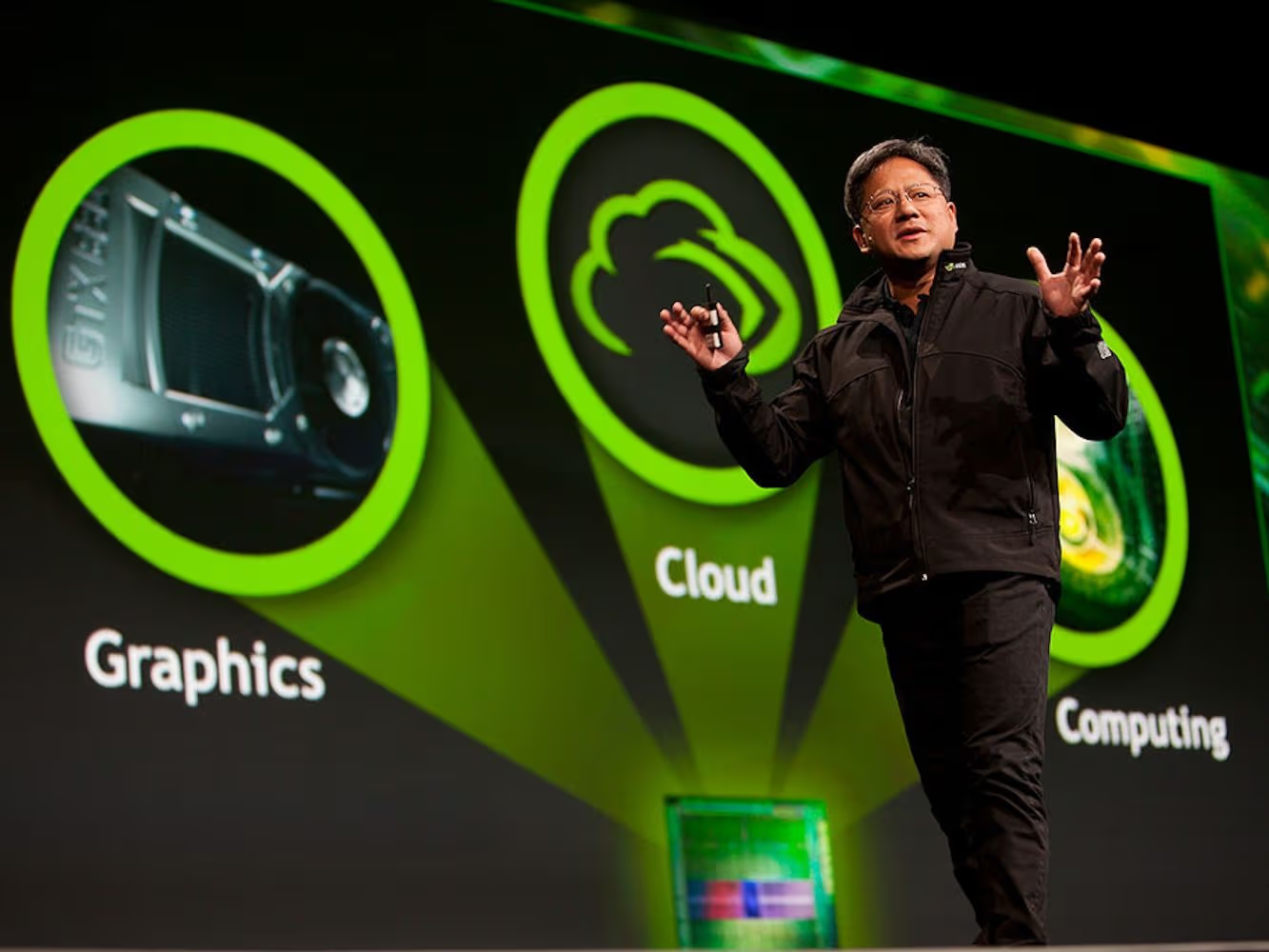

Sentiment in stock and crypto markets worsened on Tuesday evening as Nvidia shares tumbled after the close amid a $5.5 billion lawsuit stemming from the Trump administration's decision to ban sales of the company's H20 chips to China.

Bitcoin, the largest cryptocurrency by market cap, fell to $83,600, extending its decline from a two-week peak of $86,440 hit earlier in the day, according to CoinDesk data. Payments-focused XRP saw similar declines, falling more than 2% to $2.08, while Cardano's ADA token fell 4% to $0.61. The CoinDesk 20 Index, a broader market measure, also weakened more than 2%.

Meanwhile, coins purportedly related to artificial intelligence (AI) continued to fall, with NVDA shares down 8% to $89.10 after the company said in a regulatory filing that it expects to take a $5.5 billion write-down in its fiscal first quarter due to new restrictions on exports of its H20 chip to China.

The news comes a day after unusual activity in the NVDA put options market suggested a potential market crash.

Futures linked to the Nasdaq index also fell more than 1%, sending a negative signal for risk assets overall.

The next catalyst, due out Wednesday morning ET, is the U.S. retail sales report for March. Economists surveyed by Dow Jones expect the data to show consumer spending rising 1.2% for the month, up from a 0.2% gain in February.

A better-than-expected report would likely help calm recession fears fueled by President Donald Trump's trade war with China and other trading partners. But there is a risk that markets will dismiss it as backward-looking and fail to take into account the significant escalation in trade tensions seen this month.

Federal Reserve Chairman Jerome Powell is also scheduled to speak Wednesday at the Economic Club of Chicago to give his outlook for the U.S. economy.

“All eyes are on Powell as markets hold their breath ahead of his speech on Wednesday. With the trade war raging and recession talk growing, traders are watching closely for any hints that the Fed may be forced to cut rates sooner than expected,” Secure Digital Markets said in a research note on Tuesday.

Forward-looking market measures such as the breakeven inflation rate have weakened amid trade tensions,

Источник