Tether, Galaxy, Ledn Dominate CeFi Crypto Lending Market as DeFi Borrowing Soars: Report

Research Shows Tether, Galaxy, and Ledn Lead CeFi Crypto Lending Market as DeFi Borrowing Soars

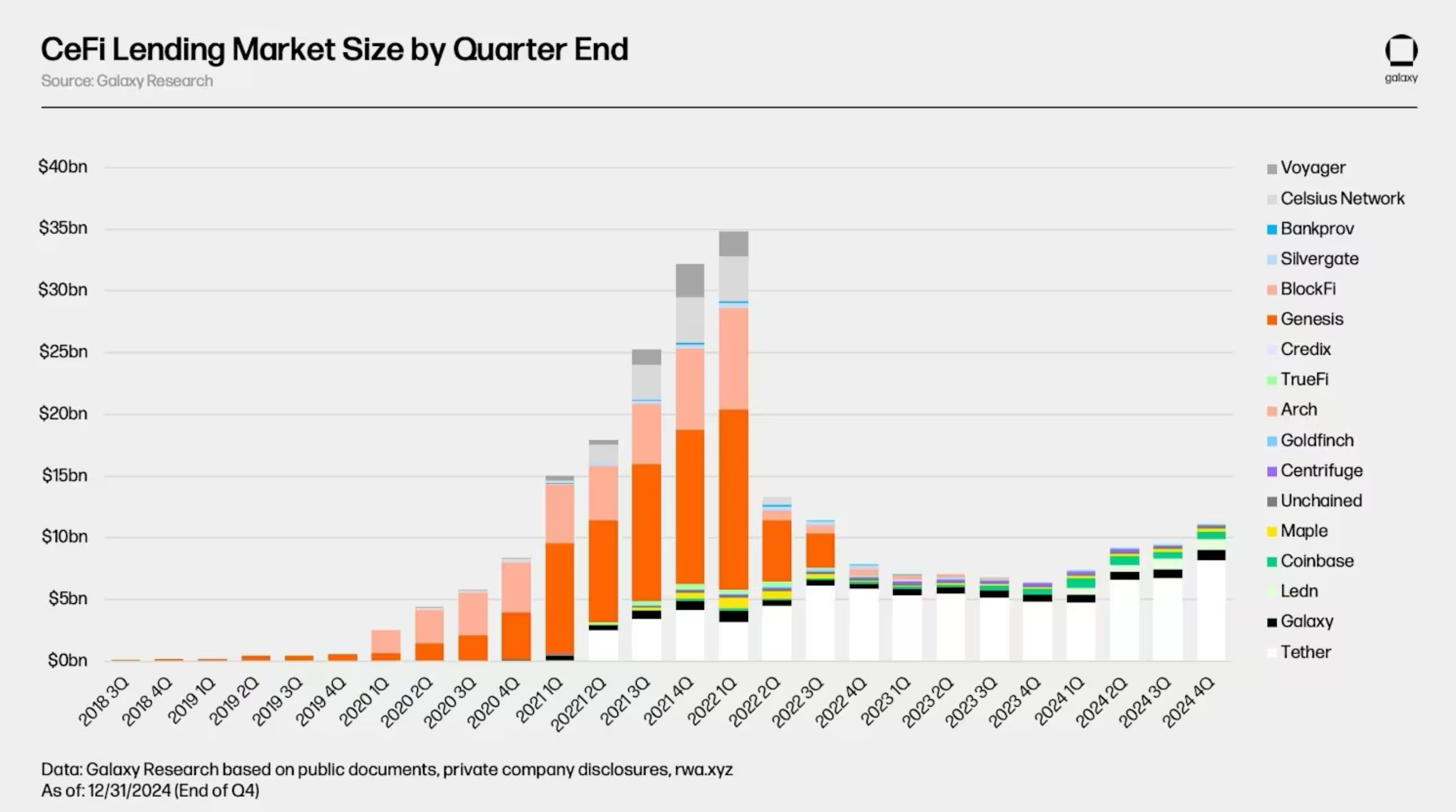

According to Galaxy, overall crypto lending is still 43% below its 2021 record, but decentralized platforms are seeing significant growth.

Author: Christian Sandor, AI Boost | Edited by: Aoyon Ashraf Updated: April 15, 2025, 12:57 PM Published: April 15, 2025, 12:23 PM

Key facts:

- According to Galaxy, the crypto lending market was worth $36.5 billion in Q4 2024, down 43% from the 2021 bull market high.

- DeFi borrowings have risen 959% from their 2022 bear market lows, reaching $19.1 billion across 20 protocols and 12 blockchains.

- Tether, Galaxy and Ledn account for nearly 90% of the total outstanding loans of centralized lenders, which is $11.2 billion.

The crypto lending market is still a shadow of its former size before the brutal crypto winter of 2022-2023, but there are signs of recovery beneath the surface, particularly in the decentralized sector, according to a report from digital asset investment firm Galaxy Research released on Monday.

According to the report, total crypto lending stood at $36.5 billion at the end of 2024, including loans backed by crypto stablecoins. That’s a significant decline from the $64.4 billion peak seen at the height of the 2021 bull run, when crypto-backed borrowing soared amid speculative excitement.

The collapse of major lenders like Celsius, BlockFi, and Genesis has left a handful of major players controlling the centralized finance (CeFi) lending sector. As the report points out, Tether holds the largest market share, followed by Galaxy and Ledn. These three companies account for nearly 90% of the outstanding loans in CeFi’s $11.2 billion portfolio. Notably, CeFi’s loans are down 68% from their early 2022 peak of $34.8 billion.

The report indicates that the real growth is happening in blockchain.

Decentralized lending protocols, which allow users to borrow cryptocurrency by locking up collateral, operate 24/7, and are independent of a centralized entity, are booming. Since bottoming out in late 2022, DeFi open borrowing has increased 959%, rising from $1.8 billion to $19.1 million.

Источник