Is BTC Rally In The works? Key Markets Suggest Trump Tariffs Could Lower Inflation, Challenging Fed's Stagflation Fears

Cryptocurrency Likely to Rebound as Trump Tariffs May Help Reduce Inflation

Inflation falls amid Trump's trade war.

Author: Omkar Godbole | Edited by: Parikshit Mishra Updated: April 12, 2025, 5:08 AM Published: April 11, 2025, 12:32 PM

What you need to know:

- Despite concerns about stagflation, market indicators suggest Trump's tariffs could lead to lower inflation in the long term, potentially allowing the Federal Reserve to cut interest rates.

- Historical and recent research shows that tariffs tend to have a disinflationary effect in developed countries because they can lead to reduced consumer spending and lower prices.

The ongoing trade war between the US and China is likely to help reduce inflation in the US economy, key financial market segments indicate, creating a bullish outlook for risk assets including Bitcoin (BTC).

In his inaugural address on January 20, President Donald Trump promised to “impose tariffs and taxes on foreign countries to enrich our citizens,” then launched his first attack on China, Canada, and Mexico on February 1. Trade tensions have increased significantly since then, and at the time of writing, the US and China have imposed retaliatory tariffs on each other exceeding 100%.

Tariffs increase the cost of imported goods, which is ultimately passed on to consumers and can lead to higher overall prices in a consumption-driven economy like the United States.

So, ever since the trade war began, markets have been worried about the potential for higher inflation in the U.S. due to tariffs, and the Fed added to those concerns with its stagflation forecast last month. Stagflation, a combination of low growth, high inflation and unemployment, is considered a worst-case scenario for risk assets.

As a result, Bitcoin has fallen nearly 20% since early February, driven by a widespread decline in risk appetite on Wall Street that has seen investors dump stocks, bonds and the US dollar at the same time.

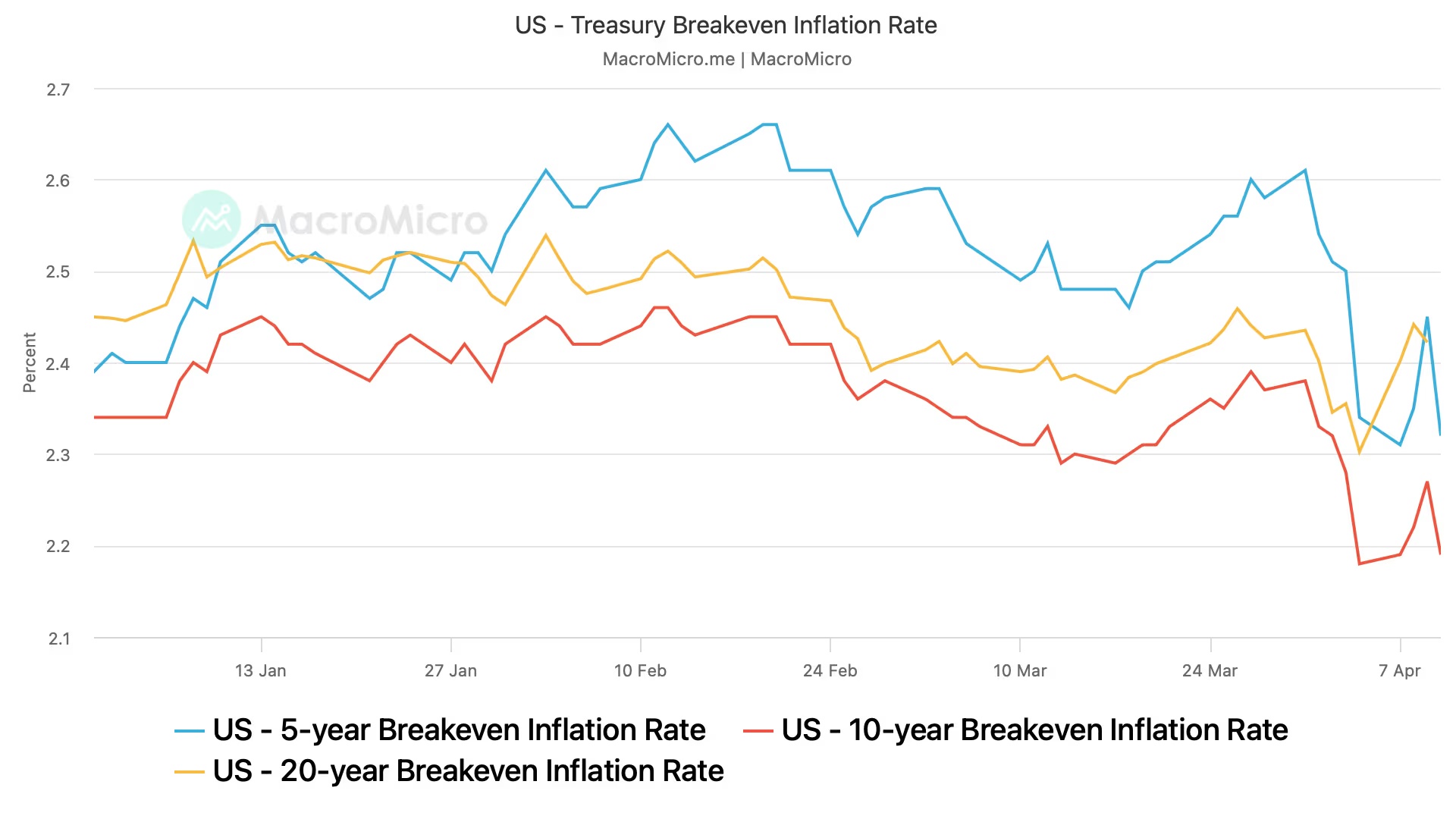

Breakeven implies disinflation

However, market inflation indicators such as the breakeven point suggest that the rates could be disinflationary in the long run. In other words, the Fed could be wrong in its concerns about stagflation and will soon have the opportunity to cut rates.

The breakeven inflation rate is calculated based on the yields on traditional Treasury bonds and Treasury inflation-protected securities (TIPS). The five-year breakeven inflation rate peaked above 2.6% in early February and has since fallen to 2.32%, according to data compiled by the Federal Reserve Bank of St. Louis.

The 10-year breakeven rate fell to 2.19% from 2.5%. At the same time, the Cleveland Federal Reserve's two-year inflation expectation remains at about 2.6%.

One-time cost

According to experts, the impact of tariffs, considered as a one-time adjustment to costs, depends on the reaction of other macroeconomic variables and tends to have a disinflationary effect in the long run.

When producers pass on rising tariffs to consumers

Источник