Bitcoin's recent plunge proves it's more than just a leveraged tech play

The recent decline in the price of Bitcoin illustrates that this phenomenon is not just a technological manipulation of leverage.

Despite being down 26% from its all-time highs, Bitcoin has shown stability against leading tech stocks, indicating its growing maturity.

James Van Straten | Edited by Parikshit Mishra Updated April 11, 2025, 1:21 pm Published April 11, 2025, 7:55 am

What you should know:

- Bitcoin's current three-month decline is much less severe than during the 2021-2022 correction, indicating improved market stability.

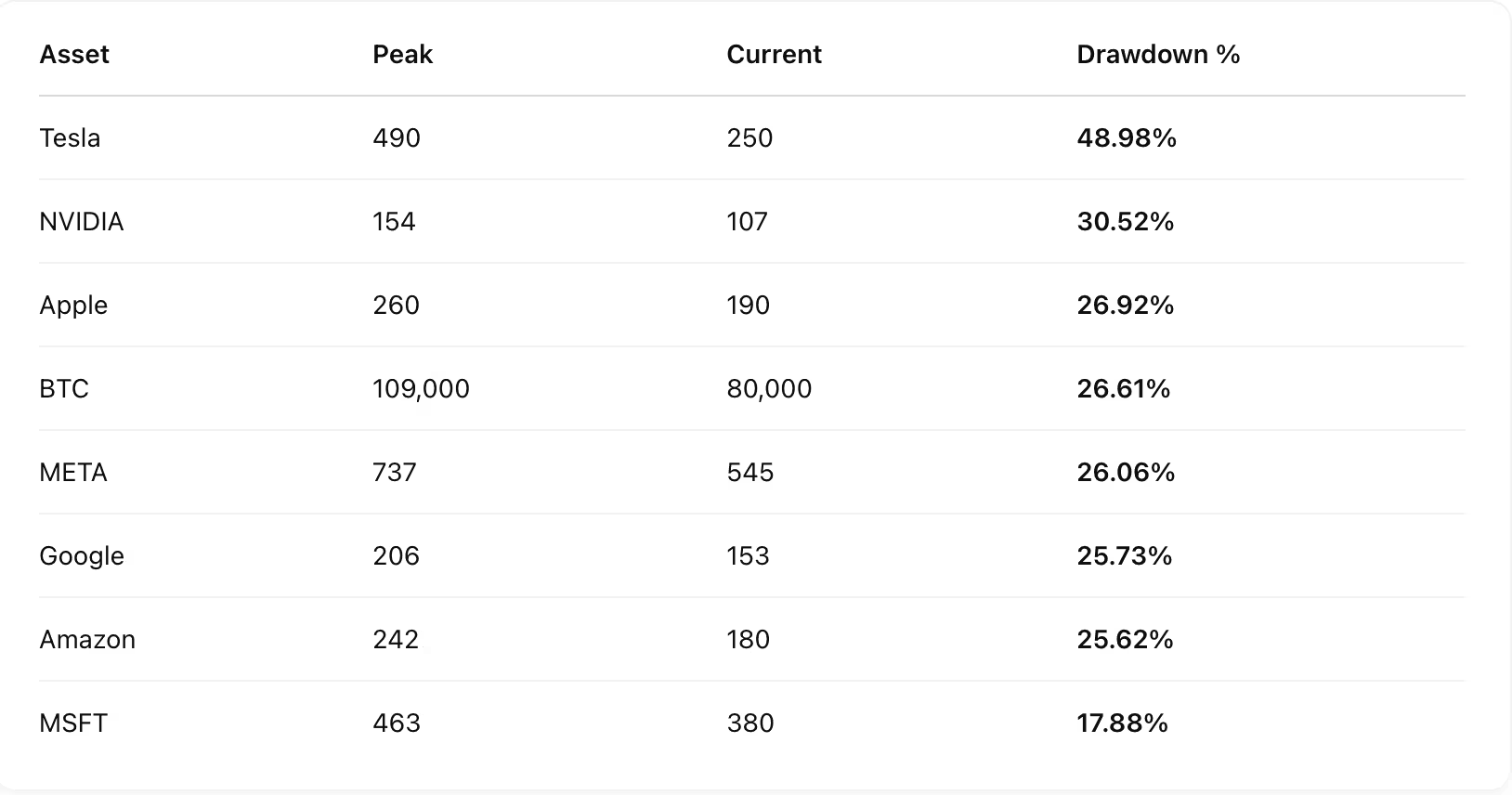

- Within the Magnificent Seven, Bitcoin is in the middle of the pack, ahead of Tesla and NVIDIA and in line with the declines seen in Apple, Meta and Amazon.

The US dollar index (DXY) fell below 100 and gold hit new all-time highs as rising tariffs added to global economic uncertainty. This led to a decline in asset prices, particularly in the tech sector and cryptocurrencies.

Since hitting an all-time high of $109,000 in January, Bitcoin (BTC) has fallen about 26%. Compared to the Magnificent Seven tech stocks, Bitcoin's decline is about average, indicating its growing maturity as an asset.

Tesla (TSLA) is currently the worst performer, down nearly 50% from its peak. NVIDIA (NVDA) is following close behind with a 31% drop. Apple (AAPL), Bitcoin, Meta (META), Google (GOOG), and Amazon (AMZN) are down about 26%, while Microsoft (MSFT) stands out with a relatively small 18% decline.

To highlight Bitcoin's resilience in the current three-month correction, it's worth making a comparison to the same period of decline in 2021 – from November 2021 to February 2022, when it fell 45% from $69,000 to $38,000. Bitcoin was the worst performer among major tech companies during that time, although Tesla was also hit hard.

Источник