Real Asset News: Total RWA Asset Value Surpasses $10 Billion Mark: DeFiLlama

Total value of blocked real assets exceeds $10 billion: DeFiLlama

The increase is due to the growth of TVL on Ethena USDtb and BUIDL from BlackRock.

Sam Reynolds | Edited by Sheldon Rebeck Updated Mar 21, 2025 9:11 PM UTC Published Mar 21, 2025 10:06 AM UTC

Key points:

- Real assets have reached the $10 billion level, including Maker, BlackRock's BUIDL, and Ethena's USDtb, each with over $1 billion in total value locked (TVL).

- USDtb, a stablecoin backed by tokenized BlackRock money market shares, has seen the biggest gains, increasing over 1,000% in TVL over the past month.

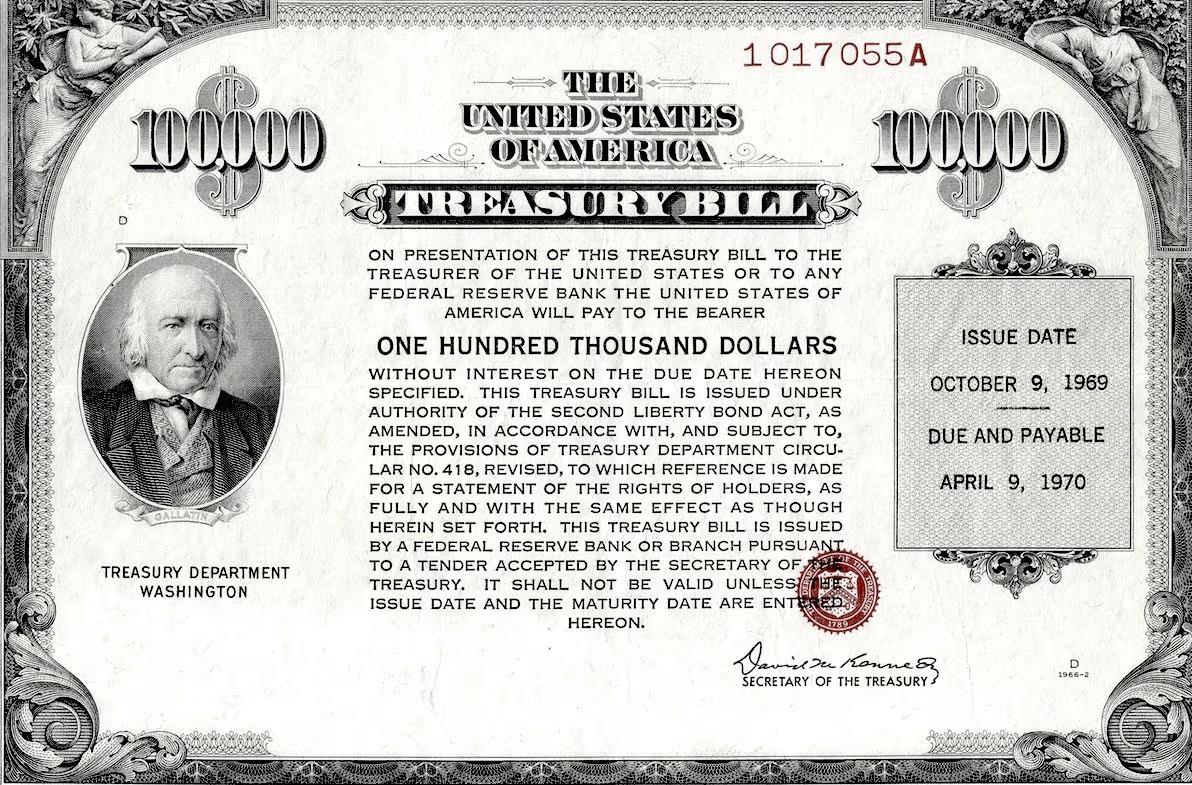

- Treasury-backed tokens are leading the way, highlighting investors' preference for safer assets amid the crypto bear market.

According to data from DeFiLlama, real world assets (RWA) currently make up the $10 billion category, with the total value locked (TVL) of Maker, BlackRock's BUIDL, and Ethena's USDtb each exceeding $1 billion.

Of the three, USDtb — a stablecoin that is intended to contrast with Ethena's USDe — has seen the biggest gains, up more than 1,000% in TVL over the past month.

USDtb is backed by tokenized BlackRock money market shares, while USDe uses crypto assets and perpetual futures strategies to generate crypto-based returns.

CoinDesk previously reported that treasury-backed tokens hit a record market cap of $4.2 billion in the first quarter, led by growth in Ondo Finance's OUSG and USDY tokens, BlackRock and Securitize's BUIDL, Franklin Templeton's BENJI, and Superstate's USTB tokens.

According to RWA.xyz, treasury-backed tokens dominate. The next largest category, tokenized commodities, is valued at $1.26 billion, with Paxos Gold taking the lead with a TVL of just over $500 million.

Analysts say this reflects investors' preference for safer assets amid bearish sentiment in the crypto market, with Treasury yields outpacing those of major DeFi protocols like Compound.

Источник