US BTC ETF Cash and Carryover Trading Collapses – What Does This Tell Investors?

What the Crash of the US Bitcoin ETF Cash-and-Carry Trade Means for Investors

Flows into US spot Bitcoin ETFs have stalled this year compared to 2024.

James Van Straten | Edited by Sheldon Rebeck on March 21, 2025, 9:40 UTC

Key points:

- Flows into US spot Bitcoin ETFs have slowed in 2025, falling short of the high growth rates seen in their launch year.

- Low Bitcoin price dynamics and reduced arbitrage opportunities have dampened investor interest, especially from institutional players.

US spot Bitcoin ETFs (BTC) have seen $180 million in withdrawals over the past month, one of the largest withdrawals since they began trading in early 2024.

ETFs have been disappointing in 2025, with modest inflows driven largely by the low price of Bitcoin, which has fallen about 10%. While there has been a brief uptick in the last five days — net inflows have been around $700 million — total net inflows since launch now stand at $36.1 billion, according to Farside.

Two key reasons for the decline emerged last month: increased volatility in Bitcoin prices and the unwinding of so-called basis trading.

Bitcoin's price has been particularly volatile this year, hitting a record $109,000 in January at the start of President Donald Trump's administration in anticipation of a crypto-friendly regulatory environment, before falling to $76,000 in early March amid concerns over Trump's tariff-driven trade policies.

Retail investors tend to sell during periods of increased volatility, reacting emotionally, as is the case with any high-risk asset.

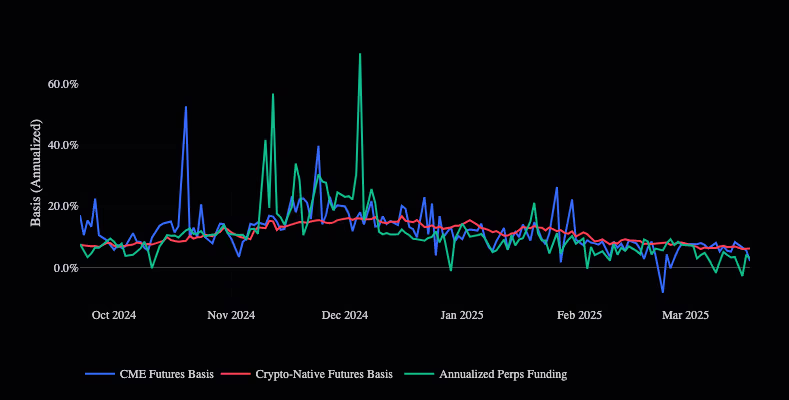

For institutional investors, they are cutting back on basis — or cash-and-carry — trading, which is a strategy that involves going long in an ETF while selling short CME bitcoin futures. The short position is a bet on prices falling, while the long position is a delta-neutral strategy that takes advantage of the price difference between futures and spot.

A delta neutral trade offsets changes in the underlying asset price by balancing positions, minimizing directional risk and maintaining neutrality to the market.

Currently, the yield on this arbitrage is only about 2%, one of the lowest levels since the ETF was first approved. Because U.S. Treasuries, which are among the safest investments available, offer higher yields, many investors are choosing less risky alternatives.

ETF inflows and outflows often indicate potential turning points in the market. When outflows become particularly aggressive, they tend to coincide with local lows in Bitcoin prices, especially when measured against the 30-day moving average. This pattern was seen recently when Bitcoin bottomed in March, as well as during similar pullbacks in August 2024 and April 2024.